We assess central banks’ latest strategies on interest rates as near-term inflation continues to rise.

Key Points

- Major-market central banks are dragging their feet on raising interest rates, while some relatively smaller central banks are pushing ahead with rises.

- The bigger economies are preferring to focus on slowing their quantitative-easing (QE) programs.

- The Fed gave itself flexibility by saying that the pace of the reduction could increase or reduce depending on data, i.e. how transitory inflation turns out to be.

- Both the US and UK have seen sharp rises in near-term inflation rates, and pressure to raise rates could grow.

- The risk is that the Fed is forced to move more quickly than it currently anticipates, meaning that front-end yields remain vulnerable.

We appear to be witnessing an evolving trend where major-market central banks are dragging their feet on raising interest rates at a time when some relatively smaller central banks are pushing ahead with rises.

Faced with the prospect of higher near-term inflation, the US Federal Reserve (Fed), the European Central Bank, the Bank of England (BoE) and the Bank of Japan all decided this month not to raise rates at this point, preferring instead to focus on slowing their quantitative-easing (QE) programs. Meanwhile, in countries that have relied less on QE, we are seeing a dramatic shift upwards in cash rates.

Fed’s Worst-Kept Secret

Three weeks ago, we saw the US Federal Reserve announce its ‘worst-kept secret’ – that tapering of the US’s quantitative-easing program would begin this month with a $15bn cut to asset purchases. It plans to cut by a further $15bn every subsequent month, ending the program by June next year.

However, the Fed gave itself flexibility by saying that the pace of the reduction could increase or reduce depending on data, i.e. how transitory inflation turns out to be. The Fed has thus taken its first baby steps on the path to hawkishness but remains well behind its peers north of the border (the Bank of Canada), across the ocean (the Bank of England), and down under (the Reserve Bank of New Zealand), so patience is still very much the watchword.

Currently, data in the US is picking up again, with the Institute of Supply Management (ISM) Services Index hitting an all-time high a few days ago, and ten-year inflation expectations in the US remaining above 2.5% (the Fed’s unofficial target for ‘hot’ inflation). The risk remains that the Fed is forced to move more quickly than it anticipates, meaning that front-end yields remain vulnerable. The US dollar would be likely to be the main beneficiary in this scenario.

Pressure Grows on BoE

Meanwhile, the Bank of England surprised investors at its meeting on November 4 by not raising rates. What it did do was to keep the idea of higher rates very much alive by hinting that an increase was imminent. The BoE would prefer to wait a little longer for further information on the labor market, which seems logical to us given that furlough payments have only recently ended, and it may take a couple more months yet for the effects of that to be visible.

The decision went against the market’s near-term expectations largely because, like the Fed, the BoE believes the inflation rise is temporary. More importantly, with the labor market in a state of flux, it can possibly afford to wait a little longer before it must react. Again, this appears similar to the Fed’s view, but with UK consumer price inflation (CPI) hitting 4.2% in October, up from 3.1% in September (and its highest level in a decade), pressure on the BoE to raise rates in December is likely to grow.

Elsewhere, the picture is more mixed.

The Czech central bank was the latest to shock investors with a large increase in rates earlier this month, lifting its key rate by 1.25% to 2.75%. Other countries that have been raising rates recently include Canada, New Zealand, Russia, Brazil and Poland, while Australia has stepped away from manipulating the front end of the curve.

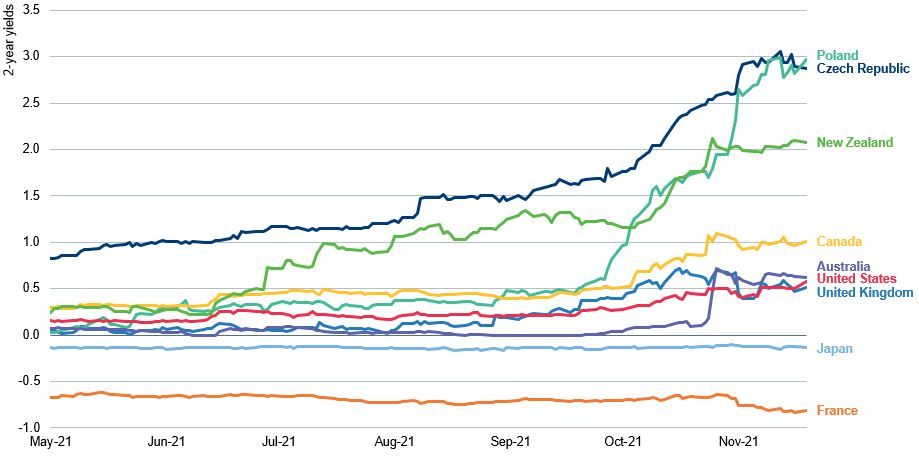

The chart below highlights the significant moves we have seen in some countries’ two-year borrowing costs and the relative stability of UK, US, European and Japanese rates. While the group of rate-rising markets is smaller than the ‘on-hold’ group, the fear is that action to date is a precursor to what could come next; the potential speed and magnitude of the moves are clearly not priced into risk assets.

Two-Year Bond Yields May 22 – November 22, 2021

Source: Bloomberg, November 22, 2021

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. ‘Newton Investment Management Group’ is used to collectively describe a group of affiliated companies that provide investment advisory services under the brand name ‘Newton’ or ‘Newton Investment Management’. Investment advisory services are provided in the United Kingdom by Newton Investment Management Ltd (NIM) and in the United States by Newton Investment Management North America LLC (NIMNA). Both firms are indirect subsidiaries of The Bank of New York Mellon Corporation (‘BNY Mellon’). Newton Investment Management Ltd is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton Investment Management Ltd is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton Investment Management Ltd’s investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton Investment Management Ltd and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited. Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2006 The Bank of New York Company, Inc. All rights reserved. In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.