What legacy will the dwindling use of coal leave for the energy industry and investors in renewables?

- Global demand for coal is falling as electricity producers seek cleaner alternatives, and the cost of renewable energy tumbles.

- While Covid-19 lockdowns are expected to have a negative immediate impact on the commissioning and construction of some renewable projects, the long-term forecast for renewables appears bright.

- Renewables can also offer investors diversification benefits and the prospect of stable income payments.

In June, the UK went two months without burning coal for energy – the longest period since the industrial revolution[1] in what some hailed as a major landmark in the move away from CO2-generating fossil fuels to more sustainable energy production.

The shift was partly owing to reduced electricity demand in the nationwide lockdown forced by the Covid-19 coronavirus pandemic. Yet, while a period of unusually sustained sunny weather also played its part, such a long phase of coal-free power generation also demonstrated the benefits of the investment the UK has made in renewable energy and other power sources over the last decade.

According to International Energy Agency (IEA) estimates, the height of the Covid-19 crisis reduced electricity demand by 20% or more in countries with full lockdown measures. In May it forecast global electricity demand was set to drop by 5% in 2020, the largest decline since the Great Depression of the 1930s.[2] The IEA added that renewable energy appears to have been the power source most resilient to Covid‑19 lockdown measures.

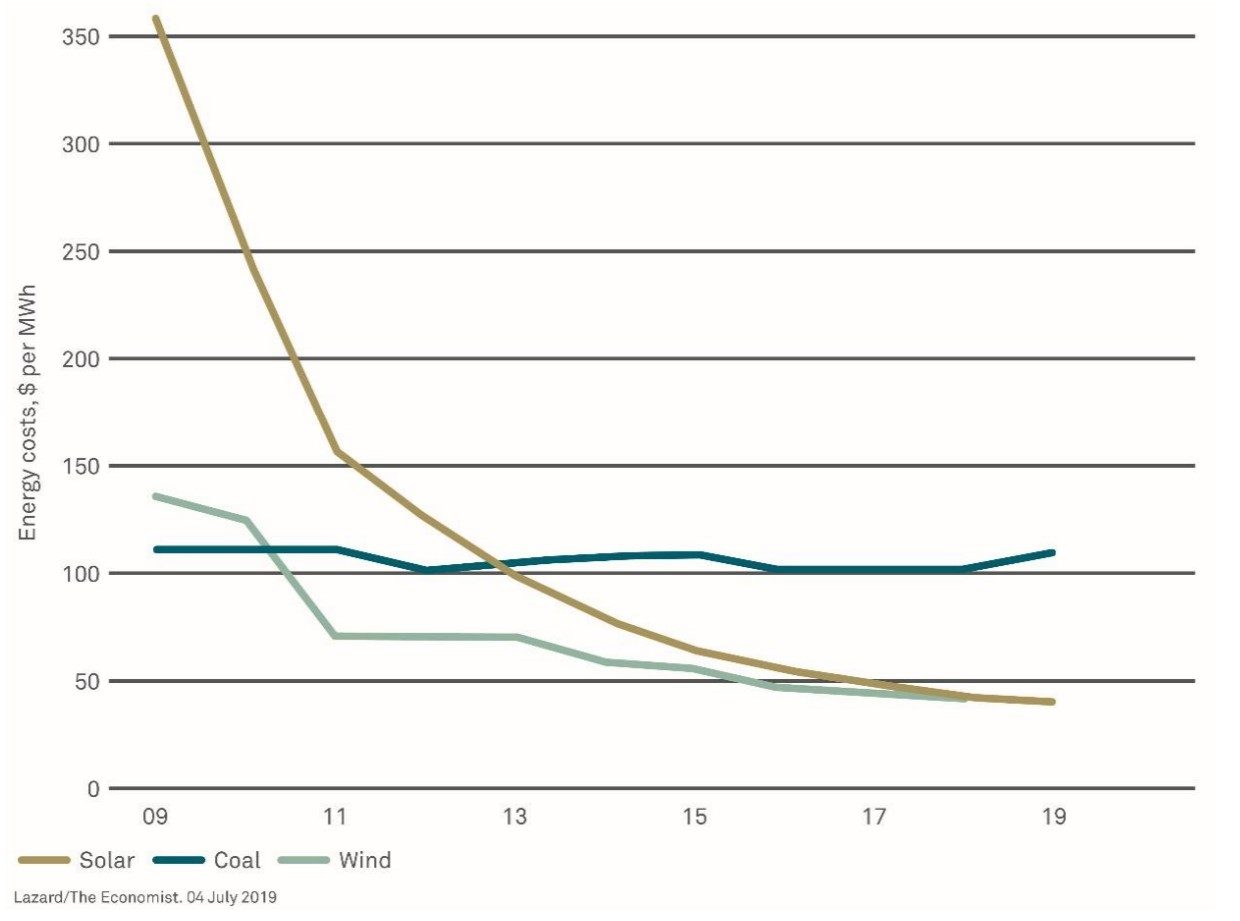

Against this backdrop, the future for coal-burning power generation in developed markets such as the UK looks increasingly bleak. In addition to the environmental costs associated with burning coal, the fossil fuel is now often more expensive than solar or wind power. Furthermore, since coal-generating power stations can be difficult to turn on and off, they can lack flexibility.

The UK is not alone in seeking to end coal-fired power generation. Other European countries are also seeking to do this, with Germany, whose grid is more reliant on coal than many other European countries, intending to phase out coal use. It seeks to end coal-fired generation by 2038 at the latest and has already agreed on a shutdown schedule for individual lignite power stations while providing compensation payments for operators.[3]

Elsewhere, continuing reform of the European Union Emissions Trading System, in moves designed to cut greenhouse-gas emissions by at least 40% by 2030, also poses a potential threat to carbon-intensive coal generation in Europe.[4]

A brighter future?

From a renewables standpoint, the recent pandemic, coupled with the slow death of coal, could deliver an unexpected bounty for more sustainable energy producers and their investors.

While Covid-19 lockdowns are expected to have a negative immediate impact on the commissioning and construction of some renewable projects – amid broader economic inertia – investors actually gave the green light to US$35bn worth of offshore wind projects worldwide in the first half of 2020, more than quadrupling the figure from the previous year in this area, and the long-term forecast for other renewables appears bright.[5]

About five million jobs are already associated with the solar and wind industries and the falling cost of new wind and solar projects over the last decade has also made capital investment far more productive – all of which is further bad news for coal and other fossil-fuel producers.

Energy costs US$ per MWh

At a wider economic level, the UK and many other major markets face potentially dire economic consequences from the coronavirus pandemic and are now looking to marshal recovery. In the UK, this looks set to be primed by government spending, some of which could be earmarked for renewable-energy projects. In June, the UK government sketched out plans for what it calls a £5bn ‘new deal’[6] aimed at building houses and renewing infrastructure which will include £3bn of energy-efficiency measures.[7]

While renewable energy remains a variable power source, dependent largely on the weather, we believe that continuing national energy-efficiency drives, the use of ‘smart’ technologies in metering and other areas of the grid all bode well for renewable-energy operators and investors in the sector. Over the last 15-20 years we have continually driven greater energy efficiency in our homes through means such as better insulation, LED lighting, smart electricity meters and improvements to the wider grid system. As the use of renewables increases we also expect to see the development of more sophisticated battery technologies. This should provide more flexible power storage that could allow electricity to be stored and brought back to the market as it is required.

Renewables, many of which benefit from steady government subsidies that can help to underpin the value of investments in the sector, can offer investors important diversification benefits. Furthermore, while the coronavirus crisis has resulted in many dividend cuts in wider equity markets, renewables have continued to pay stable dividends throughout this turbulent period. This can help to compound returns over the longer term, and is also particularly relevant in the context of the growing number of retirees who require a regular income from their investments.

[1] The Independent. Britain goes coal-free for two months – longest period since industrial revolution. 9 June 2020.

[2] IEA. Global energy demand to plunge this year as a result of the biggest shock since the Second World War. 30 April 2020.

[3] Clean energy wire. Spelling out the coal exit – Germany’s phase-out plan. 30 June 2020.

[4] European Council, Council of the European Union. EU Emissions Trading System reform: Council approves new rules for the period 2021 to 2030. 27 February 2018.

[5] Guardian. Offshore wind energy investment quadruples despite Covid-19 slump. 13 July 2020.

[6] BBC. Coronavirus: Johnson sets out ‘ambitious’ economic recovery plan. 30 June 2020.

[7] FT. UK government’s £3bn energy efficiency plan ‘not yet a green recovery’, 8 July, 2020.

These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors.

Comments