We analyse what recent events in Russia could mean for the Ukraine war and Europe’s mid-term inflation outlook.

Key points

- With Russia on the backfoot as Ukraine steps up its counter-offensive, Ukraine’s President Zelensky is incentivised to push to regain as much territory as possible over the coming weeks.

- However, with US elections in 2024 and US military aid to Ukraine already costing $60bn, President Biden will be keen to show his electorate some progress and avoid another American ‘forever war’.

- Although there may well be more bloodshed in the weeks and months ahead, we anticipate that peace negotiations may commence in the coming months.

- We believe it is likely that the European Union will need to fund the lion’s share of Ukraine’s reconstruction – perhaps as much as 70% or €700bn.

- Equity sectors we believe could benefit opportunities include the obvious beneficiaries of physical reconstruction: construction, building materials, industrials and utilities.

In this blog, we explain why we believe the Wagner Group’s mutiny and early-stage coup on 23-24June could be a potential gamechanger for the war in Ukraine. Although Wagner stepped down just 200km from Moscow in a deal brokered by Belarus’s President Lukashenko, Russian President Vladimir Putin’s leadership and scope for strategic flexibility appears to have been compromised.

The mercenary group’s leader, Yevgeny Prigozhin, laid bare the enormous folly, false pretenses and human cost of the war in Ukraine, while leaders from Russia’s military stood aside as his group occupied the city of Rostov-on-Don in southern Russia.

With most of the Wagner paramilitary group disbanded or in Belarus, the Russian war effort has lost its most potent and effective fighting force. It is likely that Putin must now be hyper-sensitive to the risk of sending additional resources (men) to perish in Ukraine as it heightens the risk of social instability at home and the prospect of further plots against his regime. To us, it seems that maintaining Russia’s chances of winning (not losing) the war in Ukraine will come at the cost of domestic stability: battlefield success and Russian domestic stability could be mutually exclusive outcomes.

Earlier timeline for a peace deal

With Russia’s existing occupation of most of Donetsk and Luhansk creating a land bridge to Crimea, and facing the strategic risks highlighted above, we believe that Putin’s best move now would be to sue for peace. As such, we would expect back-channel peace negotiations sponsored by major actors including China and Turkey to step up over the coming weeks.

With Russia on the backfoot as Ukraine steps up its counter-offensive, Ukraine’s President Zelensky is incentivised to push to regain as much territory as possible over the coming weeks, and thus we believe it extremely unlikely that Ukraine will accept a peace offer in the first instance. The US and its NATO allies will also want to push for Ukraine’s maximum territorial reclaim and possibly test the stability of Putin’s regime.

Avoiding a ‘forever war’

However, with US elections in 2024 and US military aid to Ukraine already costing $60bn, President Biden will be keen to show his electorate some progress and avoid another American ‘forever war’. In short, we anticipate that peace negotiations are likely to commence in the coming months, with a 60% chance of a ceasefire or peace deal by year end, in my view.

This does not preclude the prospect of extremely violent and bloody warfare in the next few months as Ukraine and NATO push for maximum advantage. What the Wagner insurrection has done is to shift the Russian calculus in favour of an early peace deal in order to minimise domestic damage. This appears likely to mark a significant strategic shift from the prior focus on playing the long-game war of attrition.

Rebuilding Ukraine

Any peace negotiations will be centered on three key issues: defence guarantees for Ukraine, the territorial limits of either side (including demilitarised zone), and how the reconstruction of Ukraine will be financed. We examine these factors below:

- The reconstruction of Ukraine including its physical and social infrastructure is likely to cost up to €1 trillion[1] (for context, eurozone GDP is c. €15 trillion) over five to 10 years, or some US$100-200bn per year.

- This could prove a conservative estimate; the reunification of Germany cost an estimated €2 trillion over 20 years, but East Germany was not a war zone with 8 million+ people displaced. The total population of East Germany in 1990 was 16.1 million. Furthermore, the €2 trillion. reunification cost was nominal. At inflated 2023 prices, this cost would be much higher.

- There has been recent debate in European Union (EU) circles as to whether Russia’s seized international reserves could be used to help fund the reconstruction. The latest sentiment by EU leaders appears skewed against doing this on legal grounds, and because of potential international repercussions for the euro if foreign-exchange reserve holders begin to de-risk euro exposure as a consequence.

- Despite these reservations, our view is that any peace deal with Russia will still be likely to feature a role for its confiscated international reserves. A reasonable assumption would be that 50% or c.US$150bn could be requisitioned to help finance the reconstruction of Ukraine.

- Europe, the US and other wealthy international powers (including China) will need to fund the remainder. As the immediate neighbour and proximate beneficiary (and with Ukraine seeking to become an EU member in due course following a peace deal), it is likely that the EU will need to fund the lion’s share of Ukraine’s reconstruction – perhaps as much as 70% or €700bn.

European inflation and bond markets

Like other developed economies, Europe is currently in the middle of an inflation shock caused by previous rounds of Covid stimulus and a tight labour market, and this has been exacerbated by the Ukraine war. The latest core inflation print for the eurozone remains elevated at5.5% year on year as of the end of June.

While the European Central Bank’s (ECB)’s restrictive monetary policy (+400 basis points of hikes in under 12 months) is likely to grind inflation back towards the 2% target over the coming 12-18 months, this might barely have been achieved just as the eurozone faces its next great inflation shock: the enormous cost of taking on the bulk of Ukraine’s reconstruction cost.

Assuming €100bn in annual reconstruction costs for Europe, with half funded by the private sector and half by Brussels, the €50bn increase in annual cost would equate to a c.30% increase in EU budget spend, a sizeable fiscal expansion.

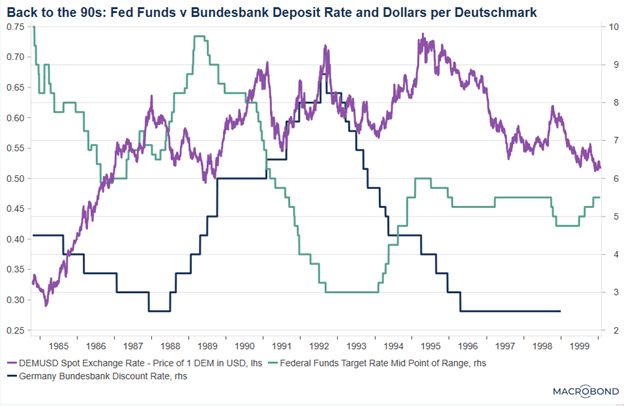

Germany’s reunification highlights how German inflation in the late 1980s and early 1990s rose from close to 0% to +5% with interest rates remaining elevated into the middle of the decade. Furthermore, the Bundesbank tightened monetary conditions very sharply, achieving positive real rates of +2-3% (in contrast to where real rates are in the eurozone today).

With the need to fund Ukraine’s reconstruction, the eurozone could emerge as an inflationary outlier compared with other parts of the developed world over the course of the remainder of this decade. This view, however, is not priced in by bond markets, with eurozone yield curves remaining among the lowest in the developed world. As the prospects of a peace deal, Ukrainian reconstruction, European majority funding and persistently elevated eurozone inflation become clearer over the coming quarters, European bond markets could gradually begin to reprice the risk of higher persistent inflation for the remainder of this decade.

Investment opportunities

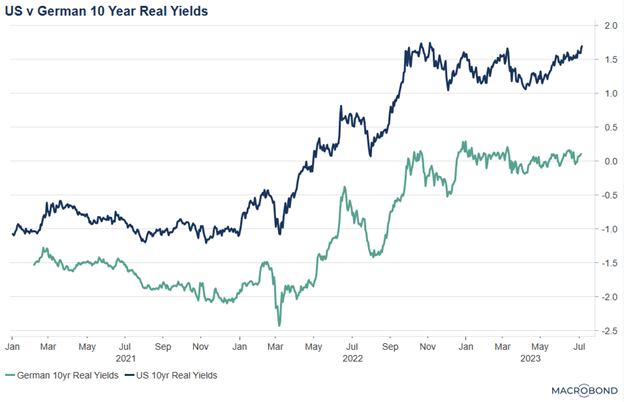

With higher inflation risks in Europe, we believe the ECB will need to remain hawkish and long-term real interest rates will need to move into positive territory as they have in the US. We believe there is merit in being short many of the eurozone sovereign curves, particularly at the front end where yields remain deeply negative in real terms.

If our outlook scenario for higher long-term eurozone inflation plays out owing to high fiscal spend on reconstruction (significant resources mobilised from western to eastern Europe/Ukraine), ECB policy will need to remain restrictive and rate differentials would favour the euro versus other major G10 currencies as other developed economies restore inflation and policy rates towards more neutral levels.

In the early 1990s German reunification precedent, the Deutschmark appreciated +40% versus the US dollar as the Bundesbank was in tightening mode while the Federal Reserve was cutting.

Equity sectors where we would be inclined to hunt for opportunities include the obvious beneficiaries of physical reconstruction: construction, building materials, industrials and utilities.

Source: Macrobond, 6 July 2023

Source: Macrobond, 6 July 2023

Source: Macrobond, 6 July 2023

[1] Source: World Bank/European Commission/ UN estimate as of 24 February 2023 is US$411bn (€383bn) https://www.worldbank.org/en/news/press-release/2023/03/23/updated-ukraine-recovery-and-reconstruction-needs-assessment

Ukraine’s government estimate is higher: estimated $750bn even before the end of 2022

https://www.dw.com/en/how-much-could-it-cost-to-rebuild-ukraine/a-63533638

Important information This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Richard Bullock is an employee of BNY Mellon Investment Management Singapore and provides support to Newton Investment Management as a geopolitical strategist.

Important information

This material is for Australian wholesale clients only and is not intended for distribution to, nor should it be relied upon by, retail clients. This information has not been prepared to take into account the investment objectives, financial objectives or particular needs of any particular person. Before making an investment decision you should carefully consider, with or without the assistance of a financial adviser, whether such an investment strategy is appropriate in light of your particular investment needs, objectives and financial circumstances.

Newton Investment Management Limited is exempt from the requirement to hold an Australian financial services licence in respect of the financial services it provides to wholesale clients in Australia and is authorised and regulated by the Financial Conduct Authority of the UK under UK laws, which differ from Australian laws.

Newton Investment Management Limited (Newton) is authorised and regulated in the UK by the Financial Conduct Authority (FCA), 12 Endeavour Square, London, E20 1JN. Newton is providing financial services to wholesale clients in Australia in reliance on ASIC Corporations (Repeal and Transitional) Instrument 2016/396, a copy of which is on the website of the Australian Securities and Investments Commission, www.asic.gov.au. The instrument exempts entities that are authorised and regulated in the UK by the FCA, such as Newton, from the need to hold an Australian financial services license under the Corporations Act 2001 for certain financial services provided to Australian wholesale clients on certain conditions. Financial services provided by Newton are regulated by the FCA under the laws and regulatory requirements of the United Kingdom, which are different to the laws applying in Australia.

Comments