Bond investors can play a pivotal role in moving the planet to a lower-carbon way of life.

Key points

- The role of fixed income in funding the energy transition is becoming increasingly important.

- Fixed-income investors have a pivotal role to play in directing capital to projects that can help move the planet to a potentially more equitable, lower-carbon way of life.

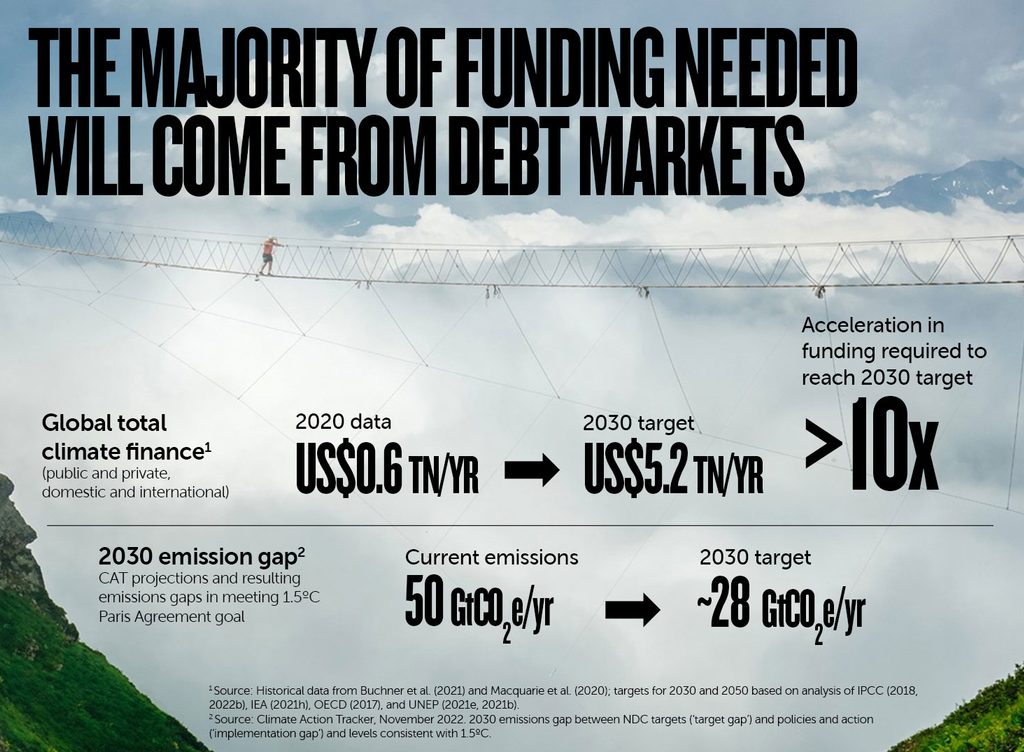

According to Climate Action Tracker,1 global finance flows related to addressing climate change need to reach a huge US$5.2 trillion per year by 2030, which is more than ten times the current level of spending. Climate Action Tracker is just one of many sources calling for a similar scale of spending through to 2050 to fund the transition.

A substantial emissions gap remains between current policies and required action, and we are not yet seeing the scale nor speed of implementation needed to close the gap and keep the possibility of limiting global warming to 1.5 degrees alive. However, even on the current trajectory, significant spending is set to occur, the majority of which will come from debt markets.

Credit quality is an important consideration because some of the spending will go into non-income generating assets, resulting in an increase in leverage. Companies may need to operate with lower leverage, given the headroom required to support higher costs, capital expenditure and a larger debt burden.

Whichever way you look at it, a huge amount of additional capital needs to be not only funded, but also refinanced over time, and global debt to gross domestic product is set to increase as a result. Over 2022, there has been a slowdown in the raising of finance for investment, a big part of which has been owing to higher inflation and interest-rate volatility. However, we believe it is cheaper to act now than to have to deal with the consequences of inaction later.

Fixed income already plays a major part in the re-engineering of the financial system, and the role it has to play in funding the transition is becoming increasingly important. It is not just about government action; the private sector is key to the mobilisation of mainstream capital, and it is reliant on credible frameworks and regulations being put in place.

There is a question of what yields will be required in order for the market to absorb the issuance, and also what happens when the private sector is at risk of being crowded out by growing sovereign bond issuance. Therefore, the degree of government support is important, specifically whether grants and guarantees are required.

The UN Environment Programme Emissions Gap report2 says a wide-ranging, large-scale, rapid and systemic transformation is needed, including from the world of finance, to make financial flows align with net zero.

Sustainable finance has been growing quickly

Major stimulus programmes are already in place, but they are just the beginning. Sustainable finance is still relatively small but has been growing quickly. There are now more ways in which fixed-income investors are better able to direct capital towards improving outcomes. Some are through labelled bonds, where proceeds are directed to specific projects or where a failure to meet certain targets results in the penalty of higher interest costs. But a growing appreciation of ESG (environmental, social and governance) analysis means standard (or ‘vanilla’) bonds, which make up by far the largest part of the bond market today, are an important tool too. The labelled bond market, although it has reached $1.7 trillion in size, only represents 2.5% of the global bond market.3

The threat of greenwashing

While investors need to be vigilant against the threat of greenwashing, demand for labelled bonds is likely to continue to grow. Fundamental analysis of ESG factors from a holistic perspective, rather than a single asset and project focus, can help investors to avoid greenwashing pitfalls.

New sector frameworks from non-governmental organisations, such as the Climate Bond Initiative, cover harder to abate sectors such as steel and cement (with emissions that are either prohibitively costly or impossible to reduce with currently available abatement technology), and are gaining greater adoption from market participants. Bringing in more transition areas, if done properly, means the planet should have more to gain from ‘brown turning greener’ than solely having a best-in-class focus.

Consider the ‘just transition’

It is important to consider the ‘just transition’; there are social consequences to funding with a climate focus, such as the change in the profile of skills demand from the workforce and the impact on communities. In our opinion, green targets should not be considered in isolation; economic development objectives are also important.

To deliver meaningful change, there will need to be greater accountability of all stakeholders, including governments, companies, investors and asset owners. We have seen the introduction of some environmental and other covenants into debt securities, resulting in a penalty for missing targets, for example in sustainability-linked bonds.

Some management teams we engage with admit that they have gone down the labelled bond route in order to benefit from the ‘halo effect’ and therefore enjoy a lower cost of funding. In our opinion, broader and more robust accountability measures are key and should ultimately mean less need for label-chasing, but more emphasis on the differences in the cost of capital between issuers.

We expect to see more stranded assets

A likely next step is the ‘internalising of externalities’, which is to say companies may in future have to pay a higher price for carbon emissions, a cost which society bears today. As regulations expand, we expect to see more stranded assets and risks to business models. Sectors increasingly viewed as ‘dirty’, or challenged, face higher risks, lower credit ratings and steeper yield curves. This has material implications for fixed-income returns as credit risk for these issuers will increase, also limiting the issuers’ access to capital at attractive interest rates.

Even though we do not get to vote, bondholders can engage, and have the ability to deny capital to issuers. Not only is the initial funding required, but the debt needs to be refinanced over time.

In conclusion, while the wider backdrop of monetary and fiscal policy remains important given the significant increase in debt requirements, we expect fixed-income investors to play a pivotal role in directing capital to projects that can help move the planet to a potentially more equitable, lower-carbon way of life.

Sources

1 State of Climate Action 2022, Climate Action Tracker https://climateactiontracker.org/publications/state-of-climate-action-2022/

2 UN Emissions Gap Report 2022, page XXII https://www.unep.org/resources/emissions-gap-report-2022

3 ICE BofA indices

This is a financial promotion. These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. This material is for professional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that holdings and positioning are subject to change without notice. Newton manages a variety of investment strategies. How ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. ESG considerations do not form part of the research process for Newton's small cap and multi-asset solutions strategies.

Comments