As 2018 came to a close, the World Bank highlighted 14 key charts that capture the global challenges that we face.[1] These challenges affect the economic context, as well as trends that shape investments across the globe. At Newton, we have reviewed which of these charts are especially pertinent to investors.

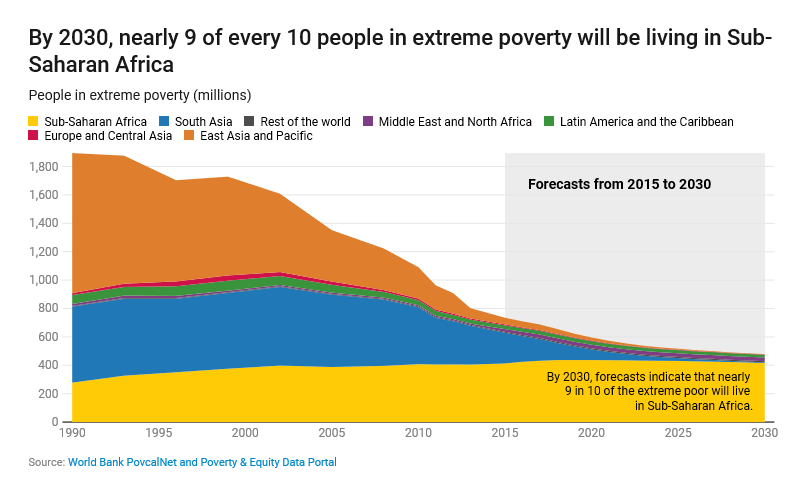

Extreme Poverty Is Concentrated in Sub-Saharan Africa

Contrary to the global trend, extreme poverty is increasing in Sub-Saharan Africa – there are more people in extreme poverty here than the rest of the world combined, with average poverty rates at 41%, which is well above the global average of 13%. The UN Sustainable Development Goals (SGDs) aim to alleviate global poverty by 2030, and these statistics make it clear that significant progress is required in Sub-Saharan Africa in order to reach this goal. As such, initiatives that positively affect this region are likely to have a greater impact on addressing poverty and achieving the SDGs.

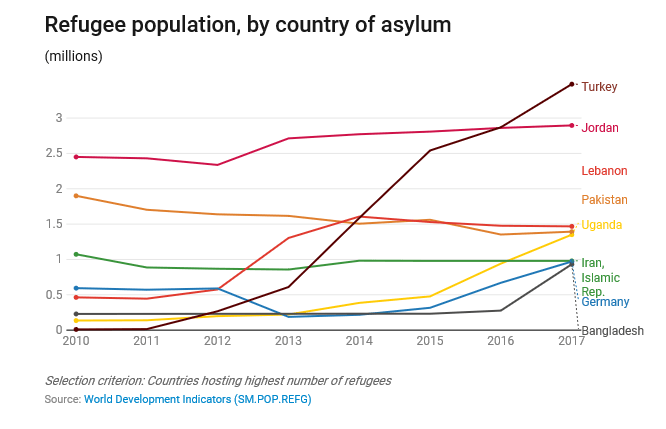

68.5 Million People Have Been Forcibly Displaced

Over 25 million refugees globally are living abroad, with 85% of these in developing countries, as of 2017. As a result of the influx of people, many countries are experiencing strains on their resources, as well as political tensions, both of which are affecting economic conditions and trade. An extreme example is Lebanon, where one in every four members of its population is a Syrian refugee, meaning that it hosts the largest number of refugees per capita in the world.

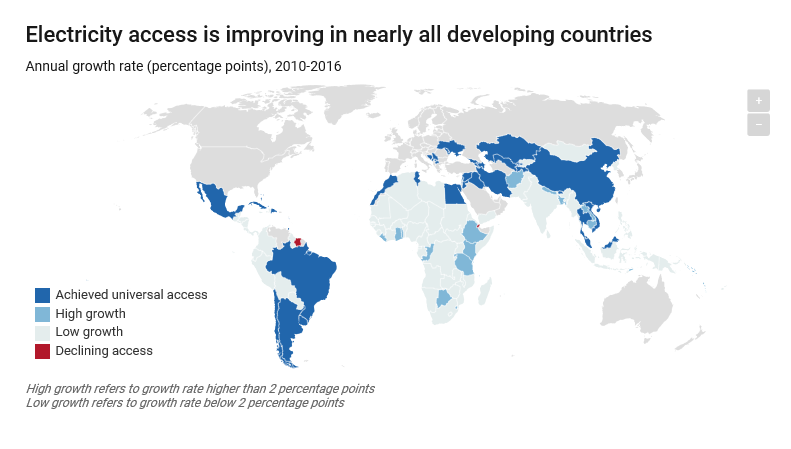

One Billion People Live Without Electricity

These one billion people make up roughly 13% of the world’s population, and are concentrated in Central and South Asia and Sub-Saharan Africa.[3] Inaccessibility to electricity disproportionally affects those in rural areas, with 87% of those without electricity living rurally. However, much like the reduction in global poverty, significant gains have been made in access to electricity. Since 2010, 40 countries have achieved universal access to electricity. Most notably, between 2010 and 2016, India consistently provided access to electricity to 30 million more people each year.

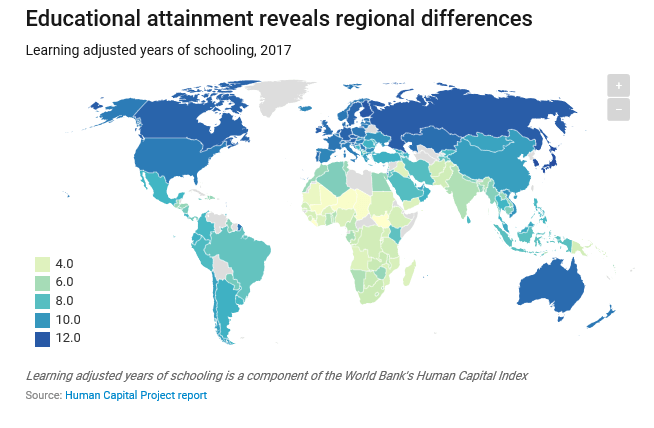

Regional Inequality in Education Remains High

In 2017, the World Bank mapped out the ‘learning-adjusted years of schooling’ across countries globally, showing extreme regional differences. For example, in Finland this value exceeds 12 years, whereas in South Sudan it stands at just over two years, while it is estimated that in lower-income countries, 260 million children and youths are not in school at all. Political instability, violence and poorer health are thought to exacerbate these regional differences. However, as demand for advanced skills increases as some roles are replaced by technology, the importance of education is likely to become even more significant.

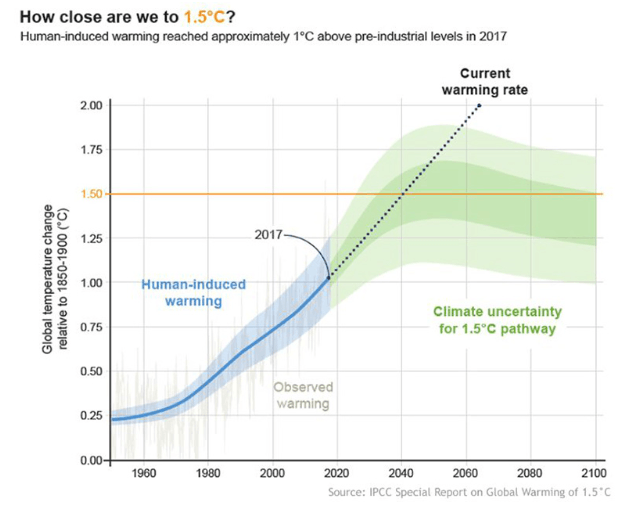

Climate Change May Worsen Both Poverty and Migration

In 2018, the Inter-Governmental Panel on Climate Change published a hard-hitting report, stating that global warming must be kept to just 1.5oC (2.7oF), but that the planet has already warmed by 1oC (1.8oF) since pre-industrial levels. This has prompted a heightened sense of urgency in the need to address climate change. Research by the World Bank suggests that climate change could have a vast impact on both poverty and migration – pushing an additional 100 million people into extreme poverty, and causing 140 million people in Sub-Saharan Africa, South Asia and Latin America to relocate. At Newton, climate change is a key area of focus for our responsible investment team – this has been an engagement priority for some time now, and is likely to remain so for the foreseeable future. In line with this, we have released a Task Force on Climate-related Financial Disclosures (TCFD) report, outlining how we consider climate risks and opportunities that affect our business, as well as our clients’ investments.

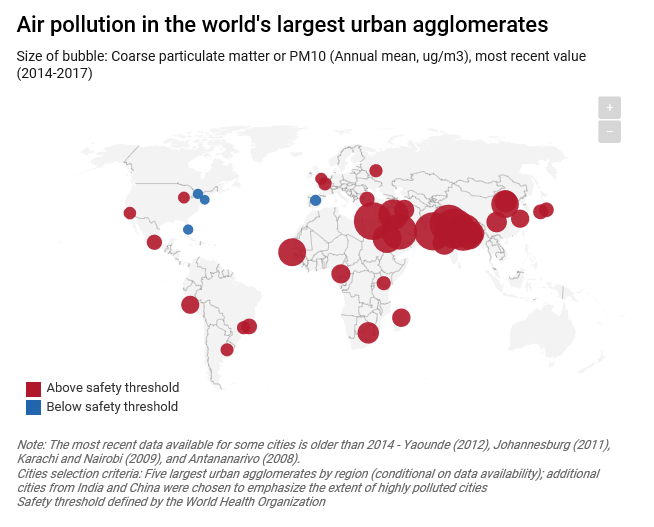

91% of the World’s Population Breathes Polluted Air

Air pollution is causing increasing concern owing to the associated health risks. As air quality declines, the risk of strokes, heart disease and lung cancer increases.[4] It is estimated that seven million deaths a year occur because of air pollution, disproportionately affecting those in low and middle-income countries. However, poor air pollution also poses a health risk in London, where pollution levels exceed the World Health Organization safety threshold.

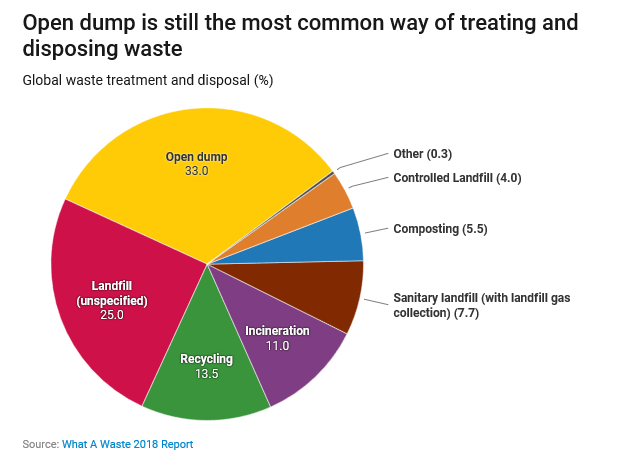

Over a Third of Waste Is Dumped or Burned[5]

TV documentaries such as the British series ‘Blue Planet II’ have been critical for drawing attention to the devastation that plastic waste in particular is causing to our oceans and wildlife. The effect on consumers in the UK has been demonstrated by the mass-rejection of disposable plastic straws and coffee cups. We have also seen the European Union pledge to ban the ten most common single-use plastics appearing in European seas and beaches, which will force companies to address the issue or face regulatory action, in addition to the increased public scrutiny that can already be witnessed.[6] However, we must not assume that this is representative of global attitudes to waste. As the World Bank states, “Adequate waste treatment and disposal is almost exclusively the domain of high and upper-middle-income countries. In low-income countries, 93 percent of waste is burned or dumped in roads, open land, or waterways, compared with only 2 percent of waste in high-income countries.”

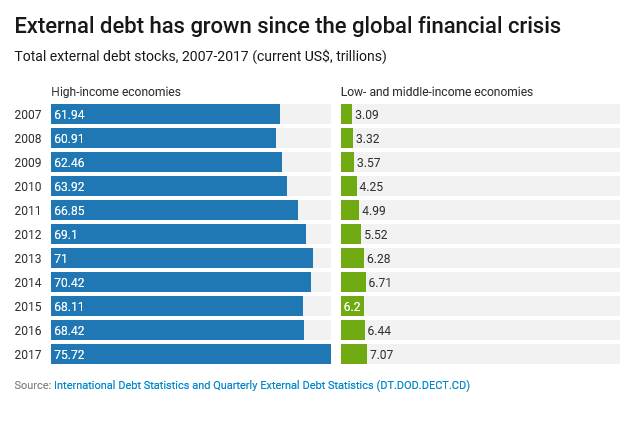

Low and Middle-Income Borrowing Has Soared

According to International Debt Statistics, borrowing by low and middle-income economies tripled between 2016 and 2017, and levels now stand at over $600 million.[7] Eleven low and middle-income countries also have higher debt levels than gross national income. Overall, this increase in debt, particularly in relation to income, is leading to concerns relating to financial instability and vulnerability.

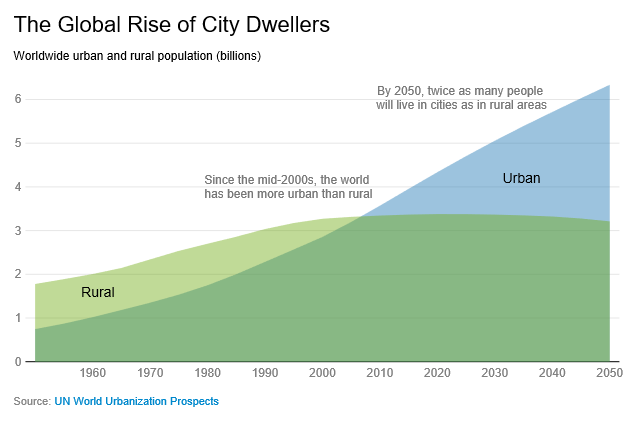

55% of the World’s Population Lives in a City

In 1960, just one third of the population lived in a city, but by 2050 it is expected that two-thirds of the population will, representing a significant shift in the movement of the world’s population. This trend is likely to be even more pronounced in developing countries. In particular, India, China and Nigeria are expected to account for over a third of the global, urban population growth between 2018 and 2050. This urbanization trend is likely to drive the demand for infrastructure, housing and services, and have significant influence on our societies.

[1] https://www.worldbank.org/en/news/feature/2018/12/21/year-in-review-2018-in-14-charts

[2] https://www.worldbank.org/en/news/feature/2018/12/21/year-in-review-2018-in-14-charts

[3] https://trackingsdg7.esmap.org/mwg-internal/de5fs23hu73ds/progress?id=VqcRW0L4CVs2JelL_NZKgWPDHaA0RrdTJ17Gl5q9zQY,

[4] https://www.who.int/airpollution/data/cities/en/

[5] https://openknowledge.worldbank.org/mwg-internal/de5fs23hu73ds/progress?id=Xb_ULVyRABwnqPf6NY8qCD9plNvqFI_naeyqqoZMptc,

[6] https://ec.europa.eu/commission/news/single-use-plastics-2018-may-28_en

[7] http://www.worldbank.org/en/news/press-release/2018/11/13/borrowing-by-low-and-middle-income-economies-more-than-tripled-in-2017-world-bank-international-debt-statistics-show

Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.