In our view, there are two ways in which to define quantitative easing (QE); first, there is the volume of assets purchased, and second, the impact that those security purchases have on broader money supply.

The two are not the same; only purchases of securities from a non-bank counterparty result in the creation of a new bank-deposit liability which directly boosts money supply. Everything else can be simply described as an asset swap between the Federal Reserve (Fed) and a commercial bank.

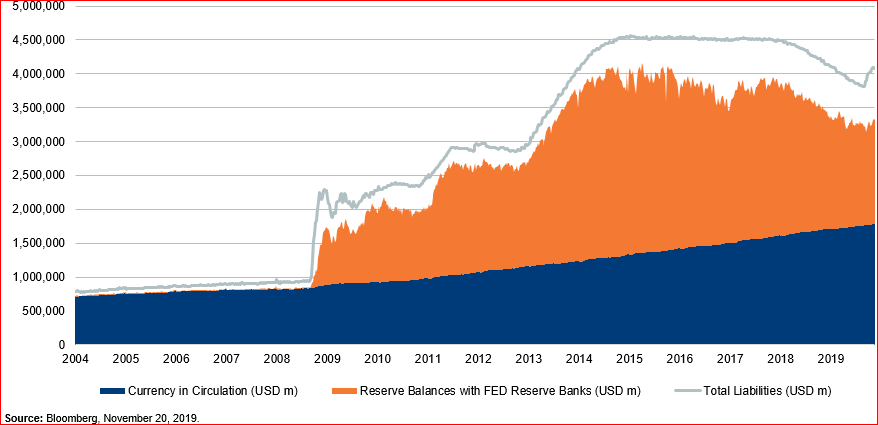

In the context of the second definition, although the expansion of the Fed’s balance sheet (represented by the grey line in the chart below) is widely used for illustrative purposes, we believe it doesn’t tell the whole story. In our view, in order to assess QE properly, it is important to focus on the increase in commercial bank reserve balances with the Fed – as represented by the orange color in the chart below.

What is clear to us from the chart is that the last 12 weeks of Fed balance sheet expansion (up to November 20, 2019) have not led to an increase in commercial banks’ reserve assets.

Federal Reserve Balance Sheet – Currency and Reserves

As commercial-bank reserves shrink, greater emphasis is placed on the commercial banks’ other high-quality liquid assets (HQLA) to meet their regulatory requirements, in particular Treasuries. Commercial banks’ reserves shrink naturally over time, as the Fed’s non-reserve liabilities (mainly currency) grow (represented by the blue series in the chart above).

However, commercial banks saw an accelerated decline in their excess reserves between mid-August and mid-September. As businesses paid their taxes, money balances were transferred from the commercial banks to the government, reducing the outstanding stock of commercial banks’ reserves and concurrently increasing the Treasury General Account (TGA), the general checking account of the Department of the Treasury, by around $170bn.This reduced the stock of HQLA available to the commercial banks by an equal amount, which led to increased stress in the funding markets and increased demand for Treasuries.

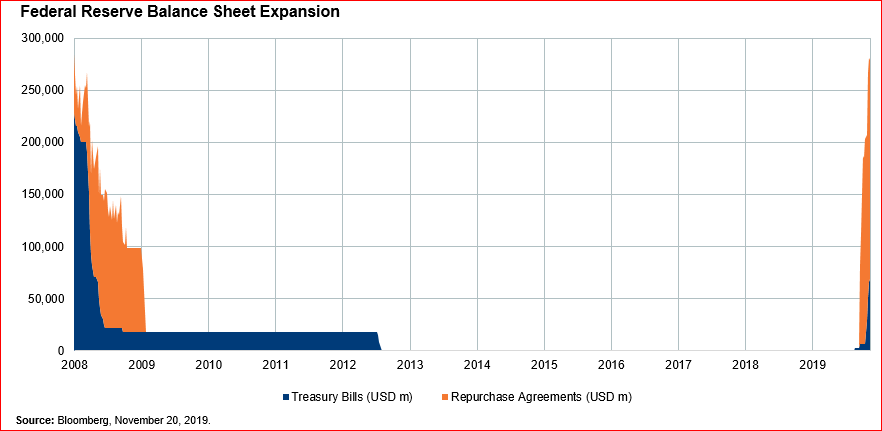

In response to this stress, the Fed launched a standing repurchase (repo) facility (allowing commercial banks to swap Treasuries for reserves while still booking the Treasuries as HQLA). Had this been done ahead of companies paying their taxes, it would have been likely to be enough to ensure there were ample reserves. However, it was not until mid-September that the Fed initiated this facility, by which time the damage had been done in the funding markets

Between the end of August and November 20, the Fed’s repo facility increased from zero to $199bn (see the chart below). Alongside purchases of Treasuries totaling $81bn, this created a combined intervention of $280bn, which had the net result of expanding the Fed’s balance sheet to absorb and offset the increase in the TGA. At the same time, however, commercial bank reserves stayed flat.

Repo Facility Is Not QE…

If the Fed had not acted in this way, the size of its balance sheet would have remained unchanged, while commercial banks’ aggregate balance sheets (both reserves and deposit liabilities) would have shrunk by $270bn.

Instead, as a result of the Fed’s actions between the end of August and November 20, its balance sheet increased by $270bn, but owing to payment of corporate taxes, bank reserves only rose by $25bn. In this sense, the Fed’s recent balance-sheet expansion should not be thought of as QE.

Given the TGA is now at the Treasury’s target of around $400bn, the Fed’s balance-sheet expansion may have come to an end. Over the week to November 20, the outstanding repo balance fell by $10bn while purchases of US Treasuries came in at $15bn – a net balance-sheet expansion of $5bn, and much lower than when the Fed was acting to offset the impact of the TGA account rebuild.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. ‘Newton’ and/or the “Newton Investment Management” brand refers to the following group of affiliated companies: Newton Investment Management Limited and Newton Investment Management (North America) Limited (NIMNA Ltd). In the UK, NIMNA Ltd is authorized and regulated by the Financial Conduct Authority in the conduct of investment business and is a wholly owned subsidiary of The Bank of New York Mellon Corporation. Registered in England no. 2675952. NIMNA Ltd is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. NIMNA Ltd’s investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including NIMNA Ltd. Certain information contained herein is based on outside sources believed to be reliable, but their accuracy is not guaranteed. Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2006 The Bank of New York Company, Inc. All rights reserved.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

In Canada, Newton Investment Management Limited is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Ontario and Quebec and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.