For many investors seeking to secure long-term capital growth via their equities allocation, a ‘fear of missing out’ (FOMO) on the very best market days can be quite a powerful emotion. As global equity markets rallied over 2017, and into the first month of 2018, investors continued to chase momentum, shrugging off strengthening market headwinds, such as high (and potentially unsustainable) debt levels, the impact of quantitative tightening after years of loose monetary policy, a rising rate environment and the potential damage from global trade wars. Perhaps, for some investors, the FOMO was too great, which might explain partly why markets remained supported for so long despite growing evidence that the market cycle was in its latter stages.

The return of volatility

A correction at the end of January has ushered in a period of relatively heightened volatility through 2018, as markets have come to focus more on some of these headwinds and attention has started to swing away from growth-orientated stocks, to ones with more defensive qualities, better able to operate through more challenging market-cycle conditions. In our view, while markets have regained some poise over recent weeks, further market falls are possible against the volatile backdrop. Is it best to keep chasing momentum and growth or to hunker down and invest in companies with more defensive qualities?

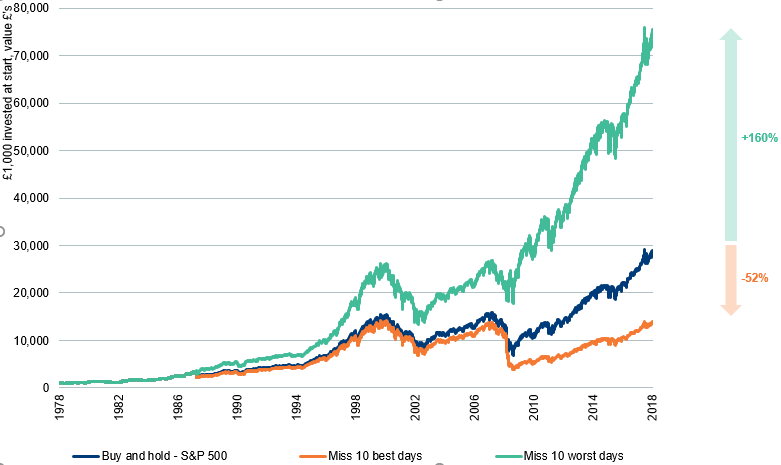

In attempting to answer this question, it is informative to look at 40 years of data from the S&P 500 index of US equities. The chart below shows how an initial investment of £1,000 in the S&P 500 on 25 July 1978 would have fared under different scenarios over the last four decades. To draw on a mountaineering analogy, many more climbers die on the way down from the summit than on the way up. Much of this could be down to the fact that a climber will use up the majority of his or her resources on the way up, and will be more tired physically and mentally on the descent when many of their supplies have been exhausted. Similarly, the asset inflation driven by loose central-bank monetary policy and the abundance of cheap debt has helped propel markets to historic highs in recent times, but as (in this case monetary and liquidity) resources are increasingly withdrawn, there is far less left in the tank to sustain and propel the markets’ upward trajectory.

The descent matters more than the summits…

Missing the 10 worst days most important: S&P 500 returns over 40 years

Source: Newton, Bloomberg S&P 500 returns 25/07/1978 – 15/08/2018

Asymmetry of return

The chart above shows quite clearly that there is an asymmetry between the effect of falling markets and rising markets on investors’ overall returns. Put simply, it has been far better for investors to miss out on the 10 worst market days over the last four decades, than to have missed out on the 10 best days. Those missing the 10 best days would be 52% worse off than if they had simply maintained a ‘buy and hold’ investment in the S&P 500, while those missing the 10 worst days of market falls would be 160% better off.

To us, using the mountaineering analogy again, the message seems clear: it is more important to acclimatise, prepare properly and manage resources prudently to boost your chances of surviving the descent. In the case of equity markets, we think one way to achieve this could be to invest in companies with strong balance sheets and visible, recurring cash flows that can be captured in the form of dividend income, to help augment returns when markets are volatile or on their way down.

This is a financial promotion. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

Comments