As conflict continues in Ukraine, we assess the potential investment implications arising from evolving Sino-Russian relations.

By Richard Bullock

Key points

- The history of Sino-Russian relations has been volatile, unstable and typically imbalanced over longer time horizons.

- At present, geopolitical realities are driving closer China-Russia cooperation across multiple domains, which is likely to be further accelerated by the Ukraine crisis.

- Nevertheless, the relationship faces a large economic imbalance, given the relative scale of the two economies; Russia will want to avoid becoming a long-term vassal state of China but has few strategic alternatives to closer proximity at present.

- China will take a long-term strategic approach – prioritising its own national interests – and will try to avoid jeopardising its relationship with the West in the near term and inviting secondary sanctions.

- The Sino-Russian autocratic alliance is being mirrored by closer alliance between democratic states with investment implications for equity-sector allocation, inflation and rates, future currency constructs and the commodity/climate debate.

A Cold War history of Sino-Russian relations

To look forward, investors sometimes have to look back. To conceive of the future of China-Russia relations, it is helpful to recall the pattern of coexistence between these two countries that was defined by the backdrop of the Cold War – a period of global geopolitical rivalry that has strong parallels with today’s emerging international environment.

Despite a common ideological starting point in the communist revolutionary cause, relations between what was then the Soviet Union and China were never consistent, nor were they stable. They have been shaped over time by both individual personalities and external events. The Soviets’ cautious support for the Chinese Communist Party began as early as 1921, and in the 1940s Stalin supported Chairman Mao’s Communists in the Chinese civil war that ended in 1949. Mao was subsequently hosted by Moscow for an extended period in late 1949 after the war had ended. This strengthened the personal relationship of the two leaders and particularly the reverence that Mao showed for Stalin.

It also set the stage for a period of very strong relations in the early 1950s, with its centrepiece being the signing of the Sino-Soviet Treaty of Friendship and Alliance and a US$300m Soviet loan to China to help with national reconstruction and economic recovery after the civil war. The Soviet Union also transferred the port city of Dalian (Port Arthur) to China and provided military assistance to China’s involvement in the Korean War (1950-53).

It was from the mid-1950s, however, that relations began to sour. After Stalin’s death in 1953, Mao did not hold the same reverence or respect for his successor Khrushchev, a relationship tarnished further by Khrushchev’s denunciation of Stalin in his 1956 ‘secret speech’. Mao came to see himself as the true communist revolutionary and ideologue, while Khrushchev began to see Mao as reckless on the international stage as he sought to stabilise Soviet relations with the West. Sino-Russian Relations deteriorated further after the Soviet Union ended support for China’s nuclear programme in the mid-1950s – it would take China another decade to make the nuclear breakthrough.

In the late 1950s and early 1960s, the relationship strain came to be defined more by international issues than bilateral or personality issues. First, the Soviet Union provided implicit support to Tibet during China’s 1959 crushing of the Tibetan uprising, and then provided support and weapons to India during the 1962 Sino-Indian war. Consequently, China ended diplomatic relations with the Soviet Union at this point. The relationship deteriorated further in 1969, when the two countries came into direct confrontation in the Sino-Soviet border conflict in Manchuria resulting in 280 total casualties, an episode that could have escalated to nuclear conflict. It was not until the late 1970s that relations began to thaw and another decade before formal diplomatic relations were resumed in 1989, with a common interest in pursuing domestic reforms.

What overarching lessons can be drawn from the history of Sino-Soviet relations in order to address the present-day relationship?

The first lesson is that the Sino-Russian relationship has not endured for any length of time as one of perceived equals. The Soviet Union was the dominant ‘big brother’ in the relationship during the 1950s owing to Stalin’s seniority, Soviet industrial advancement and the possession of atomic weapons. However, as the 1950s progressed, Mao came to see Khrushchev as a less legitimate leader of the communist cause. The personality and egos of Chinese and Russian leaders has mattered significantly to the relationship.

Today, President Putin and President Xi have a very strong personal rapport with a high degree of mutual respect. Since coming to power a decade ago, Xi has met Putin some 38 times in person. Even though Xi presides over an economy multiple times larger than Putin’s, the Russian leader’s two-decade tenure as leader and controller of the world’s largest nuclear arsenal, as well as his defiance of the West and revisionist stance towards the international order, are reasons for a balanced level of mutual respect. What will happen to the Sino-Russian relationship once either of the current leaders leaves office? The risk is more skewed towards Russia becoming a junior partner in the relationship as Chinese party politics has a greater tendency towards continuity and Russia’s economy could find itself in a more precarious structural condition.

The second lesson from the Cold War relationship is that technology sharing and technology transfer occurs between the two countries when relations are strong but cannot always be taken for granted. The Soviets ceased assisting China’s nuclear programme in acquiescence to the West, nervous of Mao’s cavalier attitude towards international relations and the prospect that he might use atomic weapons. In parallel fashion, now that Russia is heavily sanctioned by the West, contemporary China will be confronted with the prospect of how much technology to share with Russia – a decision that may prove critical for the future of Russia’s military-industrial complex. Based on history, it is not clear-cut that it would serve China’s best interests to share its leading-edge technology with Russia, despite the two leaders’ recent pledge of a ‘no limits’ relationship including across many areas of technology.

This leads into the third important lesson from the Cold War Sino-Soviet relationship: foreign policy and external interests can sometimes supersede the importance of the bilateral relationship. As strong as the bilateral relationship is, both Russia and China have their own national interests and independent foreign policies in many domains. In the 1950s and early 1960s, for China this comprised Taiwan, Tibet and the Indian border conflict. For Russia it was Eastern Europe, the Hungarian revolution and the Cuban missile crisis.

Ukraine provides a strong parallel today. It is the centrepiece of Russia’s foreign policy, but involvement for China could prove extremely costly for Beijing in terms of lost trade and investment with the West, which explains why China has attempted to position itself neutrally and distance itself from Russia’s invasion. If Cold War history is a guide, China and Russia will continue to pursue independent foreign-policy tracks where it serves their own national interests.

China-Russia in a new world order: autocrats versus democrats

The war in Ukraine and resulting heavy Russia sanctions is accelerating the formation of two broad alliance camps – one defined by autocrats and one by democratic nations. As in the Cold War, this is likely be complemented by several ‘neutral’ non-aligned countries large enough to withstand the political pressure of joining either alliance. This global rearrangement of the world order will take time to play out, but the direction of travel is becoming increasingly apparent. Russia’s invasion of Ukraine has strengthened the solidarity of democratic countries to a far greater extent than any observer could have expected: NATO is being repurposed and bolstered, security support for Asia-Pacific democracies such as Japan and Australia will be further enhanced, and we should expect greater supply-chain and trade cooperation between democratic nations.

On the other side, states with autocratic leadership, with China and Russia at the core, are being driven together in closer solidarity, as a result of both push and pull forces. Increasingly, this will include certain Middle Eastern oil-producing states that would have been one-time allies with the West but now view cooperation with the US administration in more futile terms and China as a closer commercial partner in the future. Over time, the two alliance camps of autocrats and democrats will continue to coalesce and integrate more closely within themselves, while decoupling from the other.

Trade and technology

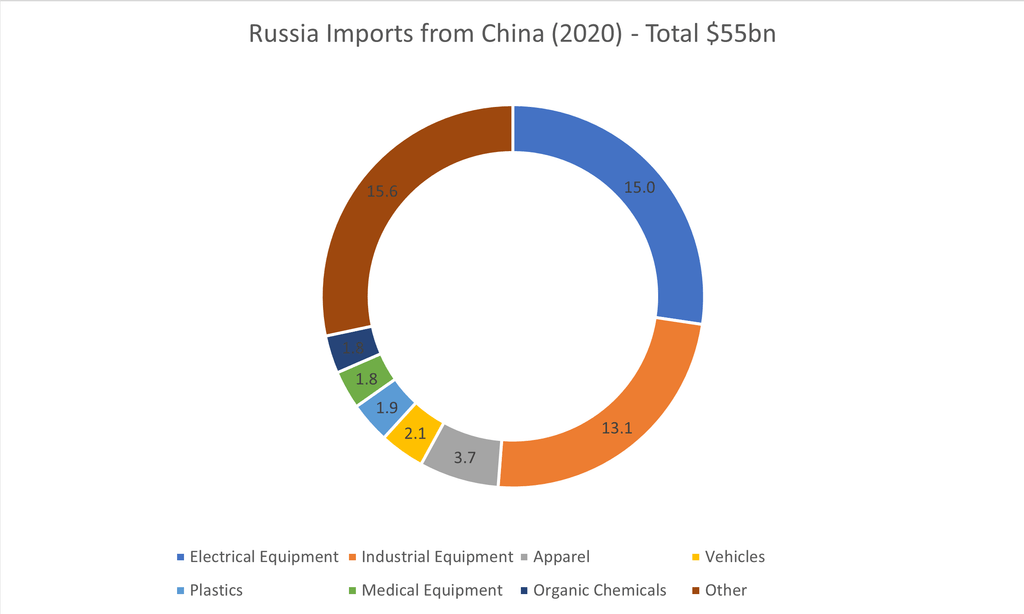

The bilateral Sino-Russian trade relationship reached US$140bn in 2021, still equating to only one sixth of China’s trade volume with Europe and one quarter of its trade volume with the US, albeit growing rapidly, with a stated commitment to reach US$200bn in the coming years. Russia and China have mutual trade synergies through comparative advantages in commodities and manufactured goods respectively. Russia is a major exporter of food, energy and metals, and China is a voracious importer and consumer of all three given its huge population with rising per-capita calorie consumption, low domestic energy self-sufficiency and an infrastructure-intensive growth model. The trade relationship will continue to expand well beyond commodities in future years, however, and Chinese companies will have the opportunity to ‘fill the void’ in Russia vacated by over 400 Western companies that have withdrawn business since the Ukraine invasion, as a recent remark by China’s Moscow-based envoy has encouraged them to do.

Source: Trading Economics, Newton, 2020

In addition to trade in goods and commodities, infrastructure will also be an area of growing cooperation between the pair. China’s strength in infrastructure and its ‘Belt and Road’ initiative (which Russia views as being synergistic with its own Eurasian Economic Union project) will have clear benefits for Russia as it seeks to modernise and develop its Far East region – including integration with China’s northeast – and for which it has targeted a 150% increase in the region’s port and rail capacity in coming years.

In technology, China has been increasingly closed out of the Western ecosystem in recent years, first with the sanctions imposed on Huawei in 2019, and then with ever-increasing export restrictions on China’s access to high-end Western semiconductors and semiconductor equipment, with a growing list of Chinese companies added to the US Commerce Department’s Entity List. With the strict application of Western sanctions and export restrictions on technology sales to Russia in the wake of its Ukraine invasion, a closer Sino-Russian technology partnership in the coming years will become a matter of necessity for both countries, given their mutual appreciation that technological progress is a matter of geopolitical survival under great power competition.

Chinese hardware should fill the gap in Russia left by Western companies in sectors such as IT and telecommunications, but beyond this, recent bilateral pledges have emphasised a desire to extend technology cooperation into science and medicine. As technology competition between alliance camps heats up, space is also expected to form an important domain of Sino-Russian cooperation (especially as Russia’s expulsion from the International Space Station programme looks to be inevitable), and the critical nature of satellite technology to many civil and military technology applications could see the emergence of a renewed space race between autocratic and democratic countries.

Technology cooperation between Russia and China should lead to advancements in some areas and, in the case of military-industrial complexes, could prevent them falling behind those of the democratic alliance. However, many observers remain sceptical about the capability of state-directed autocratic regimes to deliver technological progress and breakthroughs compared with a free-market, private sector-led democratic alliance. In the Cold War, the Soviet Union eventually fell behind the West in technology, despite early excitement over Russia’s ‘Sputnik moment’ in 1957 with the launch of the first satellite into space.

A more recent test case for technology rivalry has been the democratic states’ lead in developing new messenger RNA (mRNA) technology for the Covid vaccine, while autocratic states have lagged behind with lower-efficacy vaccines based on more dated established technologies.

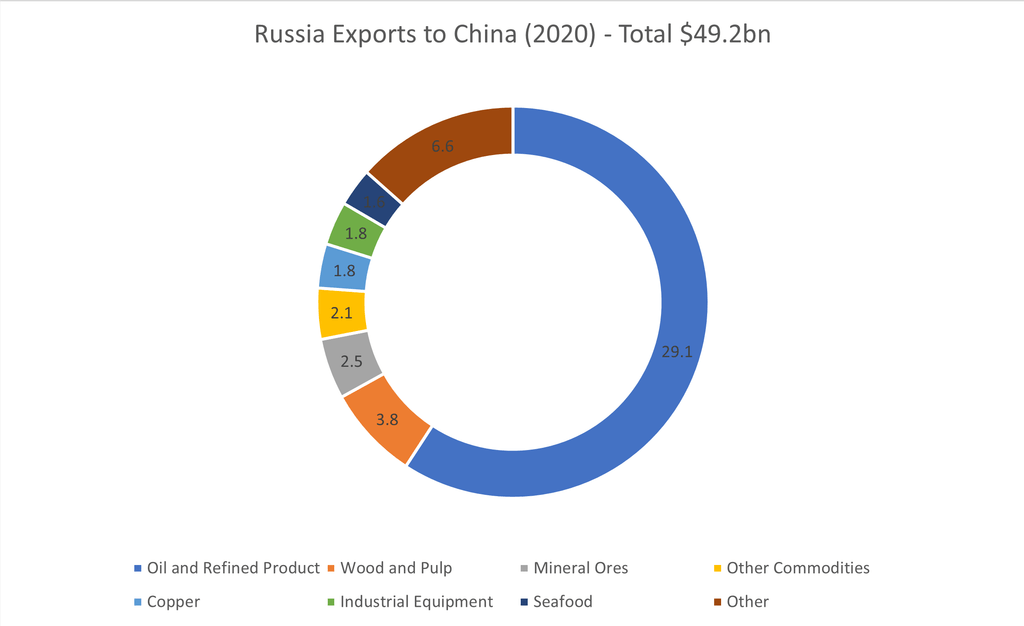

Russia’s trade volume with China (% of Russia’s total trade) 1/1/2003 – 31/12/2021

China-Russia trade balance (% of trade) 1/1/2001 –28/2/2022

Source: Bloomberg, 2022

Finance and capital

Following the Ukraine invasion, the Central Bank of Russia has been directly sanctioned by the democratic alliance, including a ban on access to the SWIFT international payment system, meaning that approximately half of its foreign reserves (those held in US dollar and euro-denominated assets) have been frozen. Given this experience, both China and Russia, along with other autocratic regimes, will have an increased imperative to find an alternative to their reliance on the US dollar and the US financial system (the same is true for euros). Intense discussions are surely taking place in Beijing over a future strategy with regard to China’s US$1 trillion of US Treasury holdings (equating to around 3.5% of the US’s outstanding sovereign debt).

In addition to an eventual hedging and diversification away from the US dollar over time, another repercussion of the SWIFT international payment access ban will be for Russia, China and other autocrats to find alternative international payment mechanisms. President Putin’s recent Beijing Winter Olympics address highlighted a growing propensity for Sino-Russian trade to take place in local currencies, highlighting that the two countries “are consistently expanding settlements in national currencies and creating mechanisms to offset the negative impact of unilateral sanctions”. Most evidently, China and Russia have already begun using China’s Cross-Border Interbank Payment System (CIPS) for renminbi trade settlements, and Russia is also reported to be discussing the establishment of direct bilateral payment systems with countries such as India for its commodity purchases. If President Putin is ultimately successful in his recent demand for “hostile countries” to pay for Russian gas in roubles, that would ultimately shift around US$150bn in annualised commodity payments away from dollars and euros.

As China increases its trade integration with countries in the Indo-Pacific along the Belt and Road route, a process that reached another milestone this January with the commencement of the Regional Comprehensive Economic Partnership (RCEP) trade agreement, Chinese officials are pushing for greater local-currency usage as they support economic development across the region. By financially alienating Russia and pushing the country into a closer embrace with China, the contours of a new global currency regime may be taking shape with Russia’s exclusion from the dollar-based system the latest development in this long-term trend. At the same time, China’s central bank, the People’s Bank of China (PBOC), stands out as a paragon of monetary discipline: China remains one of the few countries where real interest rates are positive (even at the short end of the curve), and Chinese consumer price inflation is benign (0.9% year on year in February). An international currency system in which the renminbi takes on a greater role requires confidence in China’s currency, and this appears to be something that Beijing policymakers are committed to achieving, while resisting the temptation to devalue their currency as in previous periods of economic weakness.

The dollar will not lose its hegemonic status overnight, and it will take time for other currencies or regimes to gain international confidence and acceptance. However, the push and pull forces of excluding autocratic states such as Russia from the dollar system, just as trade becomes more regionalised within alliance blocs, will serve to diminish the long-term demand for dollars. In the near term, China will need to continue to tread with some caution in relation to its financial transactions with Russia to avoid antagonising the US and Europe over sanctions circumvention.

Security and defence

Since President Xi came to power in 2013 and began the modernisation of China’s military, there has been a trend towards expanded military ties between China and Russia, and in November 2021, Russian and Chinese defence ministers signed a roadmap for even closer cooperation. The cooperation takes the form of both military equipment sales and joint military exercises which are now an annual event. China and Russia are likely to continue on this path of closer security cooperation as they seek to counter what they term ‘US unilateralism’ of the global order, and because the democratic alliance is increasing its own security cooperation through NATO, the Quad and AUKUS[1] which presents a direct threat to Russia’s and China’s security interests and spheres in Eastern Europe and Asia Pacific.

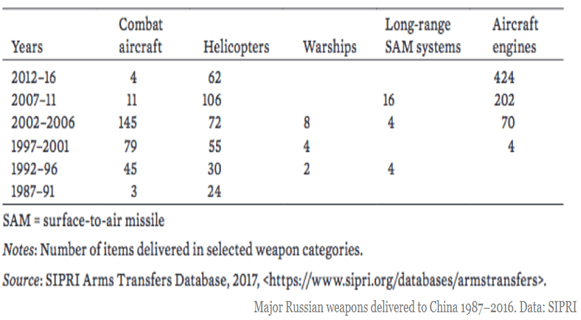

China’s military development and modernisation has been more recent than Russia’s, and Beijing has relied on Russian defence-technology support in crucial platforms including aircraft engines, while even its first aircraft carrier, the Liaoning, was an incomplete former Soviet carrier-cruiser. It can be expected that the two countries will increasingly cooperate on military-platform development from now on, with one potential area being nuclear-submarine technology, as they seek to counter the AUKUS challenge from the democratic alliance. Although Russia has a more established military platform development, in the face of Western sanctions it may come to rely increasingly on Chinese components for its defence industry. For the time being, while Russia is waging war on Ukraine, China will seek to keep a lower profile on military cooperation and should avoid transferring military equipment for use in Ukraine. After the Ukraine war, we anticipate that military cooperation efforts will inevitably step up.

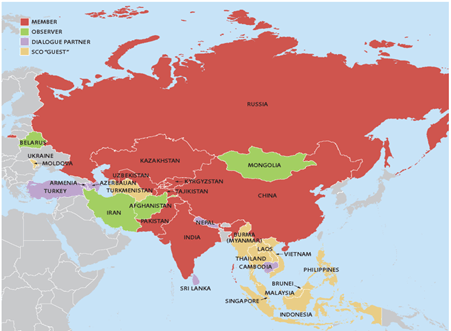

While it is unlikely that China and Russia will enter a formalised mutual defence pact in the future as each seeks to maintain an independent foreign and security policy without being dragged into undesired conflicts, there is plenty of scope for the two countries to increase security cooperation, particularly across Eurasia. The Shanghai Cooperation Organisation (SCO) would be the most likely body via which the two countries could strengthen their security alliance. The SCO was established in 2001 between China, Russia and four Central Asian countries, and has since expanded to admit India and Pakistan (see map below). Its primary objective is to maintain security across Eurasia by tackling terrorism, extremism and separatism. Although the SCO’s development has been gradual over the last 20 years, current geopolitical realities could see its military cooperation and joint operations accelerate from here, particularly in the wake of America’s withdrawal from Afghanistan, which threatens Eurasian security. The Eurasian land-based nature of the SCO also puts its military activities outside the direct purview of the US and democratic alliance (India excepted).

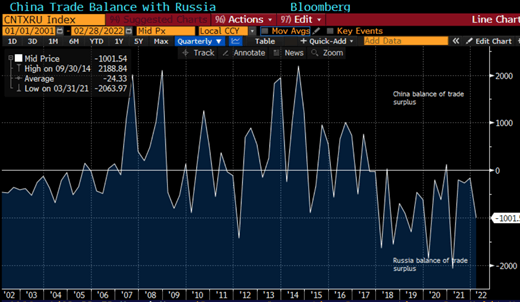

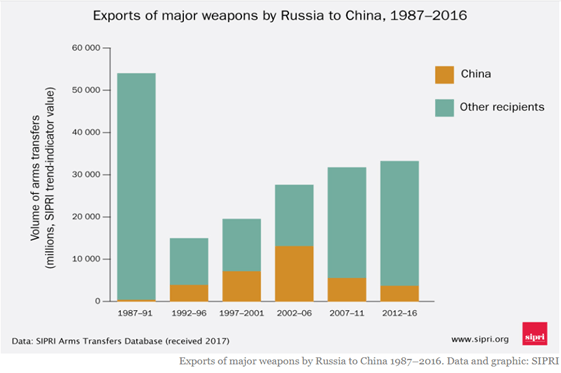

The volume of Russian weapons sales to China has been in decline in recent years as China has modernised the capability of its own defence sector and military-industrial complex

Types of Russian weapons delivered to China, 1987-2016

Source: SIPRI, 2017

Geopolitical implications

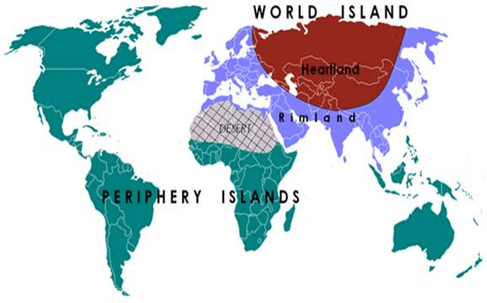

In 1904 the founding father of geopolitics, Halford Mackinder, published his Heartland Theory which posited that control of Eastern Europe enables command of the Eurasian heartland, which he termed the ‘world island’. Control of the world island would in turn confer control of the entire world. It is easy to dismiss Mackinder’s theories as anachronistic given they were developed in an era of European empires, during which land power and naval power dominated the military dynamics of the day, and the US was still considered to occupy a ‘peripheral island’.

However, it is instructive from the map below that a Eurasian heartland which unites Russia and China, and would contain such vast resources of land, energy, metals, labour and – increasingly – technology, would be a major security concern for the democratic ‘rimlands’ of Europe, India and Japan and, by extension, the US. Neither should it escape one’s attention that the SCO bears strong resemblances to the map of Mackinder’s heartland. The geopolitical implications of a closer Russia-China autocratic axis would be profound in terms of Eurasian dominance, given Russia’s vast territorial extent and China’s economic influence through its Belt and Road initiative.

Halford Mackinder’s world view in 1904

Source: Institute for Geopolitics, Economy and Security, 2020

Shanghai Cooperation Organisation today

Source: US-China Economic & Security Review Commission (November 2020)

As a consequence of closer Sino-Russian autocratic alliance, the US and its allied ‘rimland’ countries will by necessity have to increase their deterrence capability through higher military spending and cooperation in the coming years. One of the key strategies that the US pursued during the Cold War, and which is likely to have played a material role in helping it to be victorious, was to never simultaneously isolate both China and the Soviet Union. This was the essence of Nixon’s Opening to China strategy in the 1970s, which ultimately placed a greater security burden and cost on the Soviet Union. The US and its democratic alliance run the risk of forgetting this vital geopolitical lesson which could have costly and disruptive implications for security, trade and supply chains.

Future of Taiwan

Investors are cautiously assessing whether Russia’s invasion of Ukraine could foreshadow a Chinese invasion of Taiwan. While Beijing’s historical commitment to reunite with Taiwan remains undiminished, there are several indicators to suggest a move of force remains a fairly low-probability event and has even reduced further as a result of Ukraine. First is the democratic alliance’s commitment to Ukraine’s sovereign independence and Western solidarity which in all likelihood would be extended to Taiwan. Second is the cost that has been imposed on Russia’s economy as a consequence of its breach of international laws and norms, making any similar move by China highly costly. Third is the destruction to Ukrainian infrastructure (estimated so far at some US$400bn by Kyiv University). For China, eyeing Taiwan and calculating its future strategy, these factors all serve as powerful deterrents; Beijing would want to acquire Taiwan intact, and the cost of ruining bilateral trade relationships with democratic countries that are worth well in excess of US$1 trillion per annum is a risk that is not worth taking. Clearly, this calculus is fluid and could change over time, and the continuing solidarity commitment of the US-democratic alliance will be key for Beijing to watch, including upholding its security commitments with Japan and South Korea.

The Taiwan dollar has weakened since Russia invaded Ukraine, but long-term sovereign yields remain very low, indicating benign geopolitical risk factored by the bond market, as the charts below show.

US dollar-Taiwan dollar exchange rate

Source: Bloomberg, 1/4/22

Taiwan government February 2051 bond yield

Source: Bloomberg, 1/4/22

Investment implications

The emergence of a multi-polar world economy with autocratic and democratic blocs that are competitive along technological and security lines, yet largely independent in their economic interaction (save for non-strategic value chains such as low-end manufacturing and bulk commodities), has profound implications for investors.

- Equities: ‘statism’ trumps globalism

A world with permanently high geopolitical competition, independent economic blocs (in matters of key technology, if not in all trade) and rival security alliances means that governments will need to invest strongly in their own economies to enhance their resilience and national security. This will require large levels of state-led investment. Many autocratic states already function this way, but democratic states are likely to move increasingly in this direction. In fact, the contours of this are already taking shape: China and the US both have existing tag lines to this effect with their ‘dual circulation’ and ‘build back better’ plans, and the pipeline of new government spending bills includes very targeted state-led investment plans, for example the US$52bn US CHIPS (Creating Helpful Incentives to Produce Semiconductors) Act for onshoring semiconductor plants (the EU and Japan have their equivalents), and the €100bn defence fund that Germany has recently announced. A shift towards state-led and state-directed investment will favour capital-intensive sectors such as energy, utilities, industrials, defence and technology hardware. By contrast, sectors that thrived during an epoch of unconstrained globalisation, with an opportunity to tap an ever-expanding global market, could face headwinds and lower levels of growth.

- Rates: elevated and volatile inflation persists

The last 40 years of globalisation have been accompanied by an almost constant decline in inflation which has allowed central banks to cut interest rates to ever-lower structural levels. Debt was cheap and leverage expanded. The geopolitical backdrop is now calling for a realignment of supply chains within the respective blocs of democratic and autocratic countries. Some supply chains will shorten (e.g. strategic technologies), and others will duplicate, adding cost and redundancy into the trading system.

In aggregate, high levels of domestic investment compounded by already tight labour markets should prove to be inflationary over the long term and may necessitate higher neutral levels of interest rates than the market is accustomed to. During the realignment phase, which could take at least a decade given the need to untangle 40 years of global integration, periodic supply shocks driven by disputes and conflict are to be expected. Investors should expect the supply shocks of Covid and the Ukraine war to be a prelude to a more regular pattern of trade disruption. Even if central banks are able to subdue the current inflation spike, structural forces mean they might struggle to keep inflation suppressed. Economic cycles are likely to be shorter and sharper, along with higher rates and increased levels of bond-market volatility.

- FX: global currency system to be redefined

If the Russia-Ukraine conflict has taught investors anything so far, it is that the US wields enormous economic power through its control of the global financial system owing to its currency hegemony and the ability to stop non-compliant states accessing and using its financial system. In a bipolar system in which autocratic states live in fear of the US financial system and its dollar weaponisation through sanctions, it is logical they would wish to hedge their options or move away from the dollar system altogether. This is likely to become an increasing reality. It is, however, impossible to predict at this point in time what a new global currency order will look like. The dollar, euro, yen and pound sterling (along with other ‘democratic currencies’) are likely to maintain a palpable role with each other, but the latter three are effectively beholden to the dominance of the dollar as a result of the US’s supremacy in the democratic alliance.

For autocrats, it is not a given at this juncture that the renminbi will serve as the international currency of choice. China still does not have a fully liberalised capital account, and its legal institutions are non-independent. Furthermore, it is unclear whether China will enjoy such significant trade dominance within an autocratic alliance and with its own intentions to increase dual circulation (Communist Party speak for self-sufficiency). However, China has made strong relative progress with its digital renminbi project (eCNY), which gives the Communist Party the technological platform to roll out the internationalisation of the renminbi should it eventually choose to do so. A more plausible scenario is that the autocratic trading and reserves system could come to be based on a range of national currencies, along with alternatives such as gold and even cryptocurrencies.

- Commodities and climate: balanced transition

How will the world tackle climate change without cooperation between the democratic and autocratic alliances? Does this make a 1.5-2.0 degrees Celsius limit to global warming scenario unattainable? Without access to some of the raw-material inputs required for energy transition from Russia or other Eurasian countries, it will make the achievement of climate targets both more costly and more challenging. However, the democratic alliance includes countries with large clean-energy resource endowments such as Australia and Canada, and there are several strategically important countries that are also likely to remain unaligned, including Argentina and Chile.

Ultimately, energy transition – the shift from hydrocarbons to electrons – is consistent with higher levels of national security, and therefore we remain optimistic that policy is headed in this direction. In the short term, the energy-supply shortage as a result of the Ukraine war and Russia sanctions will put the emphasis back on the importance of fossil fuels in meeting economic needs. The key lesson is that governments will need to factor geopolitics into a more pragmatic energy-transition policy, and investors are likely generally to want to accommodate both fossil fuels and clean energies in portfolios.

[1] The Quad stands for Quadrilateral Security Dialogue and includes military cooperation of the United States, Australia, Japan and India. AUKUS is short for the three-country military technology sharing alliance between Australia, the UK and the US which began with submarine-technology cooperation.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices. Richard Bullock is an employee of BNY Mellon Investment Management Singapore and provides support to Newton Investment Management as a geopolitical strategist.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments