A decoupling of US and China technology ecosystems presents opportunities.

Key Points

- Chinese technology initiatives suggest that the balance of power in the global semiconductor marketplace is in play.

- The US currently has a leading position in the semiconductor industry revenues and a dominant market share in the technology necessary to produce the most advanced silicon.

- We believe geopolitical urgency is forcing the US to move its critical tech supply chains away from China and closer to home, either through onshoring or “friend shoring” with trusted allies.

- China’s growing semiconductor industry presents a rich opportunity set to invest selectively behind reliable management teams with strong intellectual property.

China’s successful development of its high-tech industries, as set out by President Xi under the country’s Made in China 2025 policy (MIC2025), remains an absolute national priority, but its successful execution has become all the more urgent in the wake of the West’s response to the Russia-Ukraine conflict. The MIC2025 policy was unveiled in 2015 and outlined ten strategic industries, ranging from robotics and green energy to new materials, that will carry the Chinese economy forward to the next level. The development of most of these strategic industries depends on an advancement of China’s own semiconductor industry.

China’s traditional growth model based on labor and capital inputs has slowed and the country’s demographics are rapidly ageing. China must innovate and continue to grow its total factor productivity via new technologies if it is to continue its economic ascent and eventual convergence with the economy of the US. The challenge is monumental, however, because a large element of China’s existing technology base has been acquired from the West—either complicitly or by other means—and the West, most notably the US, has now made restrictions on new technology transfers to China a strategic priority, often under the pretext of national security. The US has identified some of China’s key tech enablers and national champions, including Huawei, SMIC and Hikvision, and has placed commercial and trade restrictions on these companies and many others, prohibiting Western companies from transacting with them.

Taiwan

Geopolitical urgency is forcing the US to move its critical tech supply chains away from China and closer to home, either through onshoring or “friend shoring” with trusted allies. This is where the strategic complexity of Taiwan comes into play. Taipei has long been a trusted technology trade partner for the US. A large portion of the America’s critical semiconductors are manufactured by fabs in Taiwan, given the outsourced nature of semiconductor supply chains. As great-power competition intensifies between the US and China, so too will the geopolitics of Taiwan. Beijing has stepped up its political ambitions over Taiwan in recent years, including its assertion that unification of the island remains a historic inevitability.

In recent months, China has also begun to assert that the Taiwan Strait passage between its mainland and Taiwan does not comprise international waters and therefore, by implicit extension, that foreign naval vessels should not enter the Strait. As the US continues to tighten its restrictions on Chinese technology transfer, we believe it is inevitable that the geopolitical stakes around Taiwan will continue to rise, a case in point evidenced by the recent visit of US House of Representatives Speaker Nancy Pelosi, which was viewed as a major provocation by Beijing, with China responding with intense military exercises. America’s traditional relationship and strategy towards Taiwan is governed by the Taiwan Relations Act, which pledges to support Taiwan’s right to defend itself but does not provide explicit alliance protection. President Biden’s recent declaration that the US would defend Taiwan in the event of an invasion was walked back by other White House officials. For investors then, particularly those following the tech hardware and semiconductor industries, there are reasons to remain vigilant to the US-China tech war and the geopolitics of Taiwan.

Arming for the Tech War

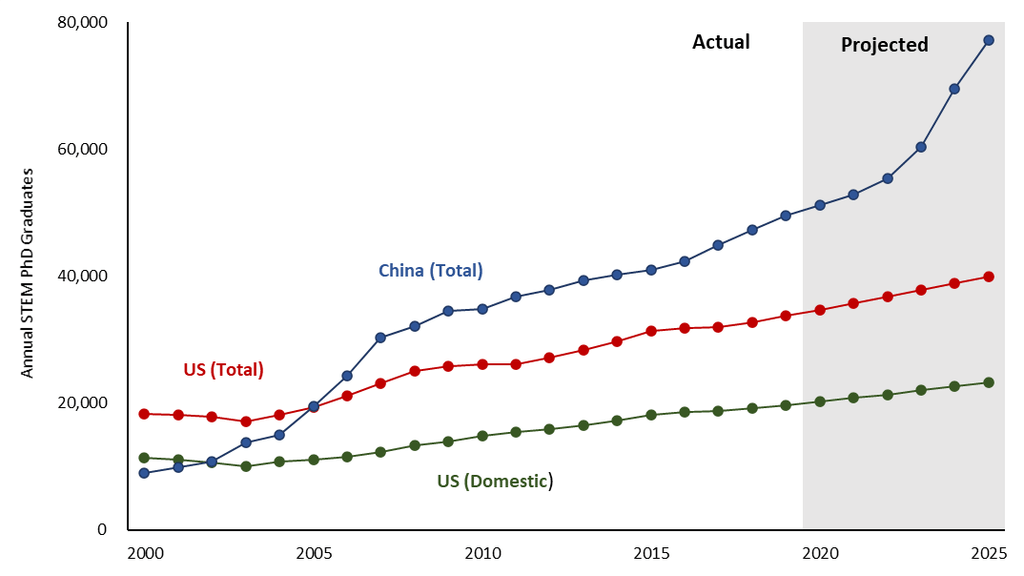

Chinese universities have long surpassed US institutions in the annual number of STEM (science, technology, engineering, and mathematics) PhDs produced. By 2025, China is expected to produce twice as many STEM PhDs as the US, as shown in the chart below from the Georgetown University’s Center for Security and Emerging Technology (CSET). Based on current trends, the gap is projected to grow wider.

Annual STEM PhD Graduates

Source: Georgetown University’s Center for Security and Emerging Technology (https://cset.georgetown.edu/wp-content/uploads/China-is-Fast-Outpacing-U.S.-STEM-PhD-Growth.pdf), as of August 2021.

The Semiconductor Industry Today

Our shared experience of the Covid-19 pandemic has shown just how critical semiconductors can be to our lives. Modern life would be hugely disrupted by an inability to source these chips, from our home and digital lives to (more importantly from a political perspective) the successful functioning of industry, communications, and defense. The industry is critical to national and economic security, and not just that of the US. How critical? Consider this potentially tragic example of just how dependent infrastructure is on semiconductors: it has been reported that Taiwan manufactures the advanced chips that sit in the Chinese missiles pointed at Taiwan.[1]

The US leads the semiconductor industry today, with greater than 50% market share of revenues and dominant market shares in the equipment, intellectual property, and software necessary to produce the most advanced silicon.[2] However, there has been a hollowing out of Silicon Valley’s manufacturing base as companies have offshored this capital-intensive process. The world is dependent on Taiwan and Korea for some of the most advanced chips that run our smartphones, data centers and supercomputers. This point raises questions for the security of supply given the increasing geopolitical tensions and those countries proximity to antagonistic neighbors.

The Rise of China

Semiconductor self-sufficiency is a key component of China’s MIC2025 plan. This has resulted in massive government support, investment, and tax incentives to compel Chinese companies to develop and buy locally sourced silicon. One example is the directive for all state-owned enterprises to use only domestically produced PCs and other hardware, which resulted in discarding and replacing foreign equipment. The scale of the ambition is staggering; we believe that for China to be self-sufficient and close its semiconductor trade gap, it would have to produce over $200 billion more each year.

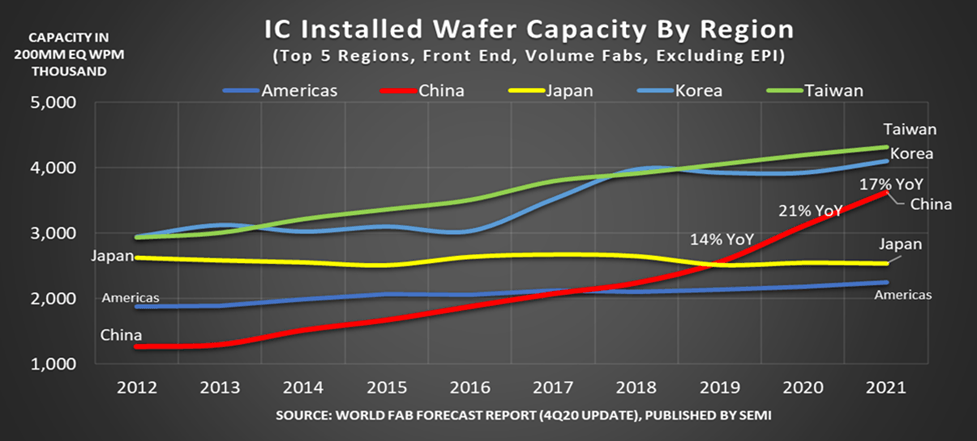

The chart below shows how quickly China’s manufacturing capacity has grown, having passed the US in 2017. There is no shortage of capital for Chinese semiconductor companies; over half the world’s venture financing for silicon startups is in China and the number of new registered semiconductor companies has trebled over the last five years. The ecosystem is expanding and China’s national champion in chip memory is now competitive with the world’s best, even getting certified for the latest iPhone.

Source: World FAB Forecast Report, as of 12/31/2020.

The US Reaction

The rise of China has caused concern and prompted action in the US. We believe this is what motivated former President Trump to target Huawei, the national champion that could develop truly world-class silicon. By restricting access to American technology Trump decimated Huawei’s semiconductor division. This was a demonstration of the power the US wields.

The broader context is important. The US has created a system where it can restrict China’s access to both advanced and foundational technology, wherever US intellectual property is relied upon. US intellectual property covers virtually all the world’s technology. Because the US-led system is global, it can stop Taiwan or Korea from supplying China and has effectively stopped the Netherlands from exporting to China the equipment required to manufacture leading-edge semiconductors. Actions have been targeted to date but there are many more measures in reserve should politicians decide to deploy them.

One reason for reticence is just how dependent the world is on China as part of the global technology supply chain. Recognizing this vulnerability, governments around the world have proposed bringing semiconductor manufacturing home. The CHIPS for America Act in the US, passed in the 116th Congress (2019-2020), includes $50 billion in investment and incentives for US chipmakers. Meanwhile, Europe targets a quadrupling of its domestic manufacturing base, and Japan and Korea have introduced multi-billion-dollar incentive programs. Despite these grand ambitions, we are still waiting for Western governments to implement their plans, and all the while China continues to invest in its domestic semiconductor industry.

Opening the Silicon Curtain

Newton are long-term thematic investors, and we believe the end state will be two distinct tech blocs: a grouping of democracies led by the US and an autocratic bloc led by China. The disentanglement of global supply chains will likely take a decade to complete and will create thematic tailwinds driving value creation for shareholders.

Wafer fab equipment companies in the West are likely to benefit from the nationalization of semiconductor supply chains. These companies sell the equipment necessary to build a local manufacturing base and could be the beneficiaries of government subsidies. It won’t be plain sailing, as between 20-30% of these companies’ revenues are driven by China today, but over the long term we think the positives should outweigh the negatives.

China’s semiconductor industry is growing rapidly and presents a rich opportunity set for global investors like Newton to pick long-term winners. We are mindful of the potential for malinvestment that a policy focusing on growth over profits can bring. However, there are opportunities to invest alongside strong management teams with good intellectual property in China, with government policy tailwinds accelerating growth.

[1] Source: Washington Post, “China builds advanced weapons systems using American chip technology.” April 9, 2021.

[2] Source: Newton estimates.

PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. For additional Important Information, click on the link below.

Important information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC ("NIMNA" or the "Firm"). NIMNA is a registered investment adviser with the US Securities and Exchange Commission ("SEC") and subsidiary of The Bank of New York Mellon Corporation ("BNY Mellon"). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand "Newton" or "Newton Investment Management". Newton currently includes NIMNA and Newton Investment Management Ltd ("NIM") and Newton Investment Management Japan Limited ("NIMJ").

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment and past performance is no indication of future performance.

Information about the indices shown here is provided to allow for comparison of the performance of the strategy to that of certain well-known and widely recognized indices. There is no representation that such index is an appropriate benchmark for such comparison.

This material (or any portion thereof) may not be copied or distributed without Newton’s prior written approval.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.