Key Points

- The proportion of people with a full understanding of what net zero means is low, with younger generations generally more familiar with the topic.

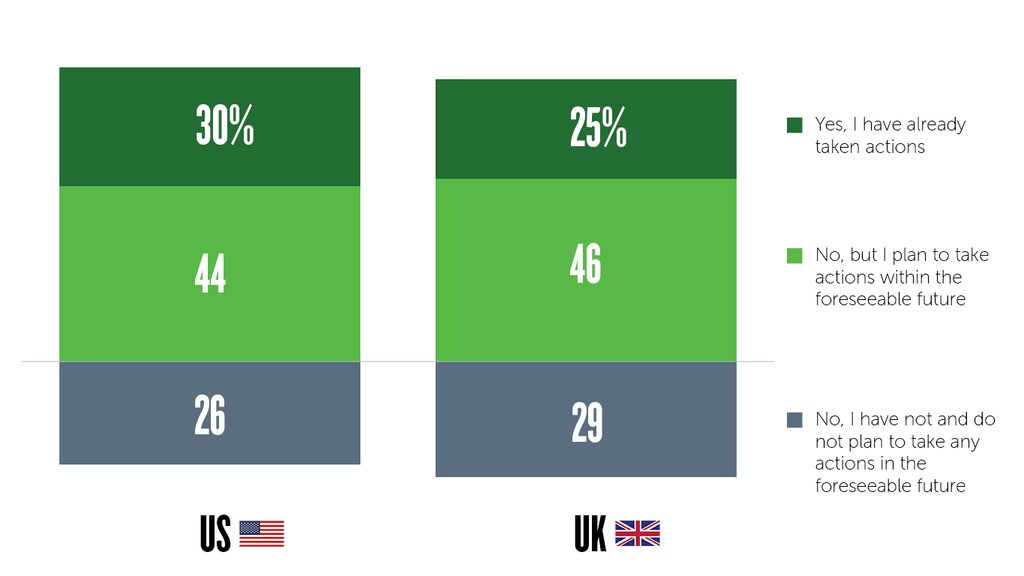

- 30% of respondents in the US and 25% in the UK who are active or potential investors currently invest with climate concerns in mind, and an additional 44% and 46% respectively do not currently invest but plan to take actions within the foreseeable future.

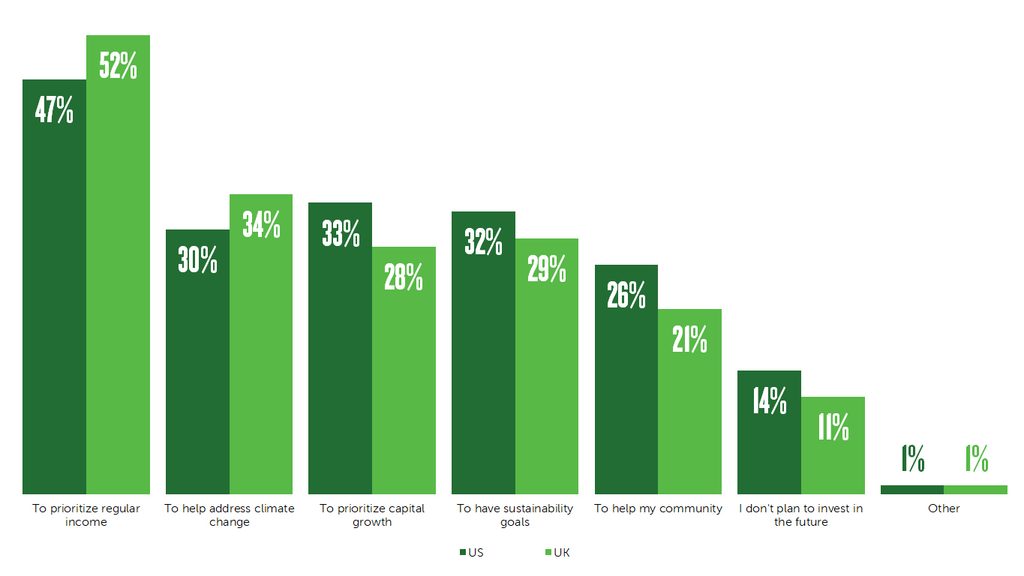

- While income growth is top of mind when investing, respondents view climate change and sustainability as important considerations.

- Increased education around both the concept of net zero and the role that asset managers can play in the transition could be key in helping more people take action.

Newton recently conducted a survey among a representative sample of adults in the US and UK to better understand current thoughts and actions relating to net zero.

Our survey suggests that the proportion of people with a full understanding of what net zero means is low, with younger generations generally more familiar with the topic. However, many are already investing with climate concerns in mind, and a considerable number plan to do so in the future, indicating that there could be scope for both investment and educational opportunities.

‘Net zero’ refers to the goal of achieving a balance between the volume of greenhouse gases added to the atmosphere and those taken out, i.e. the volume added should be no more than the volume taken away.

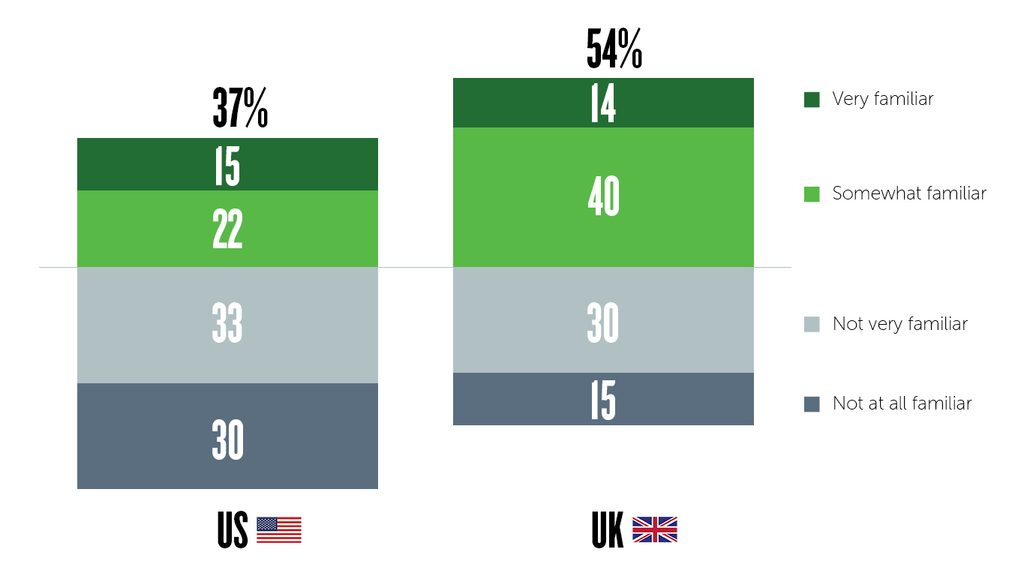

Familiarity with Net Zero

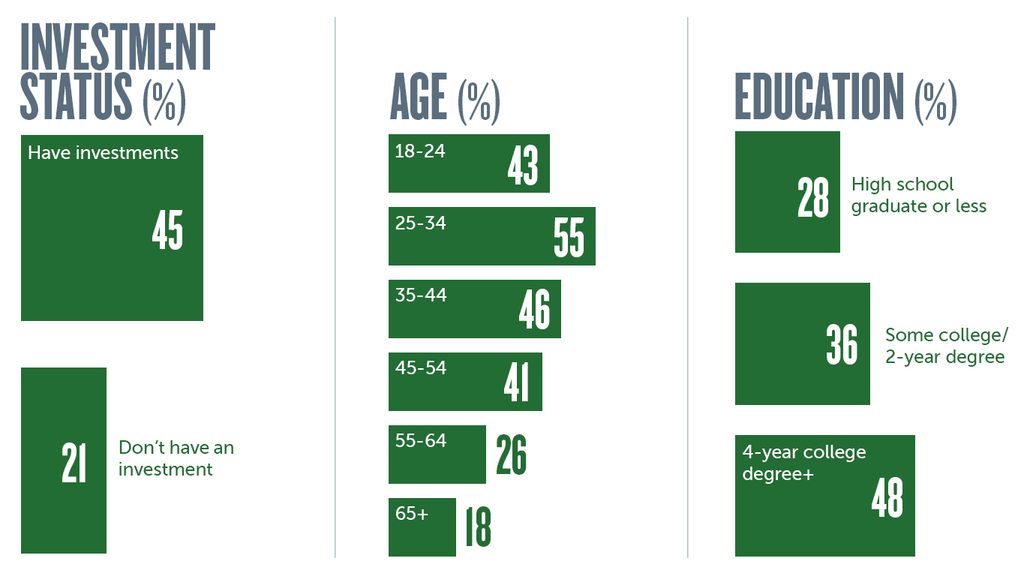

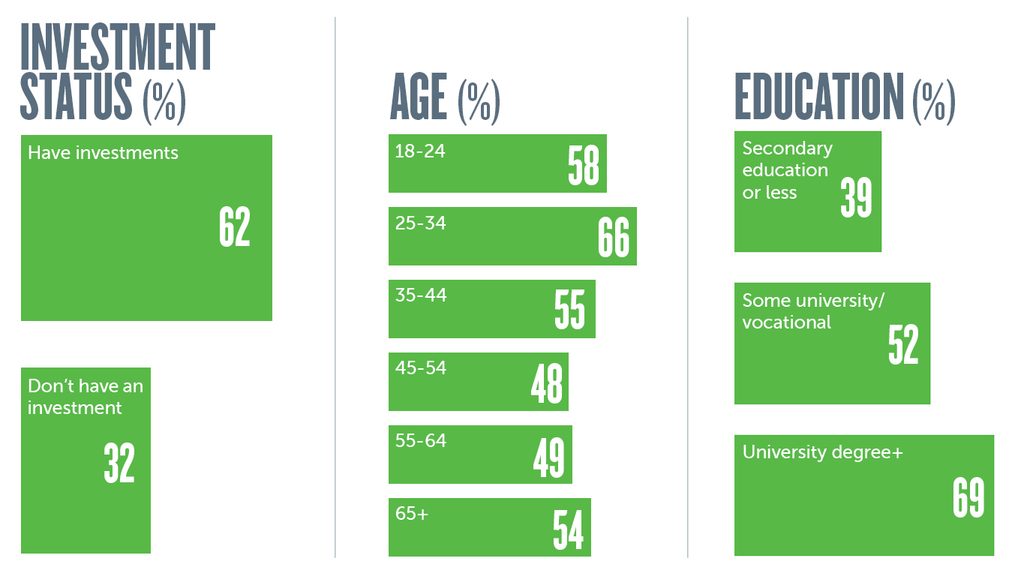

According to the survey, only 15% in the US and 14% in the UK have a full understanding of the term ‘net zero’. In both the US and the UK, those aged between 25 and 34, those who have investments, or those with a university degree, are most likely to be familiar with net zero.

Familiarity with Net Zero

Familiarity with Net Zero – US Subgroups

Familiarity with Net Zero – UK Subgroups

After being presented with the definition of net zero, 30% of respondents recognized that they have thought about the implications of it in terms of their daily life, 11% have considered it relating to their investments, and 14% have thought about both, with those aged between 25 and 34 the most likely to do so.

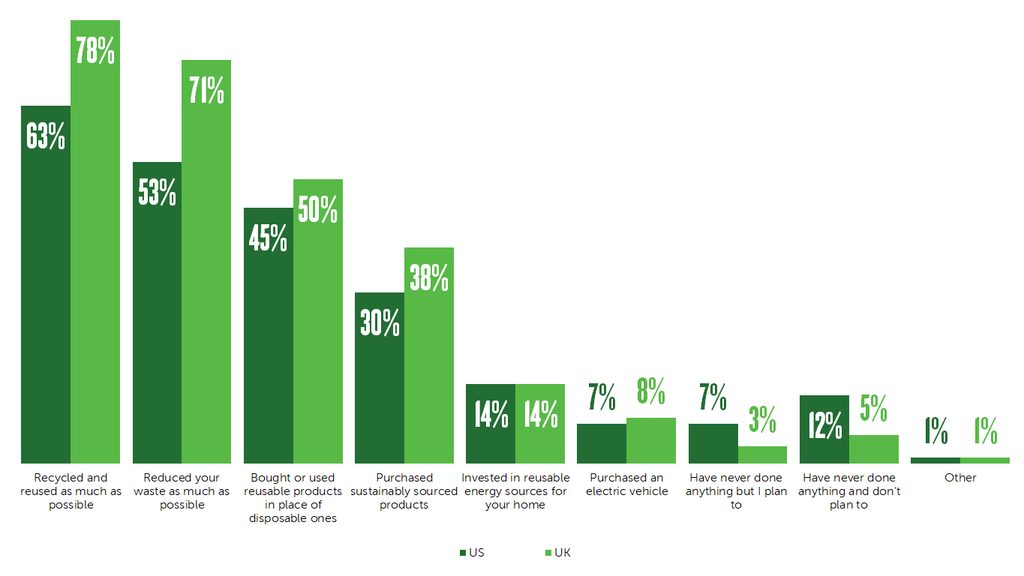

While more than half have not thought about net zero in their day-to-day lives, many are taking actions relating to climate change, including recycling or reusing, reducing waste, and purchasing reusable products. This indicates a possible disconnect between net-zero initiatives and climate-change action.

Climate Change Actions

Climate and Investment

Our survey revealed that, at present, 30% of respondents in the US and 25% in the UK who are active or potential investors currently invest with climate concerns in mind, and an additional 44% and 46% respectively do not currently invest but plan to take actions within the foreseeable future. Younger respondents are more likely to have taken action or plan to take action in the future.

Reflecting Climate Change in Investments

While income growth is top of mind when investing, respondents do view climate change and sustainability as important considerations.

Investment Priorities

Positively, the majority of respondents are in favor of policies that support net-zero goals, with 60% in the US and 70% in the UK in favor. In the US, the Northeast and Western regions are more likely to be in favor of these policies than the Mid-West and Southern regions, possibly reflecting the differing political viewpoints. However, only about a quarter feel that corporations and investment managers are doing enough to support net zero.

What Can Asset Managers Do?

While the proportion of people with a full understanding of what net zero means is low, it is clear that there is considerable support for net-zero goals. Furthermore, many people, particularly among younger age groups, plan to keep climate change in focus with future investments. In this context, increased education around both the concept of net zero and the role that asset managers can play in the transition could be key in helping more people take action.

If we are to collectively hit the pledged net-zero targets, there will need to be an extraordinary and global effort, and asset managers will have a crucial role to play. At Newton, we recognize that there are different methodologies and approaches to tackling net-zero carbon emissions among asset managers. However, such is the gravity of the global-warming threat that we believe a pragmatic approach is required, which can evolve as our understanding of a deeply systemic and complex issue evolves.

We have joined the Net Zero Asset Managers initiative, and have aligned ourselves with an independent methodology guided by the Science Based Targets initiative (SBTi). Through the latter, we are committing to having 50% of the financed emissions of the companies we invest in on behalf of our clients tied to credible net-zero plans by 2030, with the aim of reaching 100% by 2040.

We will seek to meet these headline targets via a range of transparent measures around investments in climate ‘solution providers’, engagement with fossil-fuel companies to support their energy transition, and active stewardship activities.

We emphasize the importance of emissions pathways and we are led by science (by the SBTi where the guidance is available). This forces us to focus on real-world emission reductions rather than superficial portfolio decarbonization. This guides our priorities around focusing on the regions, sectors and companies that are the most carbon-intense. Emerging markets will be the source of the vast majority of fossil-fuel emissions in the future, and this is where the funding gap is the greatest for both mitigation and adaptation.

The Financial Conduct Authority recently announced three new sustainable investment product labels, designed to help consumers navigate the product landscape. One of these focuses on ‘sustainable improvers’, highlighting that there is now space to allocate capital to companies that are seeking to improve their footprint, and therefore to effectively capture those improvements as a sustainability proposition. We believe this is a very important part of the climate-change challenge: to allocate not just to solution providers, but also to those that are doing the most.

While our 2030 and 2040 milestone targets might still seem some way off, we are making investment decisions today that we believe will aid our progress along the way. We are stepping away from areas we deem to be unacceptably risky, and we are also focusing on selective, well-managed opportunities around energy-transition metals like copper, electric-vehicle infrastructure or supply chains, and clean energy.

Making an initial pledge is easy and so is making a commitment to a long-term goal. The challenge is to break this down to develop short-term actions and make sure they are supported by our clients. We will continue to engage with our clients as we roll out our approach, define the short-term targets, and consider what this means for their portfolios.

About the Survey

Newton’s net-zero survey was administered using a demographically representative sample of adults. Fieldwork took place between October 13 and 14, 2022.

United Kingdom: 1,016 participants

United States: 1,034 participants

Subgroups:

- Age

- Investment

- Education

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.