Key points

- As much of the world seeks to move away from fossil fuels, renewable-energy investments have experienced significant growth in recent years.

- While there have been successes in global efforts to transition to cleaner energy, there are still major problems to be solved, such as intermittency of supply.

- With recent advances in battery technology, a possible solution is battery energy storage systems (BESSs), although it will be important for investors to be aware of some challenges in this area.

The correlation between CO2 emissions and rising temperatures and sea levels is an uncomfortable truth which is hard to ignore from an investment standpoint. As much of the world agrees with the transitions required to change our legacy energy framework, various government subsidies and incentives have focused on the ‘green’ agenda. This has subsequently resulted in economies of scale in hydro, wind and solar energy sectors, and created new sectors entirely. As such, green investments are becoming more economically successful. However, investing in ‘clean’ assets is not only part of a strategy to back areas of growth, but can also be part of the solution to climate impact.

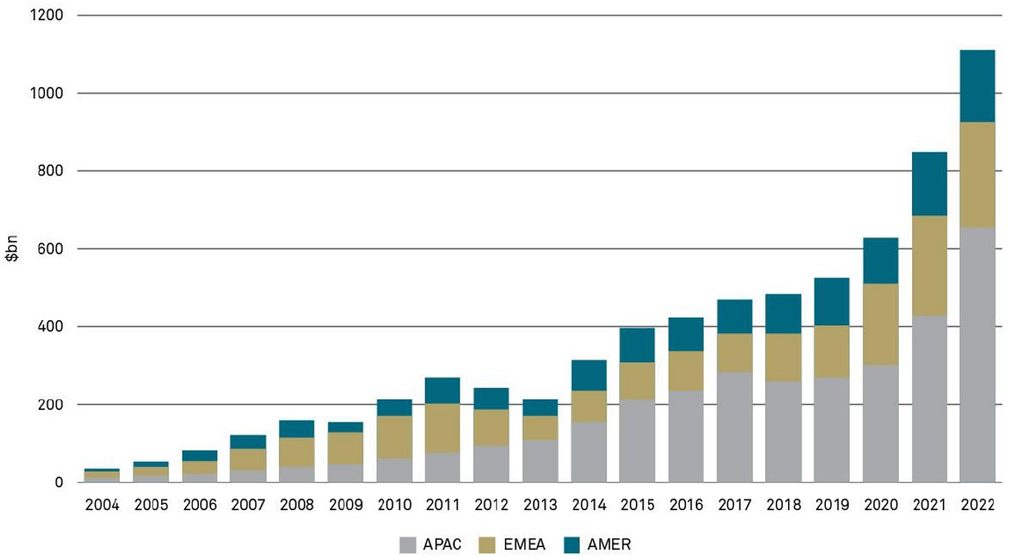

Clean energy investment 2004-2022 (US$bn) – region

Source: Bloomberg New Energy Finance, January 2023

Inefficiency in renewable-energy sources

While there have been successes in global efforts to transition to cleaner energy, there are still problems to be solved, and renewables such as hydro, wind and solar are not faultless in their design.

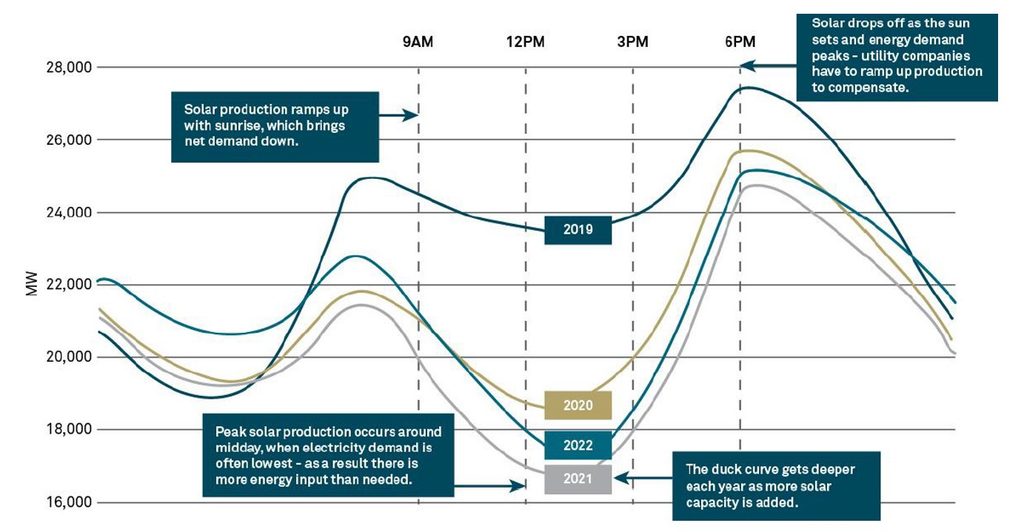

For example, with solar energy, huge amounts of electricity are generated for short time frames in the middle of the day when electricity demand is often lowest. Later, in the evening, solar energy generation drops off as the sun sets, but TVs and kettles are switched on and demand surges. This new problem of oversupply/undersupply can be visualised as the ‘duck curve’ (so called because it takes the shape of a duck).

Solar power duck curve – electricity demand in California

Source: CAISO, March 2023

These inefficiencies and associated energy loss represent a problem that will only become more pronounced as more renewable-energy sources come online. A possible solution is battery energy storage systems (BESSs), which have the potential to make renewable energy more efficient by capturing energy and storing it in rechargeable batteries, helping to balance supply and demand.

With recent advances in battery technology and declining costs of battery units, there has been growing interest in the BESS industry, with an increasing number of BESS solutions being introduced globally, providing a possible solution for power grids looking to manage intermittency of supply. In this context, companies offering such energy-storage services have the potential to provide investors with attractive yields with the prospect of capital growth.

Commodities and geopolitics

However, the BESS investment area is not without problems or competition. One potential headwind is that the commodities that go into batteries are in huge demand, with the transition to both renewables and electric vehicles (EVs) taking place at the same time. For instance, there were an estimated 10.3 million EVs sold globally in 2022, but that figure is expected to increase to 45.4 million by 2030.1 With EV and battery production set to increase, a race to obtain the natural resources needed is underway, as identified by our resource competition sub-theme.

As BESS construction continues to evolve, the advancement into higher nickel content batteries will allow for improved storage and faster charging. Between 2020 and 2030, demand for nickel is projected to grow by up to 15 times and lithium by 14 times.1 In 2023, only 5% of the global nickel supply is expected to be used for batteries, but as BESSs and EVs continue to grow over the next decade, we expect that figure to increase to just under 40%.

There are also relatively few areas where nickel can be mined. One of them is Russia, so it is important to think about the implications of further sanctions on Russian exports: a ban on Russian-produced nickel could cause significant challenges.

Another location is Indonesia, which produced 1.6 million tonnes of nickel in 2022, more than any other country. However, nickel mining in Indonesia is opposed by several environmental groups. The process of high-pressure acid leaching, through which low-grade nickel is refined into the high-grade nickel required for batteries, is very carbon-intensive, and the release of harmful chemicals can have negative impacts on water habitats such as coral reefs. It will therefore be important for investors to maintain scrutiny on these areas.

Investment implications

The renewable sectors have seen intense growth, and in many ways the world is still catching up with the demand. However, we believe the continuing focus on BESSs and the commodities required will strengthen investors’ position to navigate the upcoming challenges that the energy transition presents. As such, we favour selective exposure to companies operating in the electrification and decarbonisation industries, in line with the trends identified by our natural capital micro theme.

1 According to data from Rho Motion, Macquarie Commodities Strategy, March 2023

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Analysis of themes may vary depending on the type of security, investment rationale and investment strategy. Newton will make investment decisions that are not based on themes and may conclude that other attributes of an investment outweigh the thematic research structure the security has been assigned to.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments