The decade-old theme still points to long-term growth opportunities in differentiated areas including enterprise businesses and international markets.

Key points

- While the wide-ranging digital transformation theme has been under way for years, we believe it has a much longer runway.

- The onset of the global Covid-19 pandemic kickstarted the next phase of digital transformation, with a huge acceleration in spending for projects facilitating the transition of employees to remote work, continuing supply-chain disruptions, and the influx of online sales.

- In our view, the next iteration of digital transformation should create attractive long-term opportunities for investors in differentiated areas such as enterprise businesses and international markets.

The next wave of digital transformation has begun. The theme’s decade-long evolution has been impressive, with many technology companies’ stock prices reaching fresh highs during the onset of the global Covid-19 pandemic as companies sought to move much of their business online and incorporate advanced technologies into every aspect of their operations. However, more recently, digital and technology stocks have tumbled, leading some investors to believe that the theme no longer holds sway. We believe that this mature theme is in its next iteration, with differentiated longer-term opportunities in many areas including enterprise businesses and international markets.

Fast track of digitisation

Digital transformation incorporates technology into all facets of business, redefining company operations to meet consumer needs while driving fundamental change. The concept of digital transformation is broad, encompassing several other nascent sub-themes with far-reaching potential to affect the global economy. The associated tools and solutions can enhance company operations and transform business models through increased efficiency, greater business agility and added value for employees, customers and shareholders.

The Covid-19 pandemic completely upended our day-to-day routines, forever changing the way we live and work while dramatically increasing pressure on corporate and government leaders to fast-track digitisation. This digital transformation revolution had far-reaching influence, allowing teachers to continue educating students outside of the classroom, enabling health-care providers to treat patients via telehealth, and shifting corporate operations from boardrooms to kitchen tables.

The transition of employees to remote work, ongoing supply-chain disruptions, and the tremendous influx of online sales led to a huge acceleration in spending for digital transformative projects in 2020 and 2021. Despite overall cost reductions in many aspects of operations, spending on these initiatives increased during the pandemic, kickstarting the next phase of the digital transformation.

Why are digital trends shifting?

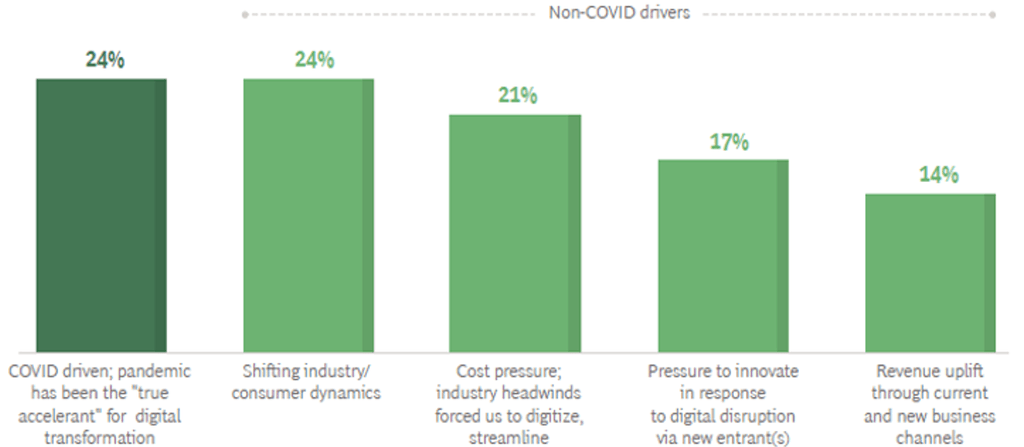

With stay-at-home orders of the pandemic behind us, companies are employing digital technology for less reactive reasons. Many companies, particularly consumer-facing businesses, have already metabolised the easy benefits reaped from their initial adoption of certain digital enhancements and are now seeking technologies that can truly enhance their operations through strategic initiatives. These drivers include shifting industry and consumer dynamics, pressure to innovate, and the potential for revenue uplift.

Multiple factors are driving digital transformation

Share of respondents who chose each factor as the top driver of their companies’ digital transformations

Source: Boston Consulting Group (BCG) Global Digital Transformation Survey, 2021; Accessed 12/05/22.

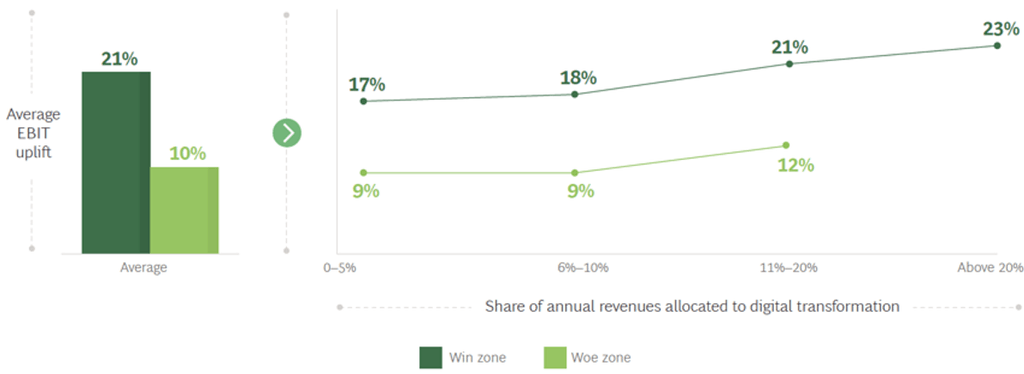

In response to the Boston Consulting Group (BCG) 2021 survey of 850 companies worldwide, 35% of participants reported success in realising their digital transformation objectives. Success scores were determined using companies’ self-ratings on BCG’s six success elements for digital transformation: strategy, leadership, talent, agility, monitoring, and tech and data. Likewise, 13% of companies fell into the ‘woe zone’, reporting that limited value was created from their projects and fewer than 50% of their targets were achieved. The survey found that companies that employ digital transformation tactics successfully reported a 21% uplift in earnings before interest and taxes (EBIT), while companies in the ‘woe zone’ reported a 10% uplift in profitability.

Dx can lead to tangible benefits to the bottom line

Average EBIT uplift achieved through digital transformation, by share of revenues allocated

Source: BCG Global Digital Transformation Survey, 2021; Accessed 12/05/22.

However, there can be limits to technology’s ability to enhance profitability. 66% of digital leaders reported a 10% or more return on investment (ROI) for digital projects. The BCG survey also found that for a digital transformation to succeed, a company should invest a minimum of 5% of its revenue in the project. However, companies that invest more than 5% of their revenue may reap only marginal benefits from their additional spending. Companies are also beginning to recognise that, without adapting their business models to keep pace with digital innovation, they may risk becoming obsolete.

Enterprise opportunities

Consumer-facing companies experienced a huge spike in sales during the pandemic owing to a pull forward in demand. The average growth of these big consumer beneficiaries was approximately 35% in 2018 and 2019, and Covid-19 accelerated demand for their products and services and boosted their market share. However, the average growth outlook for consumer-facing companies has since dropped to around 15% for the post-Covid period. While this growth trajectory is still material, the gap in pre and post-pandemic estimates, and its effect on company valuations, is significant.

Enterprise companies, the enablers of digital transformation technology that provide enterprise and system software, data analytics and IT consulting, also benefited from the societal effects of the pandemic, albeit to a lesser extent. Enterprise companies profited as the slowdown in IT spending during the early stages of the pandemic was followed by a period of catch-up in digital transformative projects in 2021. However, this gap—30% average sales growth pre-Covid compared to 25% projected future sales growth—is not as substantial.

The share price of the median enterprise company is currently about 10% lower than at the start of the pandemic, indicating that most enterprise companies have given up their pre-Covid gains.[1] However, digital transformation projects remain in the top-three investment priorities for chief investment officers, which solidly suggests that spending on digital ventures should continue.[2] While consumer-facing companies which are further along in digital transformation are generally trading at pre-Covid levels, we believe that these enterprise companies, which have lagged in that transformation process, could be poised to provide opportunities for substantial longer-term gains.

Longer-term opportunity prospects

We see significant opportunities for the next wave of adoption in international regions, regulated markets, lagging sectors and vertical solutions.

International regions

Historically, Europe has lagged the US in digital ventures and is beginning to feel the burden of underinvestment in that area. Looking ahead, we expect that European digital leaders could materially increase their spending on digital transformation in hopes of catching up with the US digital leaders that have already implemented these technologies.

Europe is not the only region with opportunities. While the pull forward of demand during the pandemic resulted in vastly increased e-commerce penetration, there are still some pockets of expected growth. Penetration overall has been much slower in emerging markets. We are keeping a close eye on these emerging-market regions—including India, Brazil and Southeast Asia—as we believe this is where there is market share to be gained. Additionally, e-commerce companies can still enjoy potential growth in regions with mature demand through increased market share.

Regulated industries

Regulations also tend to slow the pace of innovation, particularly in heavily regulated industries such as health care and utilities. In principle, regulated industries are slower to adapt to change. It is not that consumers of these industries rebuff digital experiences, but instead that the cultures of these businesses are deep-seated and more resistant to change than those of faster-moving industries. Incorporating digital objectives into their business models requires a culture shift, which takes time.

These companies must also coordinate with their respective regulators in relation to any change in order to ensure that they maintain compliance with regulations, as risk mitigation is crucial in regulated industries. The regulator essentially becomes an additional stakeholder for digital transformation projects, which further complicates the process and slows execution.

Lagging sectors

Certain segments of the economy, including utilities, gas and oil, have been slower to adopt digital technologies, owing in part to pandemic lockdowns as well as supply-chain disruptions that affected factories around the world. Advanced technologies can take time to implement, and stay-at-home orders impeded the momentum of these developments.

Some industries are further ahead than others. The industries expected to experience the fastest growth in digital technology spending over the 2020 to 2025 period are construction, securities and investment services, and banking. We are also focusing on energy and manufacturing services companies, and particularly smaller-scale companies that are further behind and have the capacity for catch-up spending in the future.

Vertical solutions

We also see long-term opportunities for digital transformation growth within vertical markets where there has been relatively low cloud penetration to date. We are currently monitoring cloud competitors that focus on vertical industries—such as restaurants, transportation, home services and auto repair—and can bring modern technology to small and medium-sized businesses. These cloud-based companies provide services that smaller businesses would not be able to develop and operate on their own. Examples include cloud-based software companies for restaurant management, which provide tools for online ordering and payroll services, or for real estate, which provide services for landlords to manage their properties more efficiently.

Cloud adoption trends

There are also many developing technologies that have the potential to reshape our global economy further in the future, including blockchain technology, decentralised finance, cryptocurrencies, cloud adoption, artificial intelligence (AI), virtual reality, and quantum computing.

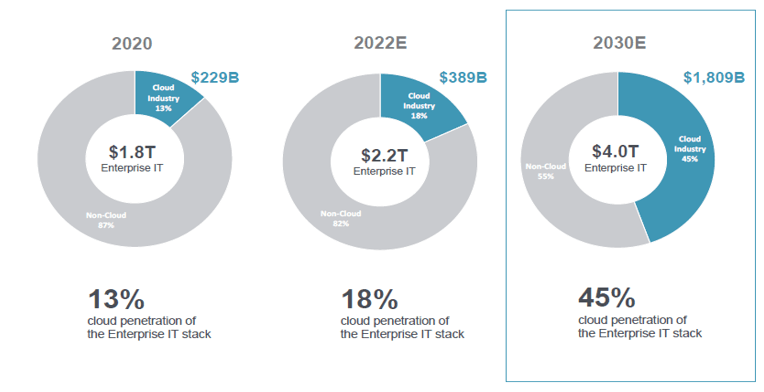

While cloud adoption is already fairly well established, we believe that there is the potential for cloud companies to grow exponentially owing to the lack of penetration in the space globally. Investment in the cloud allows corporations to lower IT costs, optimise computing resources, enhance cybersecurity, and generally perform tasks more efficiently. The cloud is also easier to scale and can accelerate growth. While North America is furthest along in cloud adoption, with 55% of public cloud spending occurring in this region, all regions across the globe are experiencing growth.

Cloud penetration poised to expand to 45% in 2030E from 15% in 2021

Relative to Enterprise IT (ex devices and comm), cloud penetration poised to reach 45% by 2030E.

Source: Company Reports, FactSet, Piper Sandler Estimates, Accessed 12/05/22.

There is a much higher growth rate in cloud penetration in the public sector, which we attribute to success in the cloud space. We believe some of these goliath winners in the public space, which are growing faster than the overall cloud itself, could triple their cloud spending by 2027 and reach five times their 2021 spending level by 2030.

Conclusion

While digital transformation has been under way for years, we believe the wide-ranging theme has a much longer runway. Developments in newer tools and technologies, such as internet of things, AI, augmented reality/virtual reality and applications that automate, should continue to propel digital transformation spending. Consumer-facing industries are further along in process, and while growth continues, there is less to gain. We see greater opportunities for growth in enterprise companies, which have experienced a slower adoption thus far and are expected to catch up over the next several years. Our multi-dimensional approach to investing and our thematic framework provide us with the perspective we need to focus on the areas of digital transformation that could be most instrumental in shaping the investment environment over the coming years.

[1] Source: Newton calculations.

[2] Source: 2022 Citigroup, Inc. Accessed 12/05/22.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. This article was written by members of the NIMNA investment team. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM) and Newton Investment Management North America LLC (NIMNA). NIMNA was established in 2021 and is comprised of the equity and multi-asset teams from an affiliate, Mellon Investments Corporation.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.