Key points

- We believe there is a significant sector dislocation in US utilities, potentially unlocking opportunity for active managers.

- Government incentives aimed at decarbonisation can provide tailwinds for renewables-exposed utilities.

- We believe electrification and investments in energy independence may continue to drive US electric and gas utilities.

Investing within the utilities space has long been a choice between the US or Europe, with varying positive and negative aspects to each locale depending on the current regulatory environment. In particular, government intervention has traditionally been a key concern for investors in European utilities. Historically, when energy prices spiked in Europe, governments and regulators protected the consumer by dampening heating and electrification prices. This consumer protection has come at the expense of utilities companies, hurting their bottom lines and making them less attractive from an investment perspective.

This is a text of the 2 column layout – this uses the default ‘pattern’ options within WordPress. This option is not used very often. This is a text of the 2 column layout – this uses the default ‘pattern’ options within WordPress. This option is not used very often. This is a text of the 2 column layout – this uses the default ‘pattern’ options within WordPress. This option is not used very often.

This is a text of the 2 column layout – this uses the default ‘pattern’ options within WordPress. This option is not used very often. This is a text of the 2 column layout – this uses the default ‘pattern’ options within WordPress. This option is not used very often.

European utilities have dominated since 2022

During the first few months of 2022, European energy prices began to surge after the start of the Russian/Ukrainian conflict raised concerns that Russia would turn off its natural gas supply to the rest of Europe. Investors largely assumed that governments and regulators would once again step in to cap prices for consumers and thereby reduce profits for utility companies. With this expectation, European utility companies largely underperformed during the first half of 2022.

At the time, our view toward European utilities was opportunistic. We found attractive valuations in the space, particularly relative to US utilities. Additionally, it was our belief that governments and regulators would again seek to help consumers but not to the extent they had previously. Instead, we thought that regulators would temper their impact on European utility companies as they recognised that utilities needed additional capital to allocate to renewables projects. These renewables programmes are key for many countries that fear overreliance on Russian energy and seek to enhance their own energy output.

Our belief in a more favourable-than-expected environment for European utilities was largely accurate. Governments were supportive of the utility sector and European utilities subsequently enjoyed a robust recovery.

Where are we now?

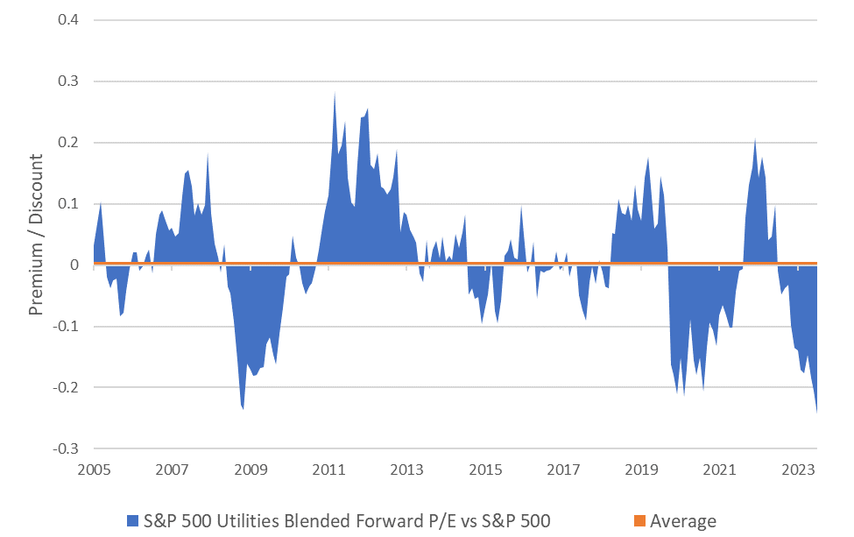

While European utility companies have produced robust returns, US utilities were one of the hardest-hit areas in 2023. As borrowing costs creeped higher, many US renewable projects became uneconomic and US utilities became quite volatile. We believe this has created a large dislocation between utilities and other sectors. As shown below, as of early February 2024, US utilities traded at their largest discount to the S&P 500® (blended forward price/earnings (P/E) ratio) in at least 19 years.

However, now new regulations in support of renewables projects have come into effect across almost all 50 states. Currently, there are 23 states in the US with 100% clean-energy goals, representing 53% of the US population.[1] Regulators understand that, in order to hit these ambitious targets, they need to help adjust the economics of utility companies, enabling continued investment in renewables projects. US utilities should continue to benefit as the incentives created by the Inflation Reduction Act accrue in the coming years, especially in areas such as wind and solar that can take years to develop from planning to completion. We believe US utility companies will not only benefit from the new renewables regulations, a critical area within the long-term decarbonisation theme, but also from the deglobalisation initiated after the Covid pandemic and rising geopolitical tensions as nations seek to better control their supply chains and sources of energy. We believe that the continuation of this US investment is crucial to ensure energy independence in an environment of growing electricity demand stemming from the energy transition.

Conclusion

Given the thematic tailwinds, government support and growing demand for electricity and renewables, we believe US utility companies are well positioned to create value. As US utilities experience attractive valuations, and as regulators begin to provide positive incentives for renewable projects, we believe that US utilities could see a rerating. In our view, the wind is blowing west, and US utilities should begin to see the fruits of the current regulatory environment.

[1] https://www.cesa.org/projects/100-clean-energy-collaborative/guide/table-of-100-clean-energy-states/

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. This article was written by members of the NIMNA investment team. ‘Newton’ and/or ‘Newton Investment Management’ is a corporate brand which refers to the following group of affiliated companies: Newton Investment Management Limited (NIM), Newton Investment Management North America LLC (NIMNA) and Newton Investment Management Japan Limited (NIMJ). NIMNA was established in 2021 and NIMJ was established in March 2023. MAR005901 Exp 03/29.