We assess whether China can escape US-led economic containment policies, and the potential implications for investors.

The US and its allies are making active efforts to stymie China’s growth and development through a process of containment. We believe the question of whether China can avoid the ‘containment trap’ or not has significant implications for global growth and stability and should also be an important consideration for investors.

China’s rapid rise

China has experienced rapid economic growth over the last few decades, not only in absolute terms, but also relative to major developed economies. It should therefore come as little surprise that the US and its allies, perhaps fearful of what China’s rise means for their own prosperity, should now seek to contain China’s further ascendency. The notions behind such great power rivalry and ascent go back 2,500 years to the Greek historian Thucydides, and have been theorised in the famous ‘Thucydides trap’. In modern practical terms, however, the notion is simple: large economic powers with a sizeable industrial base are naturally inclined to convert such strength into military power, and China has done just that. It was the country’s ‘Made in China 2025’ plan (published in 2015), in which it sought to lead the world across ten high-tech industry sectors, that sparked the US’s fears. The US now seeks to contain China’s further rise, and is deploying tools and restrictions across trade, technology and security to curb its Asian rival.

China, of course, has been aware of Western containment efforts for some time. Its 20th Five-Year Plan sought to hedge against containment through ‘dual circulation’ by focusing more growth efforts on domestic sources and by diversifying supply chains across friendly nations. More recently though, China’s cries against Western containment have become much louder. At the Chinese government’s two Sessions in early March, which included the National People’s Congress, it announced a “whole of nation effort” to overcome the technology restrictions imposed by the West, and to accelerate the development of domestic innovation.

Containment is another structural headwind for the Chinese economy which, alongside its debt and demographics challenges, poses a significant risk to the country’s long-term economic growth and development. A slower-growth China is also an economic threat to countries strongly interlinked with it, such as those of Northeast Asia, Europe and much of the developing world. Less obvious but even more concerning is the security risk that China will seek to take by force that which it cannot access through trade. History is replete with such examples of this. The World War II aggression of Japan follows a path in which the country was itself contained in its ability to access key resources that it required for its economy to grow.

Can China overcome containment?

Given what is at stake for global growth and world peace, this is a vital question both for investors and for humankind. I find the market consensus on China’s medium-term growth outlook to be rather pessimistic (with growth from 2025 and beyond projected to be well below 5%) and believe this in large part reflects the expected headwinds of containment that China will struggle to navigate. Given investor positioning and weak sentiment, I take a more sanguine stance on China’s ability to circumnavigate the forces of containment. This is predicated on the three fundamentals discussed below.

- Government commitment:

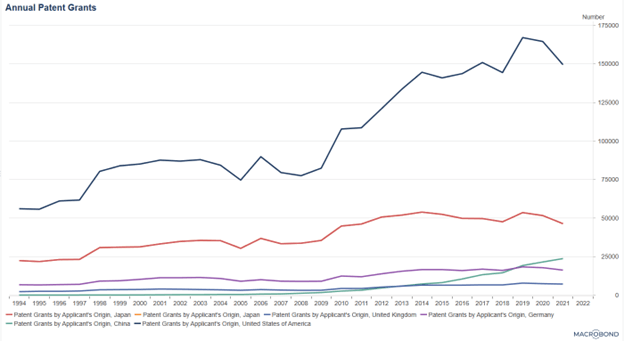

First, overcoming containment is now a whole-of-nation effort. Whole-of-nation efforts matter under authoritarian regimes because governments, without voter legitimacy at the ballot box, typically seek to attain such legitimacy by hitting national targets linked to prosperity. China has been very successful at this in the past, and there is no reason to believe that President Xi and his top economic officials will not follow through on their commitment. There is clear evidence of the magnitude of resources being deployed for domestic technology and innovation, including the Big Fund ($100bn semiconductor fund), support for 10,000 ‘little giants’, and the new technology super ministry that was granted additional powers recently at the National People’s Congress. In terms of early concrete progress, China overtook the UK and Germany in terms of patent filings in 2019. Although it is still far behind the US and Japan on this measure, it is clearly on an upward trend, while its rivals’ numbers are either falling or flat (see chart below).

Source: Macrobond, World Intellectual Property Organization (WIPO), 2021

- Domestic capability:

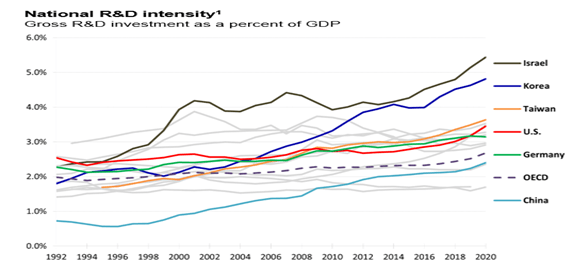

Second, by definition, China must be considered a peer competitor with the US in terms of domestic technology and industrial capability, as that is the very reason for the West’s sense of insecurity and consequent containment efforts. China possesses enormous domestic resource depth: a 900 million-strong working-age population, a highly educated population, a productive economy with excellent physical infrastructure, and a sufficiently strong level of national pride and national cohesion to drive progress without succumbing to ethnic tensions. The chart below shows the uptick in China’s research and development (R&D) budget in recent years.

Source: AAAS, OECD Main S&T Indicators, March 2021

- International friends:

Third, despite the democratic world’s efforts to contain China’s further economic development, China enjoys very strong relations with the ‘Global South’, which includes some very significant economic and political powers and most of the world’s population. This allows China access to resources, to large domestic consumer markets, and to export markets for its technologies. Despite the West’s best efforts to alienate China, most countries in the Global South favour doing business with China because it enhances their economic development, and China refrains from interfering in their political systems.

Doubling down on containment?

There is a risk that the West, principally the US, doubles down on its China containment efforts; this is my base-case expectation. In recent weeks and months, the US has been rallying allies such as the Netherlands and Japan to restrict key technology sales to China. The US’s Department of Commerce Entity List has seen an ever-expanding number of Chinese companies added to it almost on a weekly basis. The largest incremental risk from containment could come in the form of financial sanctions or restricted access to the Western financial system if, for example, China begins providing explicit material support for Russia’s war in Ukraine. Western intelligence officials have hinted that China may be intending to provide such support but, as yet, there is no concrete evidence of military support. Financial sanctions would also come at a cost for the US; containing China’s access to the Western financial system, or sanctioning its largest banks, would be likely to accelerate the process of de-dollarisation (reducing reliance on the US dollar) and could have significant blowback self-harm implications for the US and for global economic stability.

Investment implications

Given my base-case outlook that the West will continue to exert significant containment pressures and that China will pursue a whole-of-nation innovation effort in response, I see three ways in which investors should consider positioning. First, I believe investors can best gain exposure to domestic innovation development through a basket of domestic technology companies on the China A-share market. This will include many of the ‘little giants’ that the government has singled out for support. Secondly, China’s innovation drive and industrial upgrading will undoubtedly necessitate the import of critical raw materials and industrial goods. If China can no longer access these from the US, it will look to Europe, where possible, and to other emerging markets (allies in the Global South) as a priority. Thirdly, given uncertainty around the persisting global dominance of the Western financial system and US-dollar hegemony (especially if the US overplays its hand with financial sanctions), we believe investors should be diversifying their currency exposure. For us, a combination of defensive currencies and selective high-beta currencies makes sense, as does an allocation to precious metals.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility due to differences in generally accepted accounting principles or from economic, political instability or less developed market practices. Richard Bullock is an employee of BNY Mellon Investment Management Singapore and provides support to Newton Investment Management as a geopolitical strategist.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments