In early February, the US military shot down a Chinese-operated high-altitude balloon in North American airspace, alleging that it was being used for spying; in the days that followed, a further three mystery objects were shot out of the sky. While these events captured the public’s imagination and fuelled speculation over extra-terrestrial activity, they also served to highlight the growing geopolitical insecurity and increasing tensions between two of the world’s great powers.

Equity markets started 2023 by gaining altitude, with a recovery in technology stocks helping the Nasdaq Composite index to deliver its best January performance in more than 20 years.1 Share prices were lifted by positive sentiment around China’s reopening after the swift abandonment of its zero-Covid policy, combined with better-than-expected inflation and economic activity data which appeared to reduce the odds of a prolonged recession and spur hopes of a ‘soft landing’. However, February saw expectations fall back down to earth, with the remainder of the quarter characterised by growing uncertainty over the likely path of interest rates and inflation, and, in March, by the prospect of a new banking crisis.

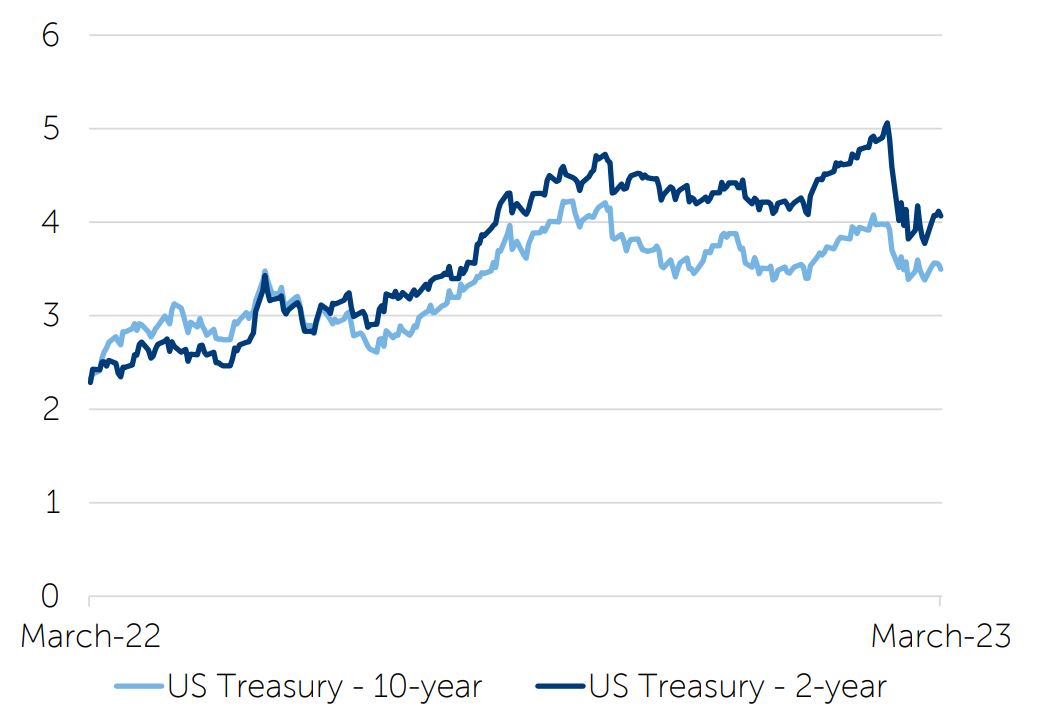

Key to the weakening mood in February was evidence that labour markets and inflation were continuing to run hot. The US economy added more than half a million jobs in January, almost triple the consensus forecast,2 while the country’s consumer price index saw only a slight deceleration to 6.4% compared to the previous year, a smaller fall than economists had predicted.3 With inflation threatening to remain sticky, investors all but abandoned hope that there would be interest-rate cuts before the year end. Most equity markets reversed some of their earlier gains, although European stocks held up amid improving business confidence and consumer sentiment brought on by lower energy prices. Bond markets moved to reprice for ‘higher-for-longer’ rates, with 10-year US Treasury yields edging back up to around 4% by the end of the month, and the Treasury yield curve (which typically predicts a recession) at its most inverted since the 1980s.

US Treasury yields

(%)

Source: FactSet, April 2023

In early March, hawkish rhetoric from US Federal Reserve (Fed) Chair Jay Powell at a congressional appearance seemed to confirm the central bank’s determination to fight persistent inflation, as he stated that “the ultimate level of interest rates is likely to be higher than previously anticipated”,4 initially causing stocks to fall sharply and bond yields to jump. However, turmoil in the banking sector soon upended this narrative and dominated markets for the remainder of the quarter. Within a matter of days, Silicon Valley Bank (SVB), the 16th largest US bank by assets, and fellow US bank Signature went from business as usual to failure and regulatory shutdown. A week later, Credit Suisse, a 166-year-old banking institution, was essentially forced to sell to its main Swiss rival at fire-sale prices, with the bank’s additional tier 1 capital bonds being wiped out in a controversial move by the Swiss regulator. The events led to heightened volatility across banks and other financial-sector assets.

The pressures facing the banking sector inevitably put the spotlight on liquidity concerns and central banks’ aggressive tightening cycles, and on 19 March the Fed and other leading central banks announced measures to improve access to dollar liquidity.5 In addition, while the Fed pressed ahead with a 0.25% interest-rate rise on 22 March, it softened the language around future hikes, removing the previously repeated warning that “ongoing increases” would be necessary to bring inflation under control.6 These moves helped restore some stability to the banking sector, and most major equity markets ended the quarter making respectable gains, in spite of the chaos earlier in the period and continued uncertainty regarding the economic and monetary-policy trajectory.

In fixed income, UK gilts, as represented by the FTSE Actuaries UK Conventional Gilts All Stocks Index, returned +2.0% over the quarter, while overseas government bonds, as represented by the JP Morgan Global Government Bond Index (excluding the UK) produced a return of +0.3% in sterling terms. Corporate bonds, as represented by the ICE BofA Sterling Non-Gilt Index, returned +2.4% over the quarter.7

European ex UK stocks produced the strongest return among the major equity markets during the quarter, delivering +8.6% in sterling terms. North American equities returned +4.6%, Japanese equities delivered +3.3%, and UK equities produced a quarterly return of +3.1%. Meanwhile, Asia Pacific ex Japan equities returned +2.7% and emerging markets returned +0.2% to UK-based investors.8

Gold rose by 8.0% in US-dollar terms over the quarter, while in sterling terms the precious metal produced a return of +5.9%.9

The collapse of SVB and ensuing banking-sector turmoil has turned the spotlight on US regulators, with the Fed facing questions around the ‘light-touch’ rules that have applied to smaller, regional lenders, and embarking on a review to determine where supervision can be strengthened. In the wake of SVB’s collapse, there have been calls for an extension of the stress-testing regime to cover smaller US banks. Larger US banks appear to be in a much stronger liquidity position given that they are subject to tighter regulations and, after recent events, have seen inflows of deposits.

At the Fed’s March meeting, the Federal Open Market Committee statement sought to balance financial stability with concerns around inflation by noting that more rate hikes might be appropriate, but acknowledging that recent developments could weigh on economic conditions. At the press conference, Fed Chair Jay Powell added that the recent events in the banking sector would be likely to lead to tighter credit conditions for businesses and households, which could have a similar effect to rate tightening. However, the degree of this impact remains highly uncertain, so it will be important to closely monitor the data and adjust policy accordingly.10

Along with other central banks, the Fed faces a major dilemma, as it seeks to avoid magnifying stress in the banking system while continuing with its mission to contain inflation, which could reaccelerate if interest rates are cut too quickly.

In a very rare occurrence, the aurora borealis (northern lights) were visible in the night sky across much of the UK at the end of February in a spectacular display caused by heightened solar activity. There were also some glimmers of optimism for the country’s economy as it narrowly managed to avoid a recession during the final quarter of 2022. However, activity was still 0.8% below its level in the same period of 2019, prior to the Covid-19 pandemic, while the US and the eurozone have grown 5.1% and 2.4% respectively over the same period.11

In addition, the UK and the European Union (EU) agreed a deal during the quarter to settle their dispute over Northern Ireland trading rules, with both UK Prime Minister Rishi Sunak and European Commission President Ursula von der Leyen heralding a “new chapter” in relations. As a consequence of the agreement, Britain will benefit from its scientists being able to rejoin the EU’s €96bn Horizon Europe science programme.

At its 23 March policy meeting, the Bank of England increased interest rates by 0.25%, following data released the previous day which showed that inflation had increased unexpectedly to 10.4% in February, driven by higher costs of food and eating out.12 Inflation in the UK, which Chancellor Jeremy Hunt described as “dangerously high”, is above levels in all other G7 countries, although the central bank expects it to “fall significantly” in the second quarter.

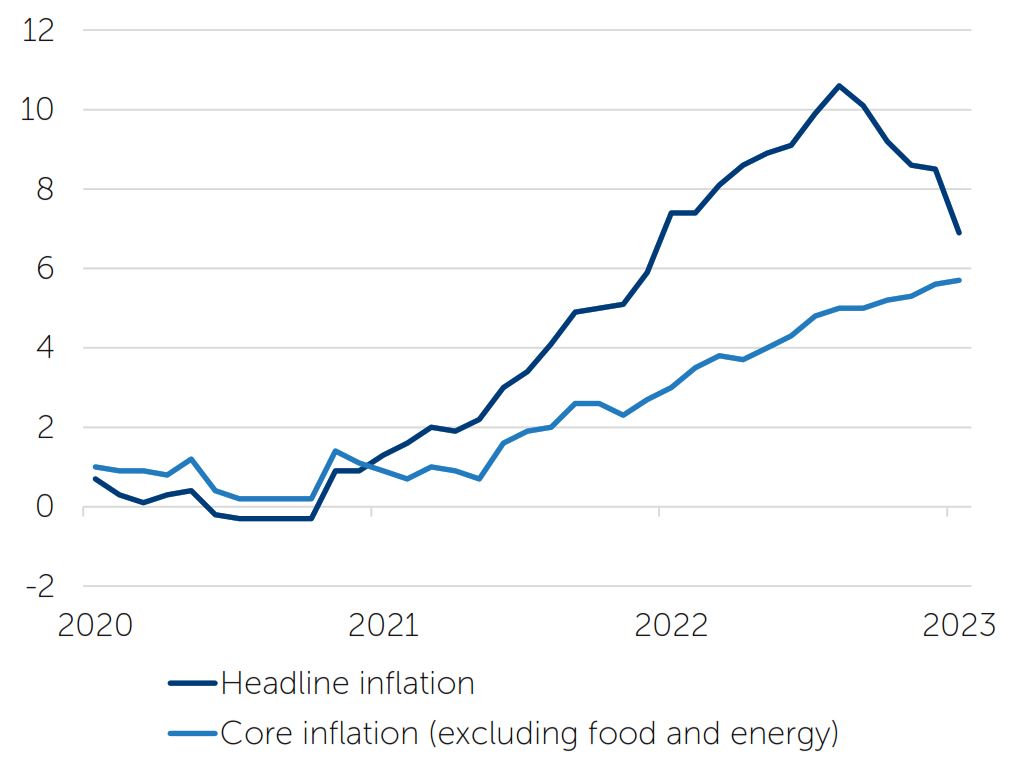

While headline inflation in Europe dropped to its lowest level for a year at 6.9% for the euro area in March after a big decline in energy costs, core inflation (which excludes food and energy) reached a new high of 5.7%.13 In spite of the worries over banking turmoil, the European Central Bank (ECB) proceeded with a 0.5% interest-rate increase at its 16 March meeting, although its governing council removed an earlier commitment to keep “raising interest rates significantly at a steady pace”, thereby indicating uncertainty over the potential for further increases in borrowing costs.

Eurozone inflation

% change year on year

Source: FactSet, April 2023.

A key concern for rate setters in Europe is rising labour costs, which went up by 5.7% in the eurozone in the final quarter of 2022 compared to the previous year. In addition, euro area unemployment fell to a record low of 6.6% in February.14 Business activity in the eurozone has remained robust, with the S&P Global composite purchasing managers’ index rising to a 10-month high of 54.1 in March,15 although most of the growth was driven by the region’s large services sector while manufacturing has seen broad stagnation. Some respondents expressed concerns about banking stress and higher borrowing costs, implying potential difficulties ahead.

In his last meeting as Bank of Japan governor on 10 March after ten years in charge, Haruhiko Kuroda declared his ultra-loose monetary policy to have been a “success” in terms of bringing out the potential of the Japanese economy, while accepting that the country had failed to sustainably achieve its 2% inflation target. At the meeting the central bank maintained negative interest rates as well as its yield-curve control bond-buying policy. However, with inflationary pressures now rising, Kuroda’s successor Kazuo Ueda faces a challenge over the future direction of monetary policy.

Japan’s ‘core-core’ consumer price index, which excludes energy and food prices, rose 3.5% in February, the biggest year-on-year increase since 1982, while major companies agreed to give employees an average salary increase of 3.8% for the new financial year beginning in April, which was ahead of market expectations.16 As the country has reopened following the pandemic, it has had to contend with labour shortages, a heavy reliance on imported commodities and a weaker yen. Ueda has hinted that, should these inflationary trends continue, monetary policy, including yield-curve control, will need to be reviewed.

The first session of China’s 2023 National People’s Congress opened on 5 March with the setting of a growth target for the year of “around 5%”.17 China achieved growth of just 3% in 2022, failing to meet the year’s 5.5% target, after extended lockdowns were imposed in large parts of the country to try to prevent the spread of Covid-19. While there is likely to be pent-up demand from consumers after years of Covid restrictions, a longer-term recovery is likely to be dependent on policies that can support the beleaguered property sector and potentially ease some of the regulatory restrictions imposed on technology businesses.

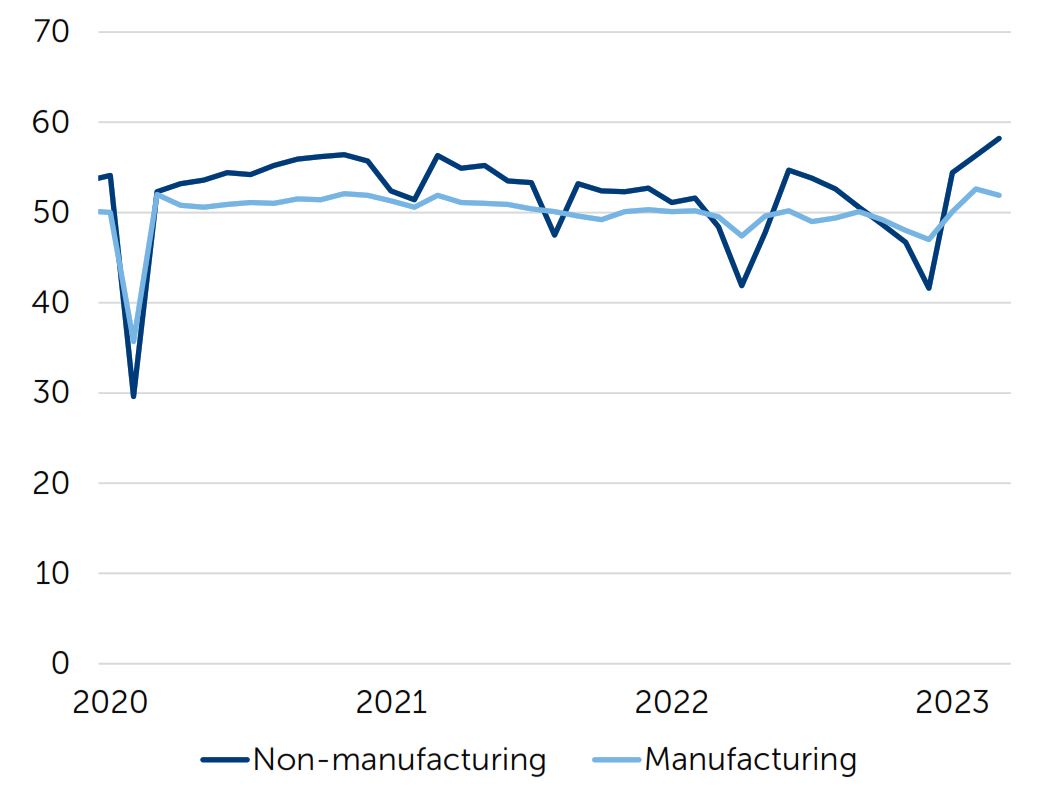

In March, China’s services activity expanded at its fastest rate in more than a decade, while manufacturing activity also exceeded forecasts. Nevertheless, outgoing premier Li Keqiang has warned that the Chinese economy still faces many challenges, including external factors such as slowing global growth and attempts to “suppress and contain China’s development”. The People’s Bank of China has cut the reserve requirement ratio by 0.25%,18 which effectively enables banks to increase lending; this followed the injection of large amounts of liquidity by state banks announced in November to support property developers. The government has also indicated that it will increase fiscal support and reduce taxes for small companies.

China purchasing managers’ indices

Source: FactSet, April 2023.

Uncertainty is the friend of the buyer of long-term values.

Warren Buffett

1 Source: FactSet, 1 February 2023

2 US jobs total surges by over half a million in January, Financial Times, 2 February 2023

3 US inflation cools slightly in January, Financial Times, 14 February 2023

4 Jay Powell warns Fed is prepared to return to bigger interest rate rises, Financial Times, 7 March 2023

5 Central banks announce dollar liquidity measures to ease banking crisis, Financial Times, 19 March 2023

6 Federal Reserve presses ahead with quarter-point rate rise despite banking turmoil, Financial Times, 22 March 2023

7 Bond market returns sourced from FactSet, 1 April 2023

8 Equity market returns sourced from FactSet, 1 April 2023 (All sterling total returns, FTSE World Index)

9 Gold bullion returns sourced from FactSet, 1 April 2023

10 Federal Open Market Committee meeting statement and press conference, 22 March 2023 (https://www.federalreserve.gov/monetarypolicy/fomcpresconf20230322.htm)

11 UK economy dodges recession but stagnates in final quarter of 2022, Financial Times, 10 February 2023

12 Bank of England raises interest rates to 4.25% despite banking turmoil, Financial Times, 23 March 2023

13 Eurozone inflation falls sharply to 6.9% as energy costs recede, Financial Times, 31 March 2023

14 Source: Eurostat, labour cost index and unemployment statistics, March 2023

15 Eurozone businesses report strong surge in activity, Financial Times, 24 March 2023

16 Key measure of Japan inflation reaches highest level in 41 years, Financial Times, 24 March 2023

17 China sets 5% growth target to drive economic recovery, Financial Times, 5 March 2023

18 China’s services activity expands at fastest rate in 12 years, Financial Times, 31 March 2023

All data is sourced from FactSet unless otherwise stated. All references to dollars are US dollars unless otherwise stated.

These opinions should not be construed as investment or other advice and are subject to change. This document is for information purposes only. This is not investment research or a research recommendation for regulatory purposes. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Issued in the UK by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Registered in England No. 01371973. Newton Investment Management Limited is authorised and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. This material may be distributed by BNY Mellon Investment Management EMEA (BNYM IM EMEA) in the UK to professional investors. BNYM IM EMEA, BNY Mellon Centre, 160 Queen Victoria Street, London EC4V 4LA. Registered in England No. 1118580. 'Newton' and/or `Newton Investment Management' is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and is comprised of the equity and multi-asset teams from an affiliate, Mellon Investments Corporation. NIMJ was established in March 2023 and is comprised of the Japanese equity management division of an affiliate, BNY Mellon Investment Management Japan Limited. This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances. Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws. Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www. asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.