We assess the prospects for oil & gas companies as they seek to navigate the energy transition.

*Investors are pulling out of traditional energy companies in growing numbers.

*Clients are increasingly asking investment managers to divest from oil and gas companies.

*Governments need to implement policies that will incentivise the energy sector to move to a lower-carbon world.

*Those oil & gas companies that can successfully adapt should survive the energy transition.

We live in a world full of complex transitions – whether in climate, technology, global trade or demographics – that are reshaping the way that we live and manage our businesses; most recently, the arrival of the Covid-19 pandemic has added a global health crisis to the mix, which has shown how complexity often leads to fragility at the time of greatest need.

Fossil-fuel companies vulnerable to change

As investors, our aim is to deliver attractive risk-adjusted returns by acting as good stewards of other people’s money, to help individuals retire well into a healthy and vibrant world or to help clients achieve other objectives. Successful investment is never achieved by looking backwards and anchoring to the past, but by looking forward at where the world is going. Looking back, it is shocking to see how many of the venerated names back in the mid-1980s no longer exist: not just through rebranding or takeovers, but by becoming irrelevant in a changing world. In a rapidly evolving system, the fossil-fuel sector in its current guise now looks increasingly vulnerable to becoming irrelevant to future investors.

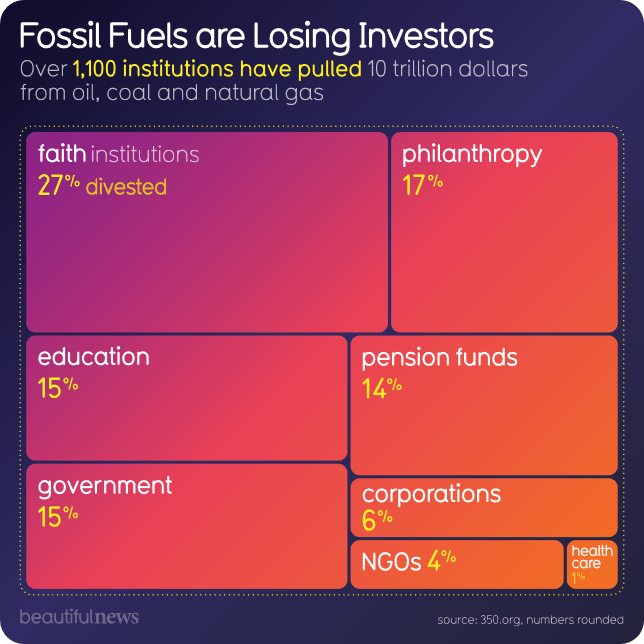

Burning through investors: the falling popularity of traditional energy

Source: Beautiful news, 350.org, April 2020 (numbers rounded)

In 2019, the MSCI World Index was up almost 24% in US-dollar terms[1] while the MSCI World Energy Index returned just over 12%, and has underperformed its wider global equity equivalent in four out of the last five years.[2] Despite a recent recovery in the oil price from record lows as global lockdowns have eased, falling returns on capital, volatile energy prices and the rise of renewables had increasingly made fossil-fuel investments an unappealing choice for investors. The primary salvation was high-dividend yields for those in need of income in an income-starved world.

In 2020, with plummeting demand for energy, fossil-fuel stocks have remained in the firing line with the International Energy Association (IEA) predicting that demand for oil & gas could fall by over 5% for the year, while growth in output from solar and wind is expected to rise by more than 10%. Did 2019 mark the peak year for fossil-fuel demand globally? In the UK, 37% of electricity production came from renewables in 2019, and their increased use is a trend which is being replicated across the globe.

Growing losses

Not only are investors in the oil & gas sector now seeing unsustainable dividend yields being cut, they are also experiencing painful losses in high-yield and private-debt holdings linked to fossil-fuel investments. At the low point this year, the iBoxx USD Liquid High Yield Oil & Gas index had fallen by 46%, similar to the rout seen in 2015. For those investors not convinced by concerns over climate change and the rapidly increasing competition from renewables, losses from oil & gas holdings in their portfolios are bringing home the reality of investing in assets where the tide of history is against them.

Demand for oil & gas is likely to bounce back next year, and the oil price may well recover further from present levels too, but does this matter? Prices are set by marginal demand and if the future rate of change is negative, in our view, even the high yields on offer could provide insufficient compensation for the risk of asset impairment and redundancy.

Changing client preferences

But there is another tide that is diminishing the demand for fossil-fuel investments that is only compounded by recent poor returns: client preferences. Increasingly, investment managers are being asked to divest from fossil-fuel investments by private clients, pension funds, foundations and charities. At the start of May, The University of Oxford’s endowment fund announced plans to exclude all fossil-fuel investments, even though some of the university’s colleges were benefitting from the (former) high-dividend yields of the oil majors to support their educational endeavours.

Pressure to change

It is not only the pressure on investment managers to avoid direct fossil-fuel holdings that is the issue: increasingly, we are seeing lobbying of banks and insurance companies to cease funding fossil-fuel businesses. One leading UK bank has already announced that it will no longer fund fossil-fuel investments, and other commercial banks are under pressure to follow suit. And it is not only the production of fossil fuels that is in focus: the use of petrochemical products, such as single-use plastics, is a topic for active engagement by investors who are putting pressure on major food companies to limit their use.

Many major oil companies are pledging that they will be running zero-carbon strategies by 2050, reflecting the demand from many in civil society for a more rapid energy transition, and the pressure for increased disclosure and reporting of their carbon footprints. The hidden message in these announcements is calling out governments to put in place the incentives (and disincentives) to accelerate that transition: betting on continuous support from governments for fossil fuels as a central plank of an investment thesis could be a proposition based on shaky ground. As the cost of renewable energy (and, in time, hydrogen made using renewable power) falls further, grid systems adapt, and material science evolves, the abundance of green energy is likely to progressively undermine the economics of fossil fuels.

Survival of the fittest?

All this adds up to diminishing marginal demand that threatens to make oil & gas investments irrelevant in the face of all the other opportunities open to investors. This is a story about aggregate demand trends; there will be isolated winners, the oil price will occasionally spike, but the industry is in a painful transition that seems unlikely to reverse.

Charles Darwin’s maxim on evolution is often misquoted as the ‘survival of the fittest’. The correct version is the ‘survival of the most adaptive’, and that is the message to the oil & gas sector: to remain relevant, adaptation is an imperative in a changing world.

[1] https://www.theguardian.com/business/2019/dec/31/global-stock-markets-post-best-year-since-financial-crisis

[2] https://www.msci.com/documents/10199/de6dfd90-3fcd-42f0-aaf9-4b3565462b5a

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments