We assess Russian President Vladimir Putin’s list of demands over Ukraine and future implications for Europe’s security architecture.

Key points

- Russia has always seen Ukraine as part of its sphere of influence, but as the latter has looked progressively to the West, the dynamic has become less palatable for Russia.

- Ukrainian President Zelensky’s desire to join both NATO and the European Union, if fulfilled, would be an enormous geostrategic setback for Russia.

- Despite many economic shortfalls, Russia has remained competitive in military and defence technology, and the Kremlin feels it has the geopolitical authority and strength to challenge the ongoing expansionist threat of NATO.

- Tensions are running high, and negotiations between Russia and the West have made little progress. However, our base case remains that a ‘soft deal’ is in the interests of all parties and can still be attained.

- Despite that, the probability of a Russian military incursion is rising. We believe there is a 20% chance that Russia follows through to invade or control at least some part of Ukraine’s territory.

As US Secretary of State Antony Blinken begins the latest round of talks with the US’s NATO allies and Russia over Ukraine, Russia’s recently presented list of security demands represents a bold move in which the Kremlin has sought to reshape the European continent’s post-Cold War security architecture. With the Russian military having amassed around 100,000 troops on its western border with Ukraine, what happens next could be decisive for the geopolitics of Europe’s defence architecture, its energy security and for the future of great power competition.

Geopolitical context

For a combination of historical, cultural, demographic and security reasons, Russia considers Ukraine to be part of its sphere. The territory that comprises Ukraine today was part of the Russian empire prior to the 1917 revolution. The country was also one of the Soviet republics during the Cold War and gained independence as a sovereign nation in August 1991. Russia was comfortable with a Ukraine in political subservience and patronage to Moscow, but as Kiev began to look west and elections after 2000 installed pro-western leaders, the dynamic became less palatable for Russia.

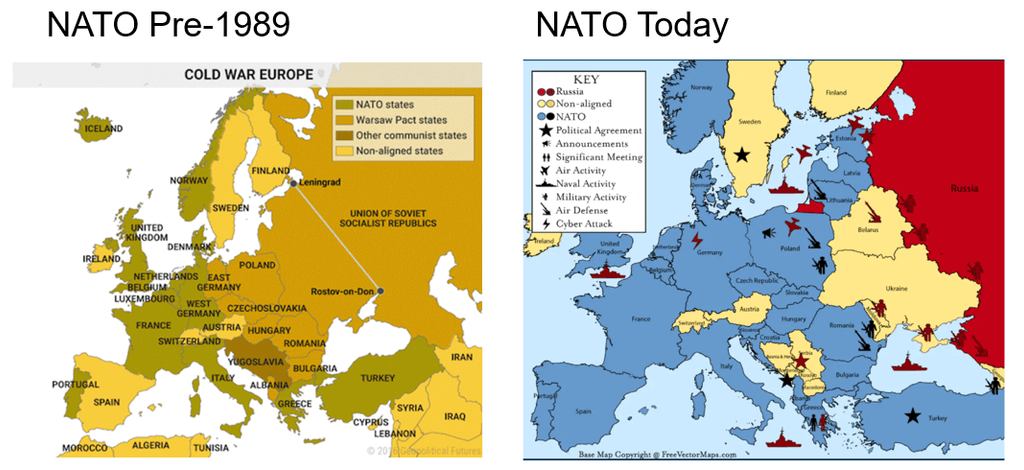

The historical and security rationale are instructive: since the 1600s, Russia has been invaded on average once a century by western European powers including the Swedes, Poles, Napoleonic French and Nazi Germany. Maximising the territorial security buffer has therefore always been a key Russian geostrategic priority. The maps below illustrate how NATO’s post-Cold War expansions, with waves in 1999 and 2004, and Ukraine’s pro-western tilt, have resulted in a Russian last line of defence that is uncomfortably close to Moscow and the industrial heartland. Therefore, when Russia’s President Putin talks about the security challenges for Moscow of NATO’s expansion, this is a matter of genuine concern for the Kremlin.

The Kremlin’s concerns go beyond security, however, and involve a political-ideological dynamic; it is about having democracies installed in its own back yard which could consequently have a destabilising impact on the political situation, social cohesion and ability to govern in domestic Russia. As the history of great power competition has illustrated, a weak security void will always be filled by the strongest power, and Ukraine is proving little different. Ukrainian President Zelensky’s desire to join both NATO and the European Union, if fulfilled, would be an enormous geostrategic setback for Russia.

Source: Base Map Copyright@FreeVectorMaps.com, December 2021

Russian revisionism

Russia’s renewed confidence as a global superpower has evolved gradually under Putin’s leadership after leaving behind the dark national humiliations of the 1990s including the rouble crisis and sovereign default in 1998, following the collapse of the USSR. The country has benefitted from the hydrocarbon windfall, built its foreign-exchange (FX) reserves to over US$600bn, largely decoupled trade (excluding oil and gas) from the West in the wake of the annexation of Crimea, enhanced the resilience of its domestic economy under seven years of US sanctions, and increased its economic and security proximity to China.

Despite many economic shortfalls, Russia has remained competitive in military and defence technology, and is one of the world’s leading exporters of military equipment. Leadership in the sector was nowhere more evident than in 2021’s successful hypersonic missile tests which rattled the US’s security establishment. Russia’s resilience over the last decade, while the US and Europe have floundered economically and politically post global financial crisis, has bolstered its confidence as a renewed superpower, and the country still has the world’s largest nuclear arsenal with around 6,500 active nuclear warheads to boot. The continuing expansionist threat of NATO is therefore something the Kremlin feels it has the geopolitical authority and strength to challenge.

Putin’s ultimatum

In mid-December, Russia’s foreign ministry presented the US and NATO with an eight-point draft treaty which included three significant provisions: no future NATO membership for Ukraine; Russian pre-approval for NATO military drills in Ukraine, the Caucasus and Central Asia; and a withdrawal of NATO military deployment in countries on Russia’s flank (including Poland, the Baltic states and the Balkan countries), effectively pushing back NATO’s expansion to pre-1999 territories. Russia urged that negotiations over the treaty begin without undue delay.

The timing for Russia’s demands is ominous, and coincides with a strategy of maximum leverage application. First, Western military intelligence determined that Russia has amassed some 100,000 soldiers along its western border with Ukraine, along with tanks and artillery support, with one US report suggesting plans for an imminent invasion. Second, natural gas inventory levels in Europe are at low levels for the current winter season and Russia has been dragging its feet on providing additional supplies to meet demand, including a short period in December during which flows reversed from Europe back to Russia. This comes as the European Commission and German government continue administration around the final certification of Russia’s Nord Stream 2 pipeline. Third, Germany’s new government, led by new Chancellor Olaf Scholz, has only been in office for a matter of weeks and is still defining a joint foreign policy with coalition partners. France has recently taken control of the European presidency and is preparing for domestic presidential elections in April. It is fair to conclude that right now would not be an optimal time for Europe to face a security crisis, but it might be a good time for Russia to initiate one.

Scenarios

Below, we set out five simple scenarios that investors might consider possible during the first quarter of 2022 along with a rationale for each.

| Outcome | Probability | Comments |

| Formal deal (appeasement) | 10% | US/NATO concede to Russia on some or all of the draft provisions |

| Soft deal | 40% | An implicit (non-treaty) agreement with wins on all sides |

| No deal – Russia bluffing | 10% | Russia disappointed but doesn’t follow through with action |

| No deal – Russia grey-zone | 20% | Russia directs its actions through the grey-zone (non-military aggression) |

| No deal – Russia incursion | 20% | Russia invades and /or controls some part of Ukraine’s territory |

Source: Newton, January 2022

The US administration has already ruled out submitting to Russian security demands as presented in the draft agreement. That would amount to a betrayal of democratic and sovereign values as member states must be allowed to choose their own membership of international organisations. Conceding to Russia on any of its terms would make Biden look soft in this important year for US mid-term elections, and would be seized upon by the Republican Party as yet another Democratic foreign-policy defeat in the wake of last summer’s calamitous Afghanistan withdrawal.

History has also proven that appeasement strategies rarely work out favourably for the appeaser as great powers sense weakness and seek to maximise their self-interest. British Prime Minister Neville Chamberlain returned from Munich in 1938 declaring “there will be peace in our time” after signing a peace pact with Hitler. Less than six months later, Germany invaded Czechoslovakia.

The most probable scenario (40%) would take the form of a soft deal in which all parties can salvage some political or commercial capital while averting the costs of war and avoiding formal treaty commitments. This could take the shape of Germany agreeing to the prompt start of Nord Stream 2, NATO agreeing to a moratorium on force deployment or military exercises in the Baltics and Ukraine, and Russia demobilising its forces on the Ukrainian border and opening a more active channel of communication with NATO. It would not provide a fix for long-term structural security challenges in eastern Europe but would allow Putin and Biden to both herald a short-term victory.

This outcome might even provide the basis for a new INF (Intermediate-Range Nuclear Forces) Treaty deal between Russia and the US, with the existing deal having expired in 2019. A soft, ‘muddle-through’ deal would also be viewed in a favourable light by investors, particularly Russian debt and equity investors, given the avoidance of further US financial sanctions on Russia. It would also be a win for German industry and a convenient way for the new German government coalition to bring on Nord Stream 2 while keeping opposition to the pipeline from the Green Party at bay.

The remaining scenarios entail a ‘no deal’ as the US, NATO and European Union dig in and reject all Russian demands and Russia remains inflexible. This certainly appears to be the direction that both US Secretary of State Antony Blinken and National Security Advisor Jake Sullivan are hinting at to the media, although such a negative tone of communication might contain an element of politicking and be intended for hard-line signalling during the negotiation process. The overall probability of a ‘no deal’ has risen in recent weeks to around 50% as multilateral talks in Geneva and Brussels delivered no tangible progress and continuing negotiations have shifted to a bilateral format.

If a ‘no deal’ were to transpire, there are three further scenarios that could play out, in our view. The first is a Russian bluff or backdown. Given the loss of credibility that President Putin and Russia would face from backing down, the probability of this occurring would be low (10%), with one caveat being that if Russia becomes distracted with other foreign-policy challenges in its sphere, such as the recent political and civil unrest in Kazakhstan, it may put any imminent plans for aggression against Ukraine on hold.

The second no-deal scenario, which has risen in likelihood in recent weeks, is a Russian ‘grey-zone’ strategy (20%) which might comprise a variety of plausibly deniable tactics including cyber-attacks, disinformation campaigns and false flag paramilitary operations. In fact, there are indications in recent days that Russia is leaning in this direction. A grey-zone strategy alone may not deliver the security concessions that Russia is ultimately seeking, but such operations could weaken Ukraine’s resolve and make a future military incursion less costly for Russia. In the meantime, plausible deniability might also enable Moscow to avoid additional US sanctions and the associated economic burdens.

The third no-deal scenario (20%) would comprise an outright Russian military incursion of Ukraine or some other aggressive means of territorial control, such as a maritime blockade. It is difficult to speculate precisely what form this might take, and how deep a possible invasion could penetrate into Ukrainian territory. At a minimum, the annexation of ethnic Russian-populated territories in eastern Ukraine would seem logical. It is unlikely that Russia would seek to occupy the entire country as there would be an enormous economic, political and security cost involved in doing so, including possible direct military conflict with NATO. To weaken the remainder of any Ukrainian territory not held (for example west of the Dnieper river), Russia might look to secure its control over Ukraine’s coastline and ports, choking off the country’s access to maritime trade and naval capability.

Macro and investment implications

Rates and currencies

With negotiations showing little progress, the probability of reaching a deal has fallen over the last two weeks and asset markets have begun to price in a more negative scenario. The rouble has experienced a c.5% decline versus the US dollar since early December, which partly reflects broader emerging-market currency weakness and Federal Reserve-induced dollar strength. Russian hard-currency bonds have also seen yield expansion of +75-100 basis points (bps) across the curve over the last month. Russian five-year sovereign credit default swaps (CDSs) have increased by 75 bps since mid-December (reflecting a sharp breakout from the five-year downward trend) and now stand at close to 200 bps. These negative moves in Russian asset prices come despite the ten-dollar rally in crude oil prices over the year to date – a traditional support to Russia’s fiscal and external position – and therefore highlight the degree to which geopolitics is dominating the Russian investment narrative.

A deal between Russia and NATO could see the rouble strengthen back to US$72-73, the market level prior to the rise in geopolitical tensions. Sovereign spreads, which have recently blown out to 220bps over 10-year US Treasuries, would be likely to tighten back to the recent 100-150 bps range. A ‘no deal’, depending on the nature of the Kremlin’s follow-through, would be likely to lead to a marked sell-off in the rouble and a further blowout in Russia’s sovereign and CDS spreads. In the event of a Russian incursion (20% probability), investors should brace for US sanctions to be applied to the secondary market for Russian sovereign debt, with a corresponding expansion in yields and spreads.

Commodities

The European natural gas market has experienced high volatility since the beginning of September owing to low seasonal inventory levels and souring relations with Russia. Prices have retrenched sharply from mid-December levels but still remain elevated. If the deal scenarios described above play out and the start-up of the Nord Stream 2 pipeline is brought forward as part of any arrangement, this could see European gas prices fall back further to the US$10-20/1,000 cubic feet (mcf) range and would provide a positive boost to the European industrial economy and Europe’s industrial competitiveness.

Conversely, a ‘no deal’ could see a renewed price spike and continuing European gas-market tightness given that several more months remain of the high-demand winter season. Brussels and other European capitals will be reflecting on lessons learned from this winter’s gas-price episode, and the experience is likely to accelerate the energy-transition process, particularly the medium-term structural shift away from Russian gas dependency. The Kremlin risks exploiting its near-term energy advantage at the expense of long-term commercial partnerships (a dynamic that Russia argues has already been instigated by the Europeans as Brussels has urged member states to move away from long-term contractual agreements with Russian gas supplier Gazprom). Continued European gas price volatility as a result of inconsistent Russian pipeline supplies can only play to the long-term advantage of the liquefied natural gas (LNG) industry and the world’s other major natural gas exporters including the US, Qatar and Australia.

Equities

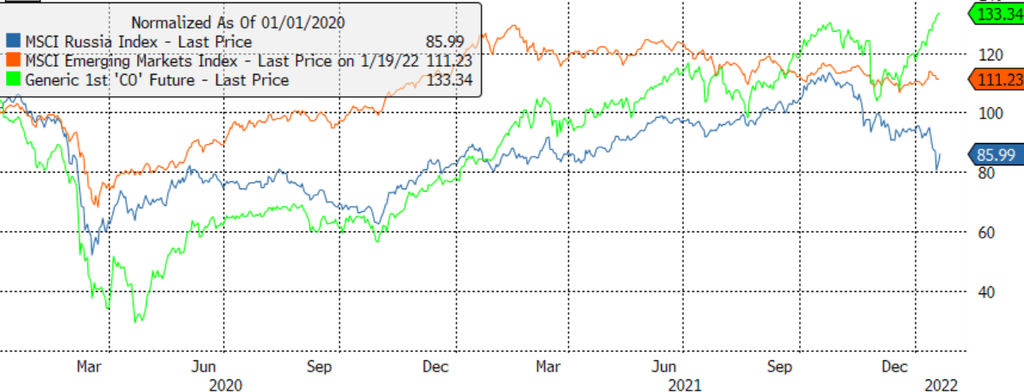

Following a strong burst of outperformance relative to emerging markets in the second and third quarters of 2021, Russian equities underperformed quite markedly in Q4, and have continued the relative underperformance so far in 2022 on geopolitical grounds. Russian equities have historically exhibited a strong correlation with crude oil prices (see below), but this close linkage has sharply decoupled over the last month with a relative underperformance of c.30%. Around 50% of the MSCI Russia Index (see below) comprises energy stocks, with a further 18% in materials, and it is clear that the confidence of Russian equity investors is being severely tested owing to geopolitical uncertainty, despite the strength in commodity prices and the healthy cash-flow fundamentals that Russian companies are currently enjoying.

Decoupling: MSCI Russia Index vs MSCI Emerging Markets Index vs Brent crude price since Covid-19 pandemic. 1 January 2020 – 20 January 2022

Source: Bloomberg, 20 January 2022

The prospects of a Russia-NATO deal would appear to be very positive for Russian equities, with the potential for a short term 20-30% rebound, given where the stocks have recently traded relative to crude oil. A deal could even pave the way for eventual compression of the Russian equity risk premium, which has been elevated since the 2014 Crimea annexation and consequent imposition of US sanctions. Realistically, however, this would be a longer-term process and require the US Congress to remove some of the existing sanctions, which is not within the current scope of outcomes. A ‘no deal’, especially if followed by Russian military action, would lead to further widening of the Russian equity risk premium as companies are excluded from international capital markets and face the prospect of further trade sanctions.

The implications for equity markets transcend Russia, however. A deal would be positive for European macro confidence and support future supplies of cheaper and more consistent energy. Over time, the Russian domestic market could gradually see reopening to European (particularly German) industrial companies and Italian and French consumer products companies. The Russian economy may lack dynamism, and purchasing power may have eroded over the last decade, but it is a nominal US$1.7 trillion domestic economy, the world’s 11th largest and just behind Canada.

A ‘no deal’, by contrast, particularly one that results in military action, would be a boon to European defence spending, as it accelerates its path from 1.6% of European NATO members’ GDP to the pledged 2% level. It would also force a swifter reappraisal of Europe’s energy policy, promoting faster green investment and greater gas purchases from the exporting countries described above, supporting the US energy sector among others.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices. Richard Bullock is an employee of BNY Mellon Investment Management Singapore and provides support to Newton Investment Management as a geopolitical strategist.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments