Millennials working in the pensions industry will come across terms like retirement, drawdown and replacement rates daily, but, even then, it can still seem very abstract and far off. And if it’s abstract for those working in the industry, it’s even more ephemeral for young people who don’t come across these ideas on a regular basis.

One of our team – a millennial herself – was recently asked to give a presentation to a group of trustees who are facing the challenge of how to engage their younger members. To prepare, she sent a series of questions to her closest friends, asking how they felt about their pensions. Their replies were very interesting…

“I have 50k of student loan debt, and I pay almost half of my monthly income in rent… a pension is not my priority right now!”

Pensions are far from the most pressing financial issue for millennials, and the stats are bleak. On average, millennials graduate with £32k-£50k in student-loan debt, and 18-36-year-olds tend to be spending a third of their post-tax income on rent (which goes up to half if you live in London). If you have any money left over after all that (while maintaining your Instagram-worthy lifestyle of course!), a pension is still unlikely to be your first savings priority; it’s probably buying a house. This is no small task, with it now taking a person in their late twenties nineteen years to save for an average house deposit. In the 1980s, it took just three years.

We all seek to achieve these different financial goals in different ways. For example, someone may use a short-term savings account for more immediate requirements like a student loan or holidays, then a separate help-to-buy ISA for a house deposit (not forgetting their pension account too).

It’s at this point we start to think of a concept from behavioural finance: mental accounting. Mental accounting is a behavioural economics term which describes how we all have a tendency to separate money into different ‘pots’ in our heads, based purely on our own subjective criteria as to the source of money or how we intend to use it.

By separating all of these goals and the way we save for them, this is exactly what we all apply to our own personal finances. However, this behaviour is problematic, and can lead us to make irrational decisions. It explains why someone might keep a savings account for a holiday while running significant credit-card debt, or why high-end bike shops get very busy after bonus time in the City.

“Sorry, remind me what DC stands for again?”

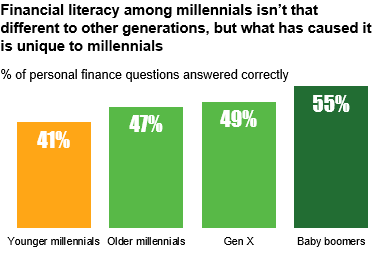

According to many surveys, while financial literacy among millennials is poor, it isn’t much better for their parents’ generation – a concerning fact when you consider that most millennials go to their parents for advice on their finances.

Source: The TIAA Institute-GFLEC Personal Finance Index (2018)

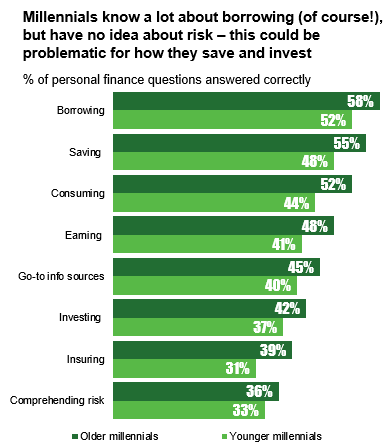

When you look at millennials’ areas of financial savvy and weakness, you can see they know a lot about borrowing (not surprising given they have to do so much of it), a more surprising amount about saving considering they do so little of it, but very little about the concept of risk.

Source: Source: The TIAA Institute-GFLEC Personal Finance Index (2018)

Misunderstanding risk is fatal when it comes to saving. Risk isn’t just about losing money; it’s also about not having enough when you come to retire, with not taking enough risk potentially making that a very real prospect. Owing to their long time horizon, most millennials have a fairly high risk tolerance when it comes to their pension. They have plenty of time to recoup any losses they may incur.

The majority of millennials who answered our questions had no idea about the risk of their pension portfolios, with those who had bothered to look saying they simply opted for the default owing to a mixture of apathy and feeling most comfortable with a ‘medium’ amount of risk.

The standard default pension scheme will be a balanced portfolio of 60% equities (higher return, but riskier) and 40% bonds (lower return, but safer). If you use the general rule of thumb that 120 minus your age is the amount you should have in equities, this is an inappropriate asset allocation for millennials, and could mean they are missing out on big returns. For example, for a millennial in their mid-20s, according to this rule, around 95% of their pension should be in equities, a long way off from the allocation in a standard default fund.

“I’ve had a permanent item on my to-do list to transfer my pension to my new company’s scheme, but it feels like a massive admin struggle.”

Enough said.

In a world where we can track current accounts, credit cards and ISAs via smartphone apps, it seems crazy that we can’t do the same for our pensions.

Life trajectories don’t necessarily follow the same traditional path they have in the past either. Millennials tend to work at one firm for a far shorter period than previous generations, and, knowing they are set to work for longer than their parents, many are taking career breaks to go back to education or to travel. This all makes for very difficult admin in the inflexible, non-transparent world of DC pensions.

Alexa, how do we get millennials to pay attention to their pensions?

If you put together a timeline of major global economic, social and cultural events since 1985 (when the first millennials were born), three key areas stand out:

- The technology boom, and the power it has brought us as consumers to access whatever information, product or service we like, when we like.

- The rise of environmental awareness from the discovery of the hole in the ozone layer in 1985 to the Extinction Rebellion protests this year.

- The financial crisis of 2007/2008, which severely damaged millennials’ trust of financial services.

We think the pensions world can use some of these millennial-shaping events to its advantage:

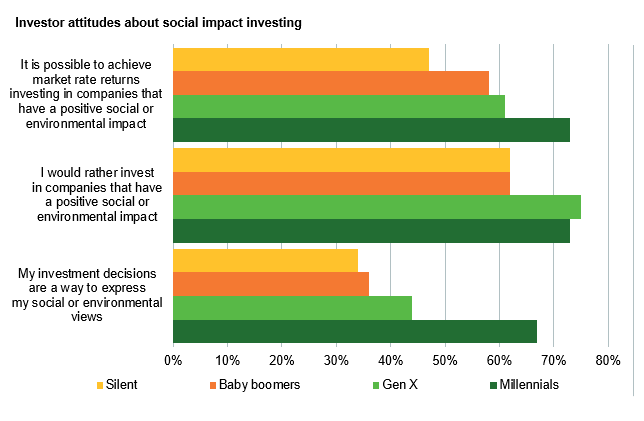

- Use different types of responsible investment to engage

It’s well known that the millennial generation is generally more socially and environmentally conscious than previous generations, and there’s also evidence that this is affecting how they choose to invest their money, as the chart below indicates. This tells us that environmental, social and governance (ESG) investment could be a great hook to get young people interested in the power of using their money to promote their own personal values.

Source: Bank of America Merrill Lynch, BNY Mellon

- Using technology to facilitate communication and education

The financial technology sector wipes the floor with its clunkier, slower and far less glamorous older brother the pensions industry when it comes to communications, content and transparency. However, it just doesn’t need to be this way! Many exciting and innovative companies are emerging and making pensions accessible, understandable, and perhaps even interesting. - Flexibility: new products that give access for key life events

Could a lifetime savings product that incorporates different goals and allows the individual to withdraw from it whenever needed be the answer? Maybe, but we also have to remember another key concept of investing: that each goal has a different time horizon and risk tolerance and therefore requires different asset classes. This muddies things somewhat, but one thing that seems fairly certain is that many people would benefit from simplicity in the way they save, and that this would encourage people to engage and save more. In fact, some research by BNY Mellon showed that 63% of millennials would save more if their pension account allowed multiple withdrawals throughout their lifetime.

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice

Comments