At Newton Investment Management Ltd, we consider our process for assessing the sustainability of sovereign bonds to be a key differentiator, both in terms of the length of time we have been incorporating it into our investment process (over a decade), and the way in which we compile our sovereign sustainability matrix, which is an integral part of the investment process for our fixed income, multi-asset and sustainable strategies.

A Single, Rigorous Process

We apply the same process to both developed and emerging-market sovereigns. Our expectation is that social and governance aspects will be more robust in the developed world where the social contract is stronger, and we therefore conduct our analysis using an emerging-market lens to ensure the necessary level of rigor.

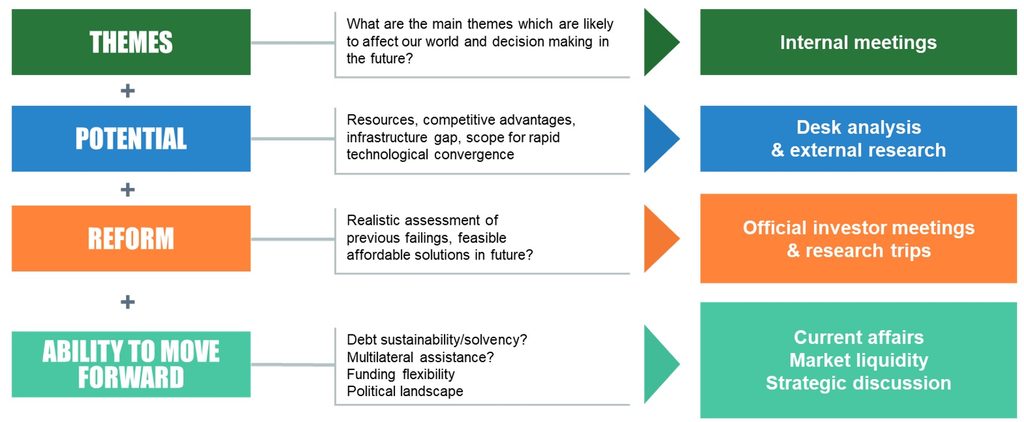

Our standard emerging-market fixed-income process has been in place since the launch of the Global Dynamic Bond strategy in 2006:

Emerging-Market Sovereign Process

Source: Newton, January 2023.

Our view is that emerging markets are usually emerging from some previous maladministration or geopolitical issue and have reached a level of market sophistication. Our stated aim is not to be a ‘best-in-class’ investor, but to identify those countries which are more likely to be embarking on the journey towards developed status. Our expectation is that improvements beget further improvements and that virtuous cycles can be created. The opposite also holds true in that deteriorations can cause a downward spiral and create vicious circles. Our emerging-market process is designed to provide the framework to consider these aspects.

We would acknowledge that sovereign sustainable investment has lagged analysis of corporate issuers for various practical reasons including differing expectations of the accountability of the issuer – while a company is accountable to its shareholders, a government is at best answerable to its voter base and at worst to itself alone – as well as the more siloed nature of government departments.

Comparing Our Matrix to a Benchmark

This accounts for the fact that, until recently, no index existed to compare our own matrix to a benchmark standard. The J.P. Morgan ESG EMBI Global Diversified Index (JESG EMBIG) has, however, emerged as a leading contender for an acceptable emerging-market sovereign ESG (environmental, social and governance) index. It is worth noting that the index is in its infancy, and processes may change as several weaknesses in the methodology have become apparent. In a joint paper published in 2021 by J.P. Morgan and the World Bank, one of the main concerns cited was an ingrained income bias.1 The report stated that average ESG scores across seven leading ESG providers were highly correlated with gross national income per capita scores. This may have the unintended consequence of creating a ‘low-income trap’ by which countries with the most pressing infrastructure requirements are excluded from accessing the sovereign debt market and therefore have scant hope of developing their own domestic financial markets. To this end, in our own proprietary matrix, we have allowed sovereigns that are poorly rated but improving on an ESG basis to be deemed investible, subject to a veto by our responsible investment team.

We consider our sovereign sustainability matrix to be an extension of our emerging-market investment process, as we have been incorporating many of the ESG inputs as a cornerstone of our analysis since 2009 when a member of the team incorporated this research into an academic paper.

Core Versus Sustainable Strategies

The main differences between the emerging-market sovereign component of our core and sustainable fixed income and multi-asset strategies can be attributed to the factor of time.2 Specific market conditions may be favorable for a sovereign which may not necessarily fit our sustainable criteria over a given period of time. These conditions could include a competitive advantage, a commodity abundance or a superior debt-coverage ratio. This may lead to an opportunity for investment in our core strategies, although inevitably there will be a trade-off versus the inherent underlying risks, which may include poorer transparency and governance, hence their exclusion from our sustainable strategies.

Flexibility in the Process

In our sovereign sustainability process, we attribute a greater weight to measures such as voice and accountability, and we incorporate freedom-of-press measures. It is clear that over the longer term, the most effective way a citizen can change their circumstances and the maladministration of government is through a democratic process. While there is a certain stability or continuity afforded to non-democratic forms of government, a transition of power is usually volatile, carries uncertainty and can be violent. Our ability to exercise a degree of judgement is reflected in some anomalies in the JESG EMBIG whereby, somewhat counterintuitively, certain issuers such as Belarus have a larger weighting in the ESG index than they do in the non-ESG emerging-market counterpart.

In summary, our sustainable sovereign matrix embeds a level of flexibility and judgement to take account not just of a sovereign’s existing standing, but also its direction of travel. We believe that, coupled with the expertise of our responsible investment team, the rigor of our fixed-income process, designed by our emerging-market bond specialists, provides us with a real differentiator versus our peers, and is further evidence of the robustness of our sustainable fixed-income approach.

Sources:

1 Gratcheva et al (2021) “A New Dawn – Rethinking Sovereign ESG”, JP Morgan and World Bank (https://openknowledge.worldbank.org/handle/10986/35753), June 7, 2021.

2 Where material and relevant information exists. Analysis may vary depending on the type of security, investment rationale and investment strategy. Newton does not currently view certain types of investments as presenting ESG risks, opportunities and/or issues, and believes it is not practicable to evaluate such risks, opportunities and/or issues for certain other investments. In addition, Newton will make investment decisions that are not based solely on ESG considerations. Newton may conclude that other attributes of an investment outweigh ESG considerations when making investment decisions.

Important Information

For Institutional Clients Only. Issued by Newton Investment Management North America LLC. Newton Investment Management North America LLC (“NIMNA” or the “Firm”) is a registered investment adviser with the US Securities and Exchange Commission (“SEC”) and subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). The Firm was established in 2021, comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management”. Newton currently includes NIMNA and Newton Investment Management Ltd (“NIM”) and Newton Investment Management Japan Limited (“NIMJ”).

This document is provided for general information only and should not be construed as investment advice or a recommendation. You should consult with your advisor to determine whether any particular investment strategy is appropriate. Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements.

Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed.

Newton manages a variety of investment strategies. How ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. ESG considerations do not form part of the research process for Newton's small cap and multi-asset solutions strategies.

In Canada, NIMNA is availing itself of the International Adviser Exemption (IAE) in the following Provinces: Alberta, British Columbia, Manitoba and Ontario and the foreign commodity trading advisor exemption in Ontario. The IAE is in compliance with National Instrument 31-103, Registration Requirements, Exemptions and Ongoing Registrant Obligations.