Energy security and decarbonization: are they mutually exclusive?

Key Points

- The European energy crisis, which has been exacerbated by Russia’s invasion of Ukraine, has been years in the making, and has highlighted the vulnerability of European energy systems.

- As nations scramble for energy, there are concerns of what this may mean for the energy transition.

- We believe that over the medium and long term, concerns around energy security are likely to accelerate the shift to alternative sources of energy, augmented by additional investment in oil and gas to ensure the security of the transition.

- We expect that there will be a number of opportunities associated with this transition, in particular in relation to the building, transport and industrial sectors.

An Energy Crisis

The current European energy crisis has arguably been years in the making. In 1990 the European Union (EU) imported approximately 50% of its natural gas demand; fast forward to 2021, and Europe imports close to 85% of its gas demand, with Russia having become the supplier of approximately 40% of total EU gas.1,2

Russia recently caught Europe off guard and ill-prepared with low gas inventories. Events over the last couple of years have provided the perfect storm to create a very tight European gas market. An acutely cold 2020/21 winter across multiple regions and lack of wind for wind-power generation took EU gas reserves down to half those of the previous year, at only around 30 bcm (billion cubic meters) versus EU storage capacity of 113.7 bcm.3 Storage inventories were then insufficiently replenished, with Russia blaming technical outages and plant fires for not delivering gas; however, the true reason became apparent with the invasion of Ukraine.

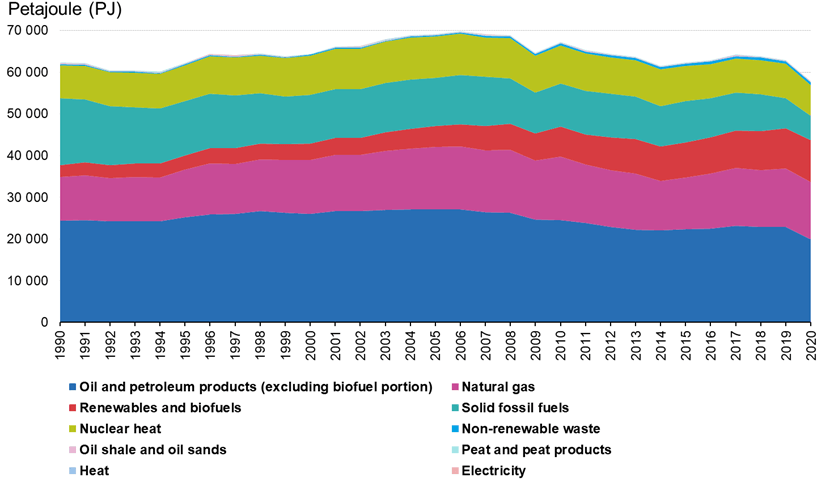

EU data from 2020 shows that 68% of total energy supply (not to be confused with electrical power generation) in the EU was produced from coal, crude oil and natural gas, with renewables accounting for only 17% of total energy supply.4 The growth in renewable energy power generation has largely been offset by the reduction in nuclear power generation. The current energy mix means that the EU is dependent on imports for 57.5% of its energy requirements, which clearly leaves it vulnerable to external shocks.5

Gross Available Energy by Fuel, EU, 1990-2020

Source: Eurostat, February 2022

Ironically, European energy policy has partly been to blame for the fragility that is now emerging in energy systems. Last year, the EU announced a target to increase the share of renewable energy to 40% of final consumption by 20306 (up from 22.1% in 2020),7 and as countries have sought to decarbonize, the continent has become more dependent on Russian gas.

Energy Transition

As a result, governments and policymakers are currently doing all they can to ‘keep the lights on’ – whether that is done by burning more coal, extending the life of nuclear power plants, or securing more oil supplies. This begs the question: have efforts to support the energy transition been thrown out of the window? In the short term, as the West continues to cut off Russia and reduce its reliance on Russian energy, the lifespan of fossil fuels is likely to be extended in order to meet economic needs. Nations are now scrambling to meet their energy needs, regardless of the source.

What this crisis has highlighted, however, is the need for countries to increase their clean-energy efforts – not only owing to the climate imperative, but also because of the close links to national security. The invasion of Ukraine and resulting sanctions have highlighted the geopolitical risks associated with the import and export of energy. Therefore, although the energy crisis may have negative effects on the environment in the short term, we believe that it is likely to accelerate the transition towards alternative energy sources in the medium and long term.

Climate Policy

Despite this crisis forcing an increase in the use of fossil fuels, the European Parliament has voted overwhelmingly to maintain the rate at which the number of permits issued in the emissions trading scheme (ETS) decline; in other words, the scheme will continue to tighten and put pressure on industries to decarbonize. It is for this reason, we believe, that the ETS price of carbon has held reasonably firm despite the challenging economic and geopolitical backdrop.

In addition, the EU has proposed the REPowerEU package, consisting of almost €300bn to improve efficiency of fuels and a faster rollout of renewable power, to help EU countries move away from Russian oil, gas and coal.8 The European Commission has been seeking to set more ambitious goals since last year, and this new package of measures suggests that the current energy crisis is not weakening the momentum of climate policy in the EU.

Short-Term Implications

In the short term, we believe that power generation from sources other than gas in Europe will stand to benefit from the cut-off of Russian gas. Operators of power generation that are not subject to fuel supply from global markets, such as domestic coal or nuclear energy, could provide short-term relief from gas shortages. However, although non-gas power producers are theoretically well-positioned, they may face additional taxes or have caps imposed on the price at which they can sell electricity in order to combat the rise in consumer bills. Use of coal and (to an extent) biofuels is not aligned with the climate-change ambitions of the EU, but in the very short term this is likely to be overlooked out of necessity. Nuclear power is always controversial, though we think that it would be imprudent to decommission nuclear before a fully decarbonized grid has been built out. Therefore, we expect that nuclear facilities are likely to remain in operation for quite some time to come.

We believe that there is also an opportunity in liquefied natural gas (LNG) storage, transportation and production as the EU looks to build extra resilience into the existing energy system. Nevertheless, there should be one eye on the exit strategy, to make sure we are not locked into more decades of burning carbon.

Medium-Term Opportunities

It is clear that efforts need to be made to strive for a largely fossil-fuel-free energy system, necessitated not just by climate change, but also by energy security.

Power generation is, in principle, the simplest sector to decarbonize, given established technologies in wind and solar. We believe that investment opportunities will emerge across the supply chain, from developers of renewables to manufacturers of components used in renewables. A grid based on intermittent power is going to require significant upgrades, combining energy storage in the form of batteries and hydrogen with ultra-high-voltage cross-continental interconnectors.

According to the International Energy Agency (IEA), the buildings and building construction sectors combined are responsible for almost one-third of total global final energy consumption,9 and we believe this is addressable in two ways. One is to accelerate the renovation and insulation of the current building stock and increase energy efficiency requirements for new buildings. The second is to speed up the rollout of heat pumps to replace gas and oil boilers. The introduction of heat pumps needs to go in tandem with improvements in building insulation in order to work effectively. Smart home control systems can also save a surprising amount of energy. At an EU level, reducing building heating by just 1 degree Celsius can save 10 bcm of gas per year,10 out of a total 450 bcm gas demand.11

Transportation accounts for 37% of CO2 emissions from end‐use sectors, according to the IEA.12 This sector presents a mixed picture; light vehicle transport is easily replaced with battery electric vehicles, the technology for which has already been proven. We are seeing investment opportunities in the electric-vehicle supply chain and charging infrastructure. On the other hand, heavy road transport, shipping and aviation are much more expensive to decarbonize. This area is likely to start to see investment, but may not be the main area of focus in the near term.

The manufacturing industry, by nature of its focus on producing products at the lowest possible cost, is already fairly efficient; however, the current high electricity prices make the payback period for installing more energy-efficient components like compressors much shorter, and therefore may accelerate investment. Heavy industry requiring high heat intensity to produce goods is likely to require a shift to hydrogen as a fuel source, which requires significant investment in technology and infrastructure. We believe that there may be opportunities in industrial gas, manufacturing of electrolyzers, and specialty chemical companies developing cathode materials.

Energy Security and Net Zero

As the current European energy crisis persists, although the short-term implication may be a setback to the energy transition, we believe that over the medium and long term it could in fact accelerate the shift to alternative energy sources. The links between increasing European energy security and achieving net-zero climate-change ambitions are striking, which gives us confidence that energy security and decarbonization are not mutually exclusive.

Sources:

- Eurostat, Energy statistics – an overview, February 2022

- Reuters, Factbox: How can Europe get gas if Russia’s supply is disrupted?, May 11, 2022

- European Parliamentary Research Service, EU gas storage and LNG capacity as responses to the war in Ukraine, April 2022

- Eurostat, Energy statistics – an overview, February 2022

- Ibid.

- Reuters, EU unveils plan to increase renewables share in energy mix to 40% by 2030, July 14, 2021

- Eurostat, Renewable energy statistics, January 2022

- EUR-Lex, REPowerEU Plan, May 18, 2022

- IEA, Buildings, accessed August 1, 2022: www.iea.org/topics/buildings

- IEA, 10-Point Plan to Reduce the European Union’s Reliance on Russian Natural Gas, March 2022

- Statista, Natural gas consumption in the European Union from 1998 to 2021, July 19, 2022

- IEA, Transport, accessed August 1, 2022: https://www.iea.org/topics/transport

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.