Key Points

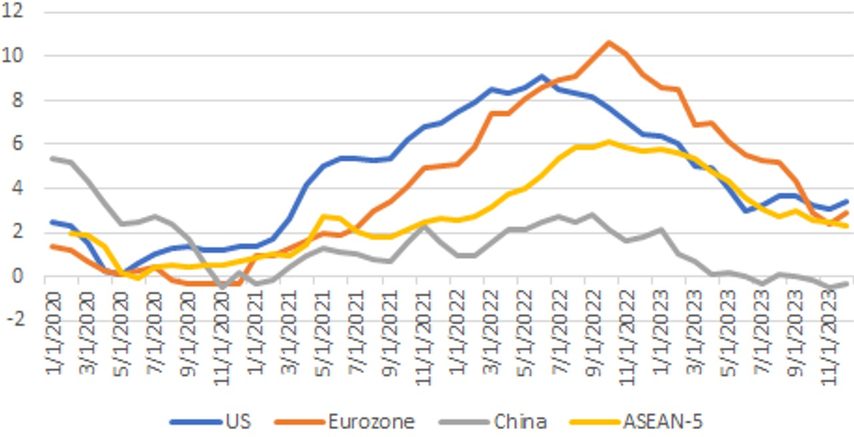

- We are witnessing a divergence between the outlook for developed-market and emerging-market inflation.

- China is playing a key role as an exporter of lower inflation to emerging markets as trade and investment integration increases within the bloc, just as China’s trade with the US and many western countries reduces.

- Many developed-market central banks continue to tackle above-target inflation following an extended period of excessive monetary and fiscal easing, trade protectionism, labor-market tightness and continuing supply-chain disruptions.

- Conversely, many emerging markets avoided excessive monetary and fiscal stimulus during the pandemic and, when global inflationary pressures were rising in 2021 and 2022, positioned themselves ahead of the curve in terms of hiking interest rates.

- We believe that lower emerging-market inflation dynamics will enable central banks to reduce rates further than consensus estimates, boosting emerging-market local-currency bond returns and providing the conditions for a lower cost of capital to support emerging-market equity markets.

The world is facing very different inflation dynamics as a divergence between the outlook for developed- market and emerging-market inflation takes place. At the heart of this dynamic is China’s role as an exporter of lower inflation to emerging markets as trade and investment integration increases with the bloc.

Cheaper emerging-market commodity availability, owing to Russia being shut out of developed markets, is also a boon to emerging-market inflation. We believe that lower emerging-market inflation dynamics will enable central banks to reduce rates further than consensus estimates, boosting emerging-market local-currency bond returns and providing the conditions for a lower cost of capital to boost emerging-market equity markets.

Excessive Monetary and Fiscal Easing in Developed Markets

While most developed-market central banks continue to tackle above-target inflation following an extended period of excessive monetary and fiscal easing, trade protectionism, labor-market tightness and continuing supply-chain disruptions, the dynamics facing many emerging markets stand in stark contrast. Many of the latter avoided excessive monetary and fiscal stimulus during the Covid pandemic and, when global inflationary pressures were rising in 2021 and 2022, they positioned themselves ahead of the curve in terms of hiking interest rates.

Furthermore, emerging markets have generally remained more open to free trade and less protectionist, and output gaps (particularly in certain Asian economies) have remained negative, which has eased the inflationary burden. While we expect inflation in developed countries to come down in the near term, we believe that it will remain volatile and prone to upward spikes as experienced during the 1970s. This is partly because western central banks will come under increasing political pressure to reduce interest rates at the earliest opportunity and partly because we now live in a volatile geopolitical world in which cost-push supply shocks are an increasing phenomenon.

However, if there is one inflationary dynamic that will favor structurally lower price rises in the emerging world versus the developed, it is the former’s constructive trade and investment relationship with China, while the developed world continues to reduce ties and increase protectionism.

China – Exporter of Low Inflation

China experienced consumer price deflation over the second half of 2023 and producer price deflation for the whole of 2023. Since the Covid pandemic, Chinese consumers have saved an extra 4% of their incomes on average. Savings rates were already high in China but remain extremely elevated at 35% of disposable income (see chart below).

China Household Savings Rate (% of Disposable Income)

Source: Macrobond, January 2024

Because of China’s economic model and long-term high savings rates, the country has had a historically high level of investment to GDP. This time around, however, investment in the real-estate sector is off limits owing to the policies and resulting downturn in this sector. Instead, investment has been increasingly channeled into manufacturing investment to fulfill the Chinese Communist Party’s quality-growth target (see chart below).

China’s Fixed-Asset Investment in Manufacturing. Cumulative Year-on-Year Over Last Five Years (%)

Source: Macrobond, January 2024

Such high levels of manufacturing investment have resulted in excess industrial capacity in certain sectors, thereby causing producer price deflation and affecting industrial profits (see chart below).

China’s Industrial Capacity Utilization v Producer Price Inflation (PPI) and Industrial Profit Growth

Purple line: China PPI year-on-year (%) rhs, green line: China industrial enterprises total profits (%) rhs, dark blue line: China utilization rate of industrial capacity (%) lhs

Source: Macrobond, January 2024

Because China is producing more than its domestic requirements, the resulting increase in exports has led the country’s trade surplus to surge over the last few years to an annualized level of c.US$450bn (see chart below).

China’s Trade Balance (Billions of US Dollars)

Source: Macrobond, January 2024

Developed-Market Versus Emerging-Market Protectionist Response

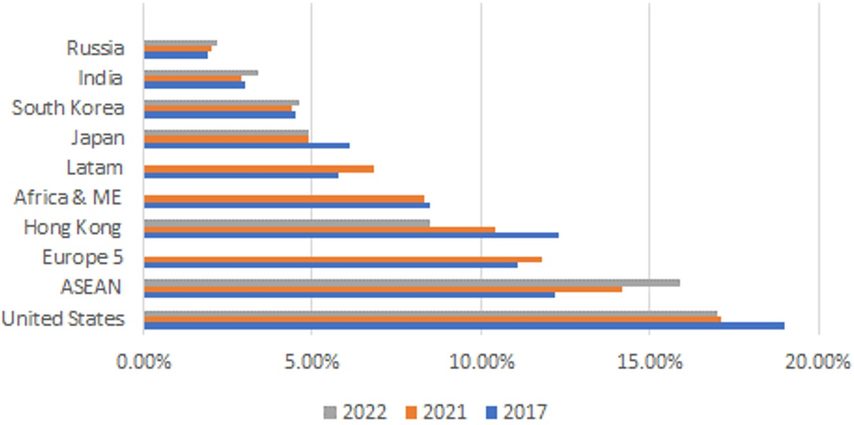

The consequence for China of operating such an economic model (i.e. insufficient domestic consumption, excessive domestic investment, large state subsidies) is that it risks upsetting trade partners. Large tariffs remain in place from the US, and we suspect that these are only likely to increase under a potential ‘Trump 2.0’ administration. Meanwhile, the European Union (EU) announced an investigation into Chinese electric vehicle state support and unfair competition in the fourth quarter of 2023. While the US and EU still comprise more than 25% of China’s total exports, this share has been declining in recent years. (See chart below).

Source: World Bank, Trading Economics, Newton Investment Management, January 2024

We contend that the majority of China’s trade partners in the ‘Global South’ (non-G7 countries) want open trade with China and are less likely to resort to protectionist measures. This is in large part because China buys their commodities and invests in their infrastructure. In the case of Asia, China is part of the Regional Comprehensive Economic Partnership (RCEP) trade group, which was established in 2020, with the aim of reducing tariffs between members. The group is comprised of 15 countries representing 30% of global GDP and growing.

As Chinese trade and investment integration with both the RCEP and African and Latin American countries grows, China will be exporting lower inflationary forces, thereby helping to keep interest rates lower across the emerging-market bloc. We believe this is good news for emerging-market local-currency bonds, which we expect to perform strongly over the coming months. By contrast, protectionist measures by the G7 will continue to limit China’s incremental access to these markets, which means the G7 will miss out on the lower goods price inflation that China can provide. (See chart below).

Developed-Market Versus Emerging-Market Inflation (%)

Source: Bloomberg, Newton Investment Management, January 2024

Russia’s Role

While this article has focused primarily on the disinflationary impulse from China to other emerging markets in the bloc, Russia is playing a similar role in the commodities sphere. With Russian commodity exports locked out of G7 markets, Russian oil, gas, food and metals have been diverted to emerging markets, often at steep discounts to international benchmark pricing, as Moscow’s customer base was curtailed. Given the continuing war in Ukraine and Moscow’s ascendency on the battlefield, it is unlikely that this commodity export dynamic will change in the near to medium term.

Investment Implications

While conditions in developed markets point towards more elevated and volatile inflation over the next decade in a potential echo of the 1970s, we believe that inflationary conditions in many major emerging markets are very different, owing to disciplined and proactive monetary and fiscal policy, less tight labor and industrial markets and, most importantly, constructive trade relations with China (and to a lesser extent, Russia).

This will help reduce the emerging-market local-currency cost of capital, which could be a benefit to both emerging-market local-currency bond and equity holders. In our view, investors should consider being overweight in both emerging market (ex China) bonds and equities in 2024.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Analysis of themes may vary depending on the type of security, investment rationale and investment strategy. Newton will make investment decisions that are not based on themes and may conclude that other attributes of an investment outweigh the thematic structure the security has been assigned to. Richard Bullock is an employee of BNY Mellon Investment Management Singapore and provides support to Newton Investment Management as a geopolitical strategist and fixed income portfolio manager. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.