Why charities partner with us

- Our focus on performance and service has helped us become one of the UK’s leading charity fund managers, with discretionary clients and investors in Newton-managed funds spanning the broad spectrum of charitable causes.

Pooled investment services for charities

-

A growing trend among charity investors

A growing number of investors are opting for a pooled approach owing to, among other reasons, the ease of administration, the simple process of adding and removing money, and lower management costs.

What do we offer?

We offer a large variety of pooled solutions to meet a broad range of investment objectives, including those focused on long-term income and growth generation, responsible investing, and also lower-volatility absolute-return strategies. -

-

Charity-specific funds

Several of our funds have applicable tax advantages -

Ethical exclusions

None of our charity-focused investment funds invest in companies that derive more than 10% turnover from tobacco production -

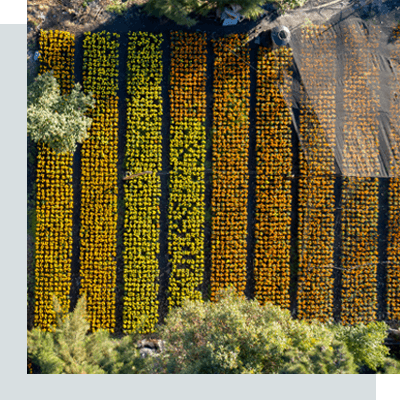

ESG integration

Financial considerations of environmental, social and governance (ESG) factors are built into all the pooled solutions we offer to charities

- Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. Newton is not a tax expert and independent tax advice should be sought.

Discretionary services for charities

-

For charities with more complex requirements

Segregated portfolios are managed under a discretionary service. This means that we take on responsibility for buying and selling holdings within the portfolio. As with our pooled funds, all investment activity would take place within our global thematic investment framework

What are the key features of the Newton discretionary service?

– Bespoke portfolios designed to meet specific objectives

– Direct access to allocated charity specialists

– Income planning

– Peer group and tailored benchmarks

– Adherence to asset allocation or ethical restrictions -

Meet the charities team

The charities team has an average of 33 years of investment experience with 21 years at Newton.

How to invest with Newton

Strategies by investment approach

-

Pooled fund investment service

Please complete the form below and send it, together with your initial investment, to the address enclosed.

Download application form -

Discretionary service

If you wish to find out more information about our discretionary service, please contact Sarah Dickson , Charity business development, on:

T: +44 (0) 20 7163 2224

E: sarah.dickson@newton-dev-01.aws.hmn.md

Your capital may be at risk.

The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.