Strategy profile

-

Objective

-

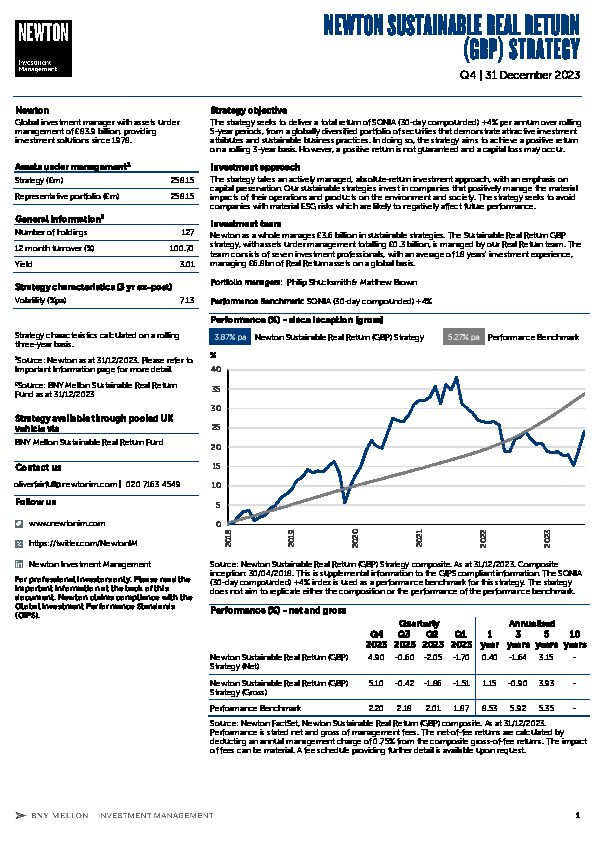

The strategy seeks to deliver a total return of SONIA (30-day compounded) +4% per annum over rolling 5-year periods, from a globally diversified portfolio of securities that demonstrate attractive investment attributes and sustainable business practices. In doing so, the strategy aims to achieve a positive return on a rolling 3-year basis. However, a positive return is not guaranteed and a capital loss may occur.

-

Performance benchmark

- SONIA (30-day compounded) +4%*

-

Volatility

-

Expected to be between that of bonds and equities over the long term

-

Red lines

- Our ‘red lines’ are built on a combination of exclusions that effectively avoid investments in security issuers involved in or that generate a material proportion of revenues from areas of activity that we deem to be harmful from a social and/or environmental perspective. Read more about our red lines.

-

Strategy inception

-

Composite inception: 1 May 2018

-

Strategy available through pooled UK vehicle

-

BNY Mellon Sustainable Real Return Fund

View fund performance

View Key Investor Information Document

View prospectus -

- * Please note that on 1 October 2021, the performance benchmark for this strategy changed from 1-month GBP LIBOR +4% to SONIA (30-day compounded) +4%.

Investment team

-

- Our Sustainable Real Return strategy is managed by an experienced team with a wide range of backgrounds. In-house research analysts are at the core of our investment process, and our multidimensional research platform spans fundamental, thematic, ESG, quantitative, geopolitical, investigative and private-market research to promote better-informed investment decisions.

Want to find out more?

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

Newton will make investment decisions that are not based solely on ESG. Other attributes of an investment may outweigh ESG analysis when making investment decisions. The way that ESG and sustainability is assessed and the assessment of their suitability for Newton’s sustainable strategies may vary depending on the asset class and strategy involved. For Newton’s sustainable strategies, ESG analysis is performed prior to investment for corporate investments (single name equity and fixed-income securities). The analysis will then also follow the Newton sustainable investment process to ensure it fits with the wider Newton sustainable investment philosophy.