We analyze the importance of sound governance and disciplined ESG analysis when selecting emerging-market government bonds.

- In our view, emerging-market governments that are engaging, transparent, and trying to do the ‘right thing’, are more likely to be treated favorably if they do require assistance from multilateral lenders.

- This hypothesis has proved to be valid, and through our own research we have been able to find a link between sovereign governance scores and credit spreads.

- Those countries which are trying to do the ‘right thing’ are also being afforded greater flexibility as they seek emergency funding in response to the pandemic.

We have long held the view that environmental, social and governance (ESG) considerations play a crucial role when selecting emerging-market government bonds. Our premise is that improvements in the governance component of the ESG triumvirate will lead to social benefits and, ultimately, environmental improvements.

Improved governance strengthens the social contract between a government and its citizens, thus helping to reduce policy volatility, while environmental prospects should also be enhanced as initiatives such as sanitation and energy efficiency improve over time. In short, we believe that improvements beget further improvements and thus, a virtuous circle is created.

Emerging Markets for a Reason

When it comes to investing in emerging-market bonds, we believe it makes sense to begin with the premise that emerging markets are emerging markets for a reason, in that they face a number of challenges as they seek to develop their economies. For this reason, we place our ESG expectations firmly in the ‘reform’ and ‘ability to move forward’ categories when making investment decisions.

Multilateral assistance is often a crucial backstop for emerging-market governments. It is often the case that many nations (and in particular the lower-credit-rated emerging markets) possess inadequate resources or financial-market depth to manage shocks to the system – especially if they are dependent on a narrow tax base for the bulk of their revenue.

‘Doing the Right Thing’

In our view, governments that are engaging, transparent, and trying to do the ‘right thing’, are more likely to be treated favorably if they do require assistance from multilateral lenders such as the International Monetary Fund (IMF) or the World Bank.

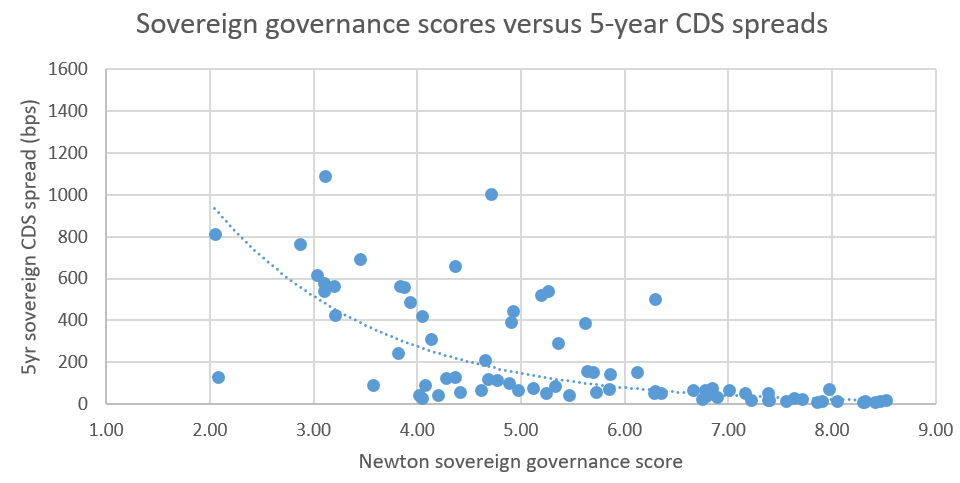

This hypothesis has proved to be valid, and through our own research we have been able to find a link between sovereign governance scores and credit spreads, as illustrated below using five-year credit default swap (CDS) spreads. The higher the governance score, the narrower the spread tends to be, although correlations will change depending on the point reached in the economic cycle.

Source: Newton, July 2020

Over the years, we have observed one anomaly which has bucked this trend. During periods of relative economic calm, we have seen on several occasions a tendency to factor in geopolitical sensitivity issues ahead of the normal modus operandi of the IMF and other lenders, which is to make lending decisions based on sustainability criteria alone. This seems like a sensible approach to us, as lenders need to ensure that they avoid throwing good money after bad.

Bespoke Solution

As fixed-income investors, we have always had numerous sources of data at our disposal. Much of this derives from our own industry and responsible investment analysts who assess corporate governance and sustainability, but there is no standard way of extending this to apply to government bonds. We believe that global and emerging-market government bonds, which often play a key role in flexible or unconstrained bond funds, require a bespoke solution.

To this end, we believe it makes sense to align ESG analysis of governments alongside an environmental attribution, screening and scoring process. We have been doing this since 2010, and we feel that it provides us with a great starting point for discussions over bond selection, as well as acting as an effective screening process for our government-bond picks.

Emergency Funding

At the time of writing, 102 governments across the globe have applied for emergency IMF funding in response to the global pandemic. Some of the poorer nations are rightly only required to meet much looser criteria to qualify for emergency funding, as without such aid being granted, there are likely to be some major humanitarian crises.

However, among the governments which are issuers of emerging-market bonds, we are now finding that our belief that good governance brings rewards to sovereign issuers and investors is holding true, in that those countries which are trying to do the ‘right thing’ are being afforded greater flexibility. We have already seen a handful of governments that we downgraded during our regular government ESG screening process, and others where we had expressed concerns, currently facing greater delays with their own emergency funding application processes (South Africa, Zambia and Belarus, for example). Moreover, approval of more substantial IMF medium-term lending programs will entail greater conditionality (and a full debt-sustainability assessment) before further funding is granted, highlighting once again the enduring importance of open and transparent political governance.

Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.