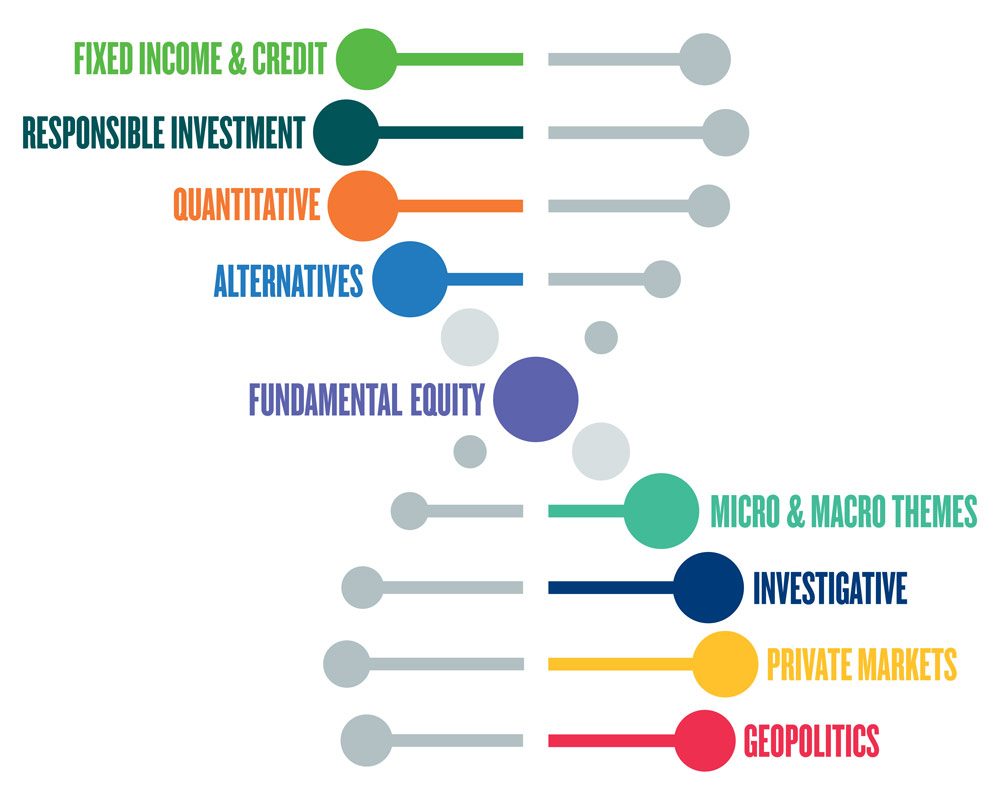

In recognising these challenges, we believe a holistic approach is a necessity, and that belief is the foundation for our multidimensional research platform.

A toolkit for the modern investor

- Our enhanced multidimensional research platform looks to deliver insights to help generate better outcomes for our clients. As we develop our research capabilities, we look for ways to innovate – for example through our proprietary ‘pod’ framework for fundamental research – and we equip our investment teams with new and innovative tools.

-

Fundamental equity

While many in the industry rely on industry classification standards to allocate research resources, we believe that in today’s markets, technology-fuelled innovation and disruption mean that there are more effective ways to organise this.

Through a proprietary quantitative and qualitative process, we have developed a fundamental equity research framework that rewrites classifications into five clusters that we call ‘pods’. These pods look to group companies based on numerous characteristics including their maturity, economic sensitivity and idiosyncratic composition. We believe this results in a more efficient and active approach to allocating our investment resources, with three key positive outcomes:

• It allows for ‘apples-to-apples’ comparison of similar businesses.

• It enables insights to be shared more freely instead of being constrained by a hierarchical industry classification system.

• It helps align our portfolio managers with areas of the market and analysts that are most relevant to their portfolios.

Fixed income & credit

Responsible investment

Find out more about responsible investment

Quantitative

Alternatives

Micro & macro themes

Themes can alert the members of our investment team to the new opportunities that change creates, and help identify the emerging risks that will impair the value of investments.

Find out more about our thematic research framework

Investigative

Private markets

Geopolitics

Case study 1

The portfolio manager and fundamental equity analyst covering the security sought our credit analysts’ perspective. After the credit analysts noted that there was a growing likelihood of the company undertaking a debt restructuring, we decided to sell the security.

This highlights how understanding the entire capital structure can be imperative when making investment decisions. Our credit analysts now join our weekly fundamental equity ‘pod’ meetings, which we believe will result in more examples of fixed-income/equity interactions benefiting our clients.

Case study 2

Our analyst engaged our investigative research team, who met industry thought leaders, trade groups, and former high-ranking executives of the retailer, as well as speaking to a tech start-up that is partnering with retailers in the sector to bring efficiency and improve employee morale.

The team saw significant potential for innovation that could help the company’s transition, and encountered a number of possible opportunities and obstacles that they believed would make execution key to the outcome for investors.

The research also uncovered a potential investment opportunity for our private markets team.

Case study 3

Although the company claimed that these issues had been addressed, we asked our ESG investigative research analyst to undertake further research. They worked closely with a human-rights watchdog group, which obtained well-documented evidence that the abuses were continuing.

As a result, the commodities team sold the position in the company, highlighting how ESG considerations can be integrated into our investment process.*

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

* Newton manages a variety of investment strategies. How ESG analysis is integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. Newton does not currently view certain types of investments as presenting ESG risks and opportunities and believes it is not practicable to evaluate such risks and opportunities for certain other investments. Where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.