A toolkit for the modern investor

-

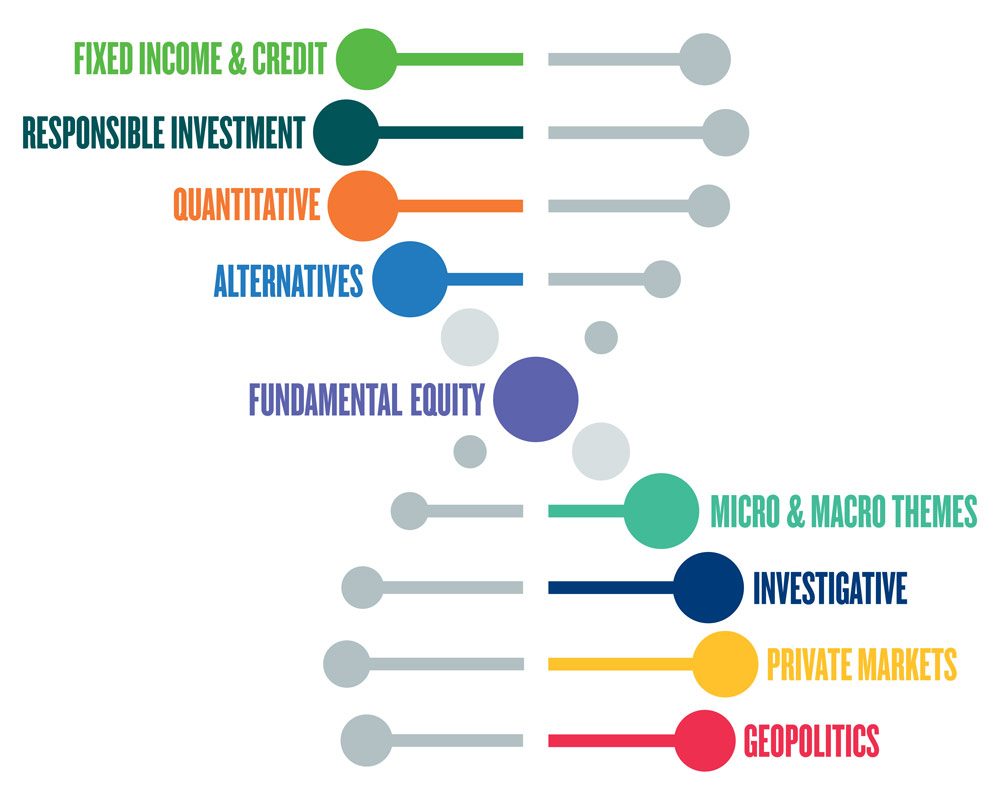

Our multidimensional research capabilities are a key component of this approach.

Our global research team’s work not only consists of fundamental, in-house analysis, but draws valuable insights from thematic, quantitative, investigative, geopolitical, credit, responsible investment and private-market research. -

Fundamental equity

At Newton, we take an active approach to the allocation of our research resources. Deep fundamental research is at the heart of our multidimensional research capabilities.

Fixed income and credit

Dedicated fixed-income and credit research analysts cover sovereign, investment-grade and high-yield markets, working closely with our equity and multi-asset analysts to thoroughly research companies across capital and governance structures.

Responsible investment

Our investment team has access to technology-based tools that map an issuer’s ESG-related approach and performance, and is also supported by our well-resourced, global responsible investment team.*

Quantitative

We believe that our quantitative tools help our team better focus their efforts by identifying companies that resonate most strongly with observable thematic trends, uncovering the idiosyncratic nature of a company, or grouping businesses that have common characteristics.

Alternatives

Certain alternative investments, including infrastructure, renewable energy and music royalties, can be less sensitive to the economic cycle, offering diversification benefits and the prospect of stable returns. However, careful analysis remains essential, and our specialists undertake detailed research in order to obtain a deep understanding of the business models involved.

Micro and macro themes

Themes provide our investment team with a long-range lens through which to view the structural changes that are taking place across the globe and to look beyond often-superficial classifications like sectors or countries of domicile. Themes can alert the members of our investment team to the new opportunities that change creates and help identify the emerging risks that will impair the value of investments. Find out more about our thematic research framework.

Investigative

Our team of skilled investigative researchers (comprising former investigative journalists) can equip our portfolio managers with differentiated views on key issues affecting investments that they consider. From talking to energy ministers to lawyers to peer journalists and academics, our investigative research team is a highly differentiated resource that can help give our investors a clearer picture on an investment case.

Private markets

Companies are staying private for longer, which can make it difficult for public equity investors to fully understand the risk of disruption from private businesses. Our private-markets team allows our investors to peek into the private realm and provide insights that can enhance our investors’ understanding of the risks and opportunities in relation to their public holdings.

Geopolitics

Our geopolitical research helps our investors understand how politics and changing international relations are influencing financial markets. It also provides a valuable input into our ‘macro’ themes.

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

These opinions should not be construed as investment or other advice and are subject to change. This material is for information purposes only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those countries or sectors. Please note that holdings and positioning are subject to change without notice.

* Newton manages a variety of investment strategies. How ESG analysis is integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. Newton does not currently view certain types of investments as presenting ESG risks and opportunities and believes it is not practicable to evaluate such risks and opportunities for certain other investments. Where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.