Our dynamic thematic framework helps identify structural growth opportunities created by rapid urbanization.

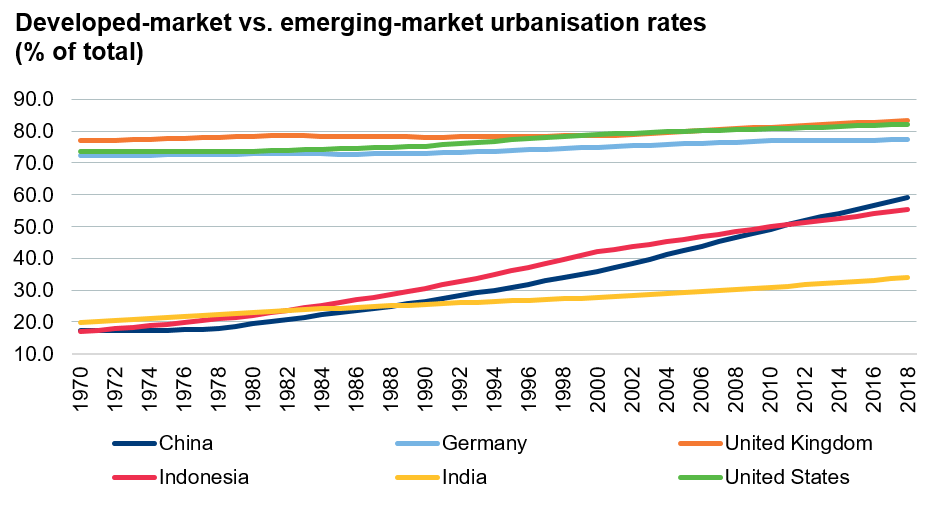

By the mid-twentieth century, the global urbanization story was largely one of bifurcation. In the 1960s, emerging-market economies had low urbanization rates and concomitant low per-capita incomes. By contrast, developed countries, including the UK, Australia and the US, had higher urbanization rates and higher incomes. This trend continued to play out for the remainder of the century.

Fast forward to 2001, when China joined the World Trade Organization, and the gap between developing and developed economy urbanization rates began to close. The urbanization phenomenon – essentially the migration of people from rural to urban areas – continues to play out in emerging economies, and has a strong statistical relationship with income gains.

UN World Urbanization Prospects, 2018

We believe that the global urbanization trend has further potential for growth. Developed countries have reached what we call ‘peak urbanization’ – urbanization rates relative to their total population of around 80% to 85%. By contrast, just 34% of India’s population lives in urban areas. According to the United Nations (UN) and World Bank, urbanization rates in developing economies could rise to between 50% and 60% by 2030, if not sooner. China already has an urbanization rate of 66% (as of 2018).

The Rise of the Megacity

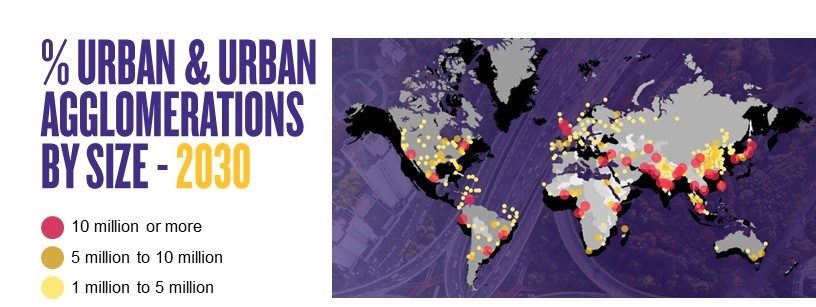

Urbanization is not just about swathes of a country’s population resettling in urban areas; it is about the growth in the size of those cities. Urbanization is changing the nature of cities. Looking at the two maps below, the red dots show the number of urban agglomerations, or megacities, with over 10 million inhabitants. The image on the left shows the picture in 1990, while the image on the right shows how the world is projected to change by 2030. Urbanization is set to accelerate. By 2030, the world is forecast to have 43 megacities, many of them in emerging markets. In 1990, China was the conspicuous absentee with no megacities; by 2030, the country will boast eight or nine. As long-term, thematic investors, we cannot afford to ignore these structural changes, the disruption they cause, and the investment opportunities they create.

ortunities they create.

Urbanization and Population Dynamics

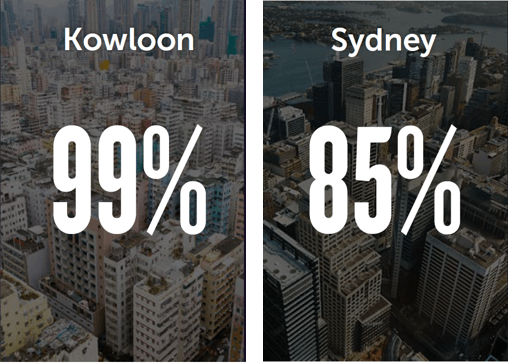

Urbanization rates in Kowloon (Hong Kong) and Sydney

Source: UN World Urbanization Prospects, World Bank

One critical aspect of our ‘population dynamics’ theme is its focus on increasing consolidation of populations around large urban centers across developed and emerging markets, and how this drives demand for property. The left-hand picture above shows Kowloon, a thriving shopping area in Hong Kong, and the right-hand picture Sydney’s central business district. Real-estate investment trust (REIT) operators focused on these districts benefit from a strong thematic tailwind, with rapid urbanization and high population densities in both areas continuing to provide a highly favorable supply/demand dynamic. With an urbanization rate of >99%, Hong Kong has the second highest population density, behind Singapore, of all countries surveyed by the UN – demand for housing, offices and bricks-and-mortar retail completely outstrips supply.

Air Conditioning: A Hot Topic?

One of the distinctive aspects of our thematic framework is that our themes seldom operate in isolation – themes are often symbiotic. In this case, we see a distinctive overlap between our ‘population dynamics’ and ‘Earth matters’ themes. Megacities are predicted to multiply by 2030, and this growth is likely to come from emerging economies, including Mexico, Indonesia, Brazil, India and China. What we are likely to see over the next decades is a collision of arguably two of the most powerful structural trends in the global economy: on the one hand, huge swathes of the population will continue to migrate from rural to urban areas; on the other, our awareness of, and willingness to take action on, climate change will reach unprecedented levels.

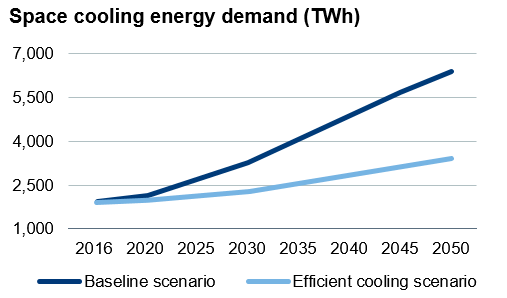

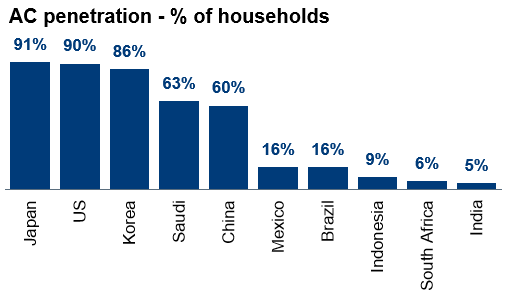

But what does this have to do with air conditioning, you might be asking? Nearly 40% of all energy-related CO2 emissions globally come from buildings, and of that the vast majority is demand for heating and air conditioning (AC). And this trend is set to continue. According to the International Energy Agency (IEA), energy demand for building cooling will triple by 2050 in the IEA’s baseline scenario – see below – and double in the most efficient cooling scenario (assuming all end markets adopt the most efficient AC units available). AC is a vital ingredient to boost economic growth in rapidly urbanizing emerging markets – the long-term demand case is clear. But if we look at current AC penetration levels, it is also apparent that in the countries that are predicted to experience the highest urbanization growth, which also have some of the hottest and most humid climates, penetration is extremely low! The opportunity for more energy-efficient AC systems to gain share in these rapidly urbanizing and hot climates is evident over the longer term.

Source: International Energy Agency

Chinese Takeaway

Urbanization also intersects with our ‘consumer power’ theme. The consumer landscape is changing. With the almost ubiquitous use of mobile phones, we have seen a noticeable rise in, and projected growth of, online food delivery penetration in major cities globally as more people migrate to cities. The ability to click your smartphone two or three times and have a meal or your weekly groceries delivered to your door is drawing more consumers towards online food delivery. As mobile penetration and urbanization rates in China look set to grow as we approach 2030, we believe it is important to consider the long-term opportunities associated with on-demand food delivery.

The examples above show how our thematic framework forces us to take a longer-term global perspective on a volatile world, while stimulating both idea generation and risk management.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.