Coronavirus-induced volatility continues to plague markets, but are there some tentative early signs of recovery?

The initial reaction of global equity markets to the news of an outbreak of a novel strain of coronavirus in Wuhan, China in January was one of ‘so what’, with the majority of global equity indices continuing to push higher on the view that the outbreak’s spread could perhaps be contained within the region.

Over the last few days, with confirmation of the arrival of the coronavirus in Europe and the US, optimism that the virus could be contained has melted away in much the same way as the global equity market over the last two weeks; the S&P 500 has suffered the fastest 10% fall since the height of the global financial crisis in 2008. Selling across the board has been indiscriminate among equities, with even the most defensive sectors posting a negative return.

At the same time, we have seen a resurgence of volatility in financial markets as the threat posed by the coronavirus outbreak has taken hold. Much of the market’s nervousness has focused on the uncertainty around the economic impact, with even the most conservative forecasts expecting as much as a 3-4% hit to Chinese GDP and a 0.3% GDP impact at a global level. Big unknowns remain the likely duration of the epidemic and the speed with which it could spread. However, it seems certain that it represents a simultaneous demand and supply shock, with demand for key services being hit owing to difficulties in sourcing components as production plants remain closed. A glance at the VIX Volatility Index below shows how the latest spike in volatility stacks up against recent scares such as China’s currency devaluation, and 2018’s global growth slowdown scare.

Source: Bloomberg, March 3 2020

Much of the commentary around the market decline has referred extensively to the coronavirus and its impact on the economic outlook. Investors initially rushed to liquidate positions in gold, and inflation expectations fell faster than rates.

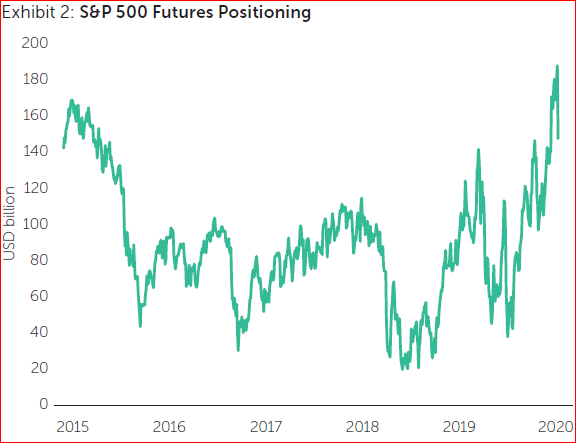

While economic activity will certainly be impaired as a result of the coronavirus, it was not the only factor at play as the chart below showing US futures on the S&P 500 Index indicates. Prior to the sell-off, asset managers’ exposure to the S&P 500 through futures was close to $190bn of notional exposure – the largest on record.

Source: Bloomberg, March 3 2020

Market risk was already elevated, leaving the market vulnerable to a shift in sentiment. Sentiment has turned more negative as the virus reached Western economies. Elevated positioning is likely to have exacerbated the severity of the declines and the disorderly nature of equity-market moves.

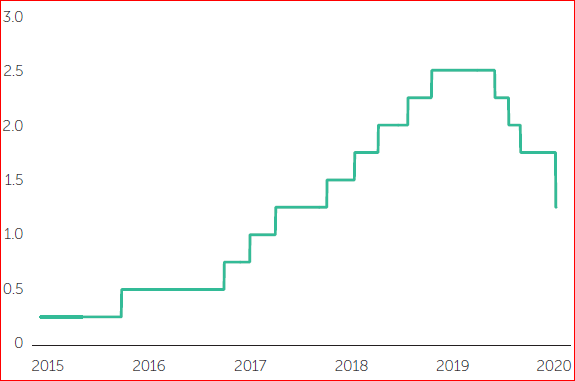

As mentioned above, the severity of the decline in equity markets prompted a further response from policymakers, with the US Federal Reserve (Fed) administering a 0.5% rate cut on March 3 (see the chart below).

US Federal Reserve Federal Funds Rate (%) March 2015 – March 2020

Source: Bloomberg, March 3 2020

While we don’t believe rate cuts can act as a ‘cure’ to the financial shock of coronavirus, or offset its impact on economic activity, the Fed and other central banks are clearly trying to lower financing costs for markets and economies. Should the economic slowdown not become a credit event, markets and economies face the prospect of a highly accommodative monetary policy and fiscal easing if/when the impact of the coronavirus begins to fade.

China Pickup?

In China, the epicenter of the coronavirus outbreak, there are already signs that things are beginning to normalize. Companies we speak to have reported that things are returning to normal faster than expected. Likewise, other data points suggest that, while still subdued, life is slowly returning to normal for the Chinese economy.

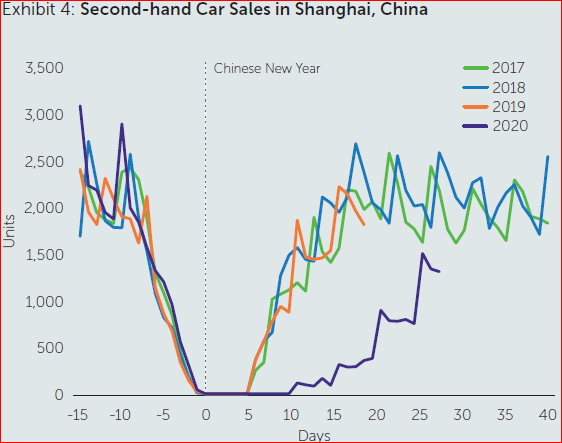

As the spread of the coronavirus renders efforts at containment redundant, we are likely to see fewer restrictions on economic activity. Indeed, two useful barometers of economic activity in China, second-hand car sales and coal consumption, are showing early signs of catching back up with long-term trends.

Traffic volumes and second-hand car sales both registered a rebound last week as activities broadly start to accelerate in China after evidence that virus infections were largely under a measure of control. The chart below shows sales of second-hand cars in Shanghai picking up rapidly after Chinese New Year, after an initial sharp lag.

Source: Exane BP Paribas, March 5 2020

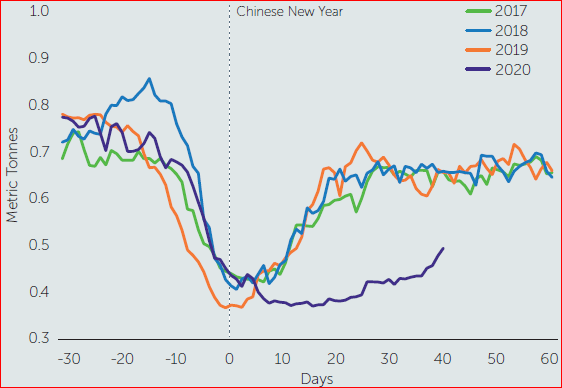

Coal consumption has also continued to ramp up after noticeably lagging the post-Chinese New Year pickup of the previous three years. Chinese authorities had shut down energy plants as part of their widespread coronavirus containment strategy, but coal burned at six large utilities on March 4 registered 0.46 metric tons (mt), versus 0.45mt on March 3, and a peak of 0.43mt in the previous week. Therefore, we would anticipate that next month’s purchasing managers’ index data from China should show some signs of improvement (see chart below).

Daily Coal Consumption at Six Largest Chinese Power-Generation Groups

Source: Exane BP Paribas March 5 2020

One caveat worth noting is that the number of virus cases outside Hubei province has risen, potentially owing to a relaxing of travel restrictions; this may still keep the Chinese government nervous. However, in our view, this is unlikely to delay China’s push to get the economy back on track.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice. Compared to more established economies, the value of investments in emerging markets may be subject to greater volatility, owing to differences in generally accepted accounting principles or from economic, political instability or less developed market practices.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.