Prime Minister Kishida’s ‘three arrows’ of wage inflation, investment cycle and corporate governance reform are reshaping Japan.

I recently visited Japan. After my previous visit six months ago, I wrote a blog concluding that the long-term status quo in terms of inflation, the labour market, economic growth and Bank of Japan (BoJ) policy would remain in place[1]. This time, I returned much more optimistic that change is afoot after sensing a far more energised country. In this blog, I look at what has changed in Japan’s macro and geopolitical landscape over the intervening six months.

Key points

- Since the collapse of the property bubble in the early 1990s and the onset of deflationary forces which kept real-wage growth close to zero, Japan has been in a relative economic wilderness. Three decades later, we believe the prospects for positive real-wage growth are at their brightest for a generation.

- Geo-economically too, Japan is emerging from a profoundly challenging period in which the US, China and South Korea eroded the country’s economic advantage. We anticipate that Japan may enjoy strong geopolitical tailwinds in the years ahead with US support at its back.

- This could translate into an additional economic driver, helping GDP growth to exceed consensus by driving superior earnings and market returns in the years ahead. Consequently, our view is that investors should consider taking an overweight position in Japanese equities.

Introduction

After years of economic stagnation, Japan has witnessed a remarkable turnaround from deflation to moderate inflation. Below, we highlight the primary factors that have fuelled this resurgence: wage inflation, a new capital-expenditure (capex) cycle driven by supply-chain realignment, geopolitics, and the promising near-term prospects for improved consumer and business confidence.

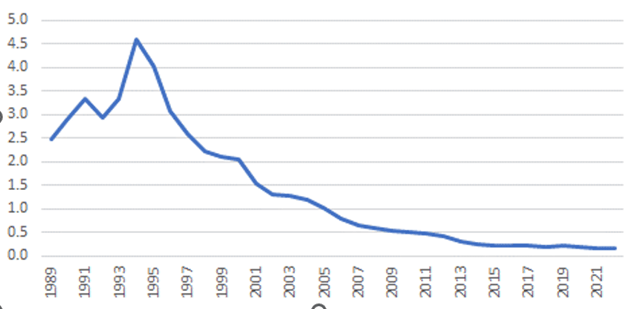

1 – Wage inflation

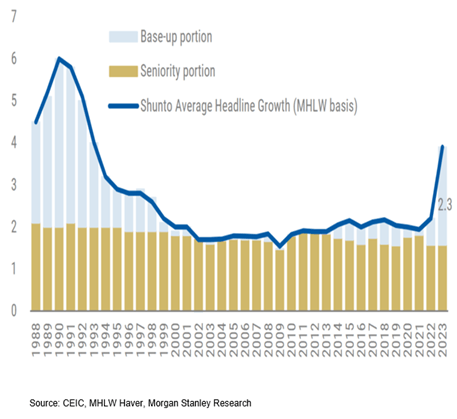

The rekindling of Japan’s economy is evident in the resurgence of wage inflation. For far too long, stagnant wages stifled domestic consumption, thus hindering overall economic growth. However, the tide is turning. Driven by labour shortages and fierce competition for skilled workers, companies are becoming compelled to offer higher wages and improved benefits. The ‘shunto’ wage negotiations between unions and major companies this spring resulted in an annual wage increase of +3.8%, the highest in over 30 years, with the important ‘base-up’ component, which excludes the seniority portion, reaching +2.3%.[2]

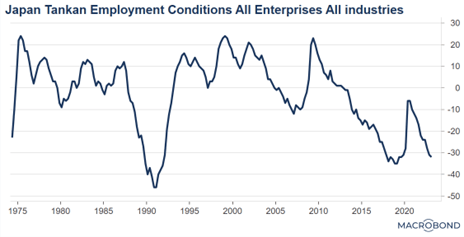

In addition, the quarterly Bank of Japan Tankan survey indicates how tight labour markets are for all companies – whether small, medium or large. Over the last decade, Japan has significantly increased its labour-force participation through previous Prime Minister Shinzo Abe’s ‘womenomics’ policies and by raising the retirement age; further increases in natural labour supply are therefore unlikely. According to former BoJ Deputy Governor Masazumi Wakatabe, who I recently met at a conference in Singapore, many companies are now expecting wage increases to persist for longer. This view is supported by the data from the latest Tanken survey of five-year corporate inflation expectations, which show a rise to 2%, from a long-term average of around 1%.

According to a group of domestic investors who I met in Tokyo, representing a US$600bn pension fund,[3] the priority for Japanese consumers in terms of incremental disposable income will be domestic services such as tourism. Therefore, many of the benefits of higher wages are likely to remain in the domestic economy, thus creating a positive transmission impact for the economy and benefiting domestic-focused companies.

Annual shunto wage agreement

Source: CEIC, MHLW Haver, Morgan Stanley Research, 5 April 2023

Meanwhile, employers are finding it increasingly difficult to find labour, as the chart below shows:

Source: Macrobond, Q1 2023

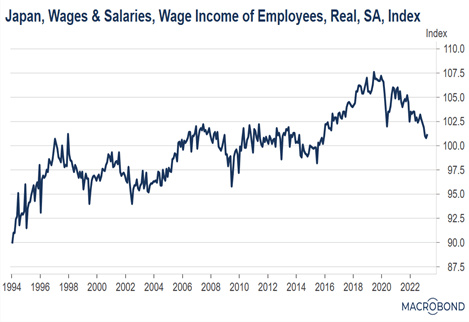

Real wages had started to accelerate on the eve of the Covid pandemic and now seem likely to rise again shortly as headline inflation pressures abate:

Source: Macrobond, March 2023

2 – Investment cycle

In our view, the role of great power competition and geopolitics will be instrumental in reshaping Japan’s economic fortunes. We believe this remains underappreciated by many investors, who tend to view Northeast Asia as a homogenous geopolitical risk zone. Japan is no longer a great power; the US spent much of the last 80 years dismantling Japan’s great power status and hegemonic economic aspirations, with painful consequences for Japan that manifested in an asset bubble, a subsequent burst, and a prolonged deflationary and macroeconomic malaise.

Today, the US’s geopolitical focus is set squarely on containing China, and Japan’s role in that endeavour is already proving significant. Japan is part of the Quadrilateral Security Dialogue (an Indo-Pacific defence alliance comprising the US, Australia, India and Japan), and also part of the newly formed Chips 4 alliance (with the US, South Korea and Taiwan). America’s newfound support for Japan’s industries as part of its containment efforts against China is providing a favourable environment for Japanese businesses. The strengthening of ties and increased support have opened doors to larger markets and enhanced global supply-chain integration. This alignment of geopolitical interests not only boosts investor confidence, but also sets the stage for sustained growth through a renewed capex cycle. Furthermore, the Japanese government’s plans to double defence spending as a share of GDP from 1% to 2% by 2027 should also boost the military-industrial complex and contribute to the capex cycle.

Capex cycle and supply-chain realignment

With a growing trend of reshoring and diversification away from China, Japanese companies are making substantial investments in domestic production while expanding operations on a global scale. This can already be seen in southern Japan where new semiconductor plants of companies including TSMC and Micron are under construction. This surge in capex bolsters economic growth and fortifies the nation’s competitive edge in critical sectors such as technology, robotics and renewable energy.

While geopolitics is one driver of Japan’s new investment cycle, it is by no means the only one. Japan’s ageing population, declining work force and rising nominal wages are also creating the conditions and incentives to increase capital spend, in order to augment the workforce, boost productivity and deliver services to the elderly. The third driver is the process of digitisation, an area in which Japan has been a laggard relative to many other countries in Asia. Japan is finally making concerted efforts to catch up following the Covid pandemic and via former Prime Minister Yoshihide Suga’s establishment of a digital agency.

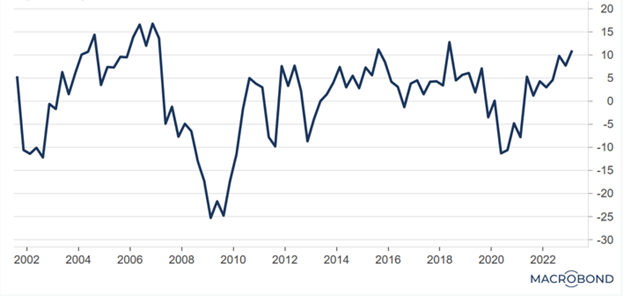

Japan’s capex cycle is picking up…

Japan capital investment (% change, year on year)

Source: Macrobond, Q1 2023

Defence spending is expected to double over the next five years from 1% to 2% of GDP, helping to address the widening gap with China:

Japan/China defence spending ratio at current prices and exchange rates

Source: SIPRI Military Expenditure Database (2023) and Newton Investment Management.

3 – Corporate governance reform

Corporate governance reform in Japan has been a significant focus in recent years, with a view to enhancing transparency, accountability and shareholder rights within the country’s business landscape. Traditionally, Japan’s corporate governance practices have been characterised by a strong emphasis on consensus-based decision-making and long-term relationships between companies and their stakeholders. However, in response to various challenges and global trends, Japan has embarked on a journey of reform to align its corporate governance standards with international best practices.

This includes the promotion of independent directors on corporate boards and enhanced shareholder voting rights through engagement. Moreover, there has been an emphasis on enhancing corporate disclosure and transparency. Companies are now required to provide more detailed and timely information to shareholders, ensuring better access to crucial data for informed decision-making, while the proportion of companies providing English reports has increased significantly.

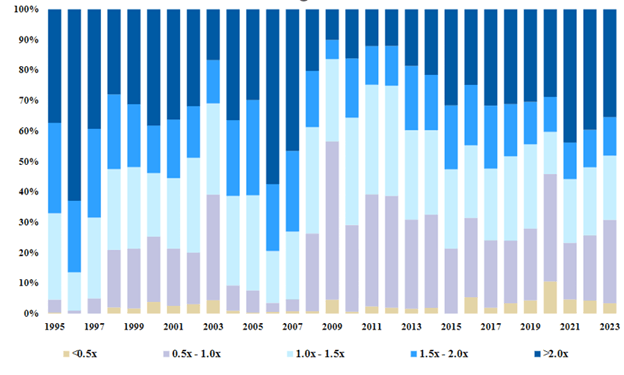

For shareholders, corporate governance reform entered a faster gear recently with the announcement by the Tokyo Stock Exchange that companies trading on less than 1x price-to-book value will be asked to disclose their policies for improving capital efficiency. Overall, these reforms seek to promote a more dynamic and globally competitive business environment in Japan. By improving corporate governance practices, the country aims to attract more foreign investment, foster innovation, and ensure sustainable long-term growth for its companies.

MSCI Japan constituents by price-to-book value have been improving over time…

Source: FactSet, RIMES, Morgan Stanley Research, 5 April 2023

Conclusion

The combination of accelerating wage growth, a strong capex cycle and improving corporate governance – Prime Minister Fumio Kishida’s ‘three arrows’ – means that Japan’s medium-term growth prospects seem likely to outpace the projected 1% mark. With wage inflation gaining momentum, Japanese households should experience improved purchasing power, leading to increased consumer spending and a boost to the overall economy.

Furthermore, the capex boom driven by supply-chain realignment and shifting geopolitics has not only bolstered domestic production but also positioned Japan as a global player in key industries, fostering innovation and technological advancement. The support from the US in terms of Japan’s containment efforts against China has provided a favourable geopolitical environment, attracting investment and creating opportunities for Japanese industries.

This alignment of interests and increased collaboration is enhancing business confidence, leading to further expansion and job creation. Looking ahead, Japan’s prospects for sustained growth are promising. The convergence of wage inflation, supply-chain realignment, geopolitical support, and improved consumer and business confidence establishes a solid foundation for the country’s economic expansion.

Investment implications

There are several investment implications that stem from this analysis of Japan’s economic renaissance. First, as the last dovish central bank (and the only one remaining with negative policy rates), the BoJ will need to become more hawkish over time. Despite incoming BoJ governor Kazuo Ueda announcing an 18-month-long review of policy, it is highly likely that the dysfunctional policy of yield-curve control – which pins the 10-year yield on Japanese government bonds between -50 and +50 basis points – will be abandoned in the near term, perhaps as soon as this summer.

In an inflationary Japan, we believe there is no merit in continuing this policy, which has resulted in enormous distortion of the Japanese government-bond market and sovereign-yield curve price signalling. The central bank’s negative interest-rate policy rate is also likely to be removed, although this may take a little longer. The global rates implications of a BoJ pivot should not be underestimated given that Japanese overseas portfolio investment of c.US$3.5 trillion makes Japan the largest single investor in several notable sovereign bond markets. Japan has between 5% and 10% ownership of the total outstanding stock of sovereign debt in Australia, New Zealand, Brazil, India, South Africa, Singapore and select eurozone countries.[4]

A gradual shift towards normalised (positive) policy rates could also prove beneficial for the Japanese yen, which remains the cheapest G10 currency, undervalued by around 20% on a real effective exchange-rate basis. We recommend that investors consider being long on yen exposure ahead of normalisation moves by the BoJ.

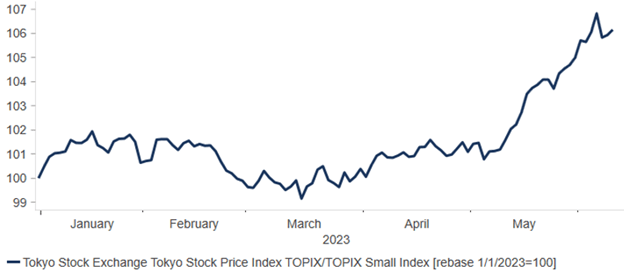

On the equities side, we recommend gaining exposure to domestic-focused companies that may benefit from the dual tailwinds of the domestic capex cycle (defence, industrials, semiconductors) and domestic consumer spending as real wage growth is restored. Although Japanese equities have enjoyed a strong run so far this year, large-cap indices have strongly outperformed small-cap, which may be owing to their nature as a macro proxy (beta play) along with the yen’s continuing weakness versus the US dollar. We believe small caps should now be better placed to benefit from an improving domestic economy, domestic consumer spending, a domestic capex cycle and a stronger yen.

Topix Index/Topix Small Index (rebased to 100 on 1 January 2023)

Source: Macrobond, 9 June 2023

[1] ‘Japan: can the sun rise again?’

[2] In Japan, people receive pay rises based on seniority, so with the working population ageing, there would automatically be wage inflation. It is therefore important to strip this component out to look at the underlying base effect.

[3] Sumitomo Mitsui Trust Asset Management, multi-asset team.

[4] Source: Bloomberg and Bank of Japan, 30th March 2023.

[Custom disclaimer] This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility due to differences in generally accepted accounting principles or from economic, political instability or less developed market practices. Richard Bullock is an employee of BNY Mellon Investment Management Singapore and provides support to Newton Investment Management as a geopolitical strategist.

Comments