Over the last three years, global equity markets have broadly continued their upward trajectory, regardless of the growing macroeconomic and political headwinds. This ability to shrug off (or simply ignore) the potential obstacles has meant that, up until recently, equity markets as a whole have continued to do well against a backdrop of low volatility.

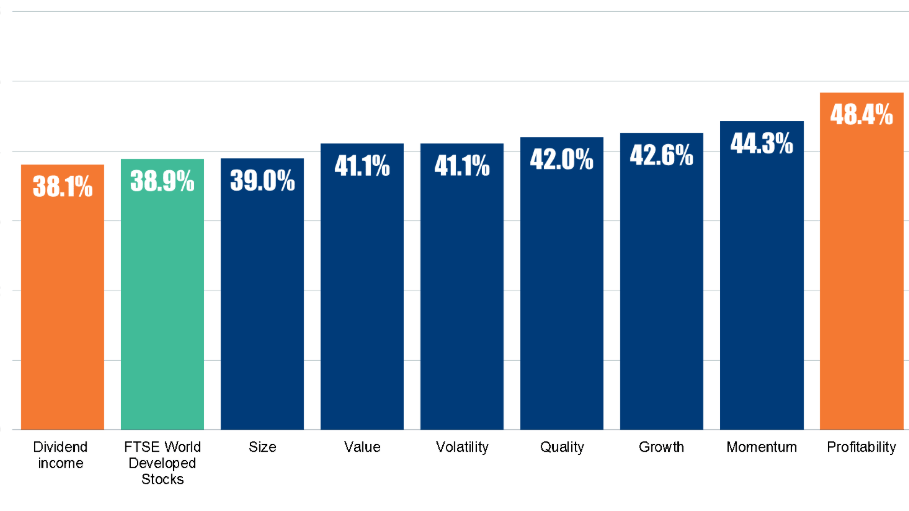

In this environment, it is therefore perhaps unsurprising that profitability (gross profit over assets) and momentum strategies have been the standout performers from the different styles of global equity investing over the last three years to August 31, while dividend income has been the poorest performing style. The chart below shows that momentum strategies produced a 44.3% total return over the time frame and profitability strategies did best with a return of 48.4%, comfortably outstripping the FTSE World Developed Stocks index return of 38.9%. Meanwhile, dividend income was the only investment style with an inferior return to the index over the three years to the end of August 2018 (38.1%).

Global Equity Investment Styles: Total Return over Three Years to August 31, 2018*

Source: SG Cross Asset Research/Equity Quant, FactSet, FTSE, September 10, 2018

*All returns are total returns on a local currency basis. Performance derived from the top quintile of stocks by each style assuming monthly rebalancing.

The strong retail flows into global equities over the last 12 months are indicative of how momentum investing has caught the imagination, fueled by markets which continued to rise despite the specter of the unwinding of central bank monetary policy, onerous debt levels and rising geopolitical risks. The UK Investment Association calculated that almost £7 billion ($9.3 billion) of UK retail money flowed into global equities over the 12 months to June 30, 2018. However, over the second quarter of 2018, as volatility returned to markets after a period of relative calm, this had slowed sharply to just £190 million ($250 million), and has been broadly flat since.[1]

The return of volatility since January 2018 has been exacerbated by concerns over global trade wars, and, in our view, investors’ mindsets are beginning to shift away from the ‘goldilocks’ markets of the last three years to refocus more on ‘end-of-cycle’ considerations. We believe attention is switching back towards global equity income at a time when more defensive stocks have been better supported by recent flows, and as investors refocus on the prospect of a more secure and stable dividend stream in more volatile markets.

Reversion to the Mean?

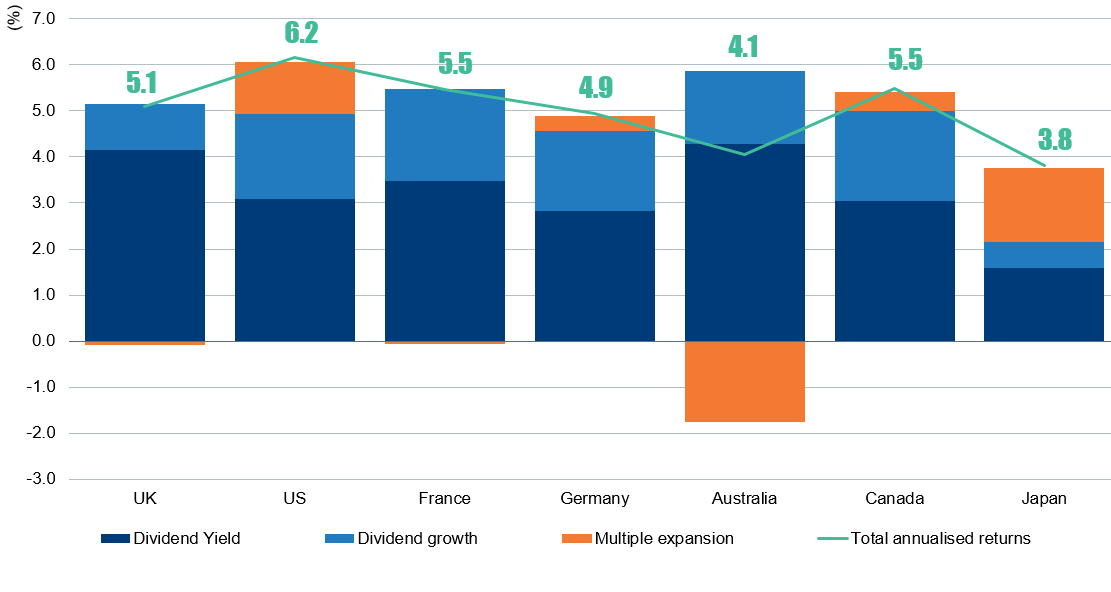

We believe this recent support for more defensive companies with sustainable cash flows is happening because investors are starting to remind themselves of what has worked over the long term, rather than simply focusing on the recent underperformance of dividend income in the last three years. As the chart below shows, over almost five decades, dividend yield, and the compounding effects of dividend growth, have provided the largest proportion of equity returns across all seven of the biggest investment markets listed in the chart.

The Dominance of Dividend Income Real Return over the Long Term (1970 – Q2 2018)

For illustrative purposes only. Source: Thomson Reuters Datastream, total annualized real return in local currency, June 30, 2018.

We believe that after three years of short-term underperformance, and with global equity markets turning more volatile, global equity income may be well placed to reassert its long-term outperformance credentials as a reversion to the mean begins to take place.

[1] Source: Newton, August 2018

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.