Palm oil is ubiquitous in modern society. As a vital ingredient in a range of products from shampoo to peanut butter, it’s highly likely you’ve already used palm oil at least a couple of times before breakfast.

Ever since the recent banned television ad damning the mass production of palm oil went viral, palm oil has gone from an unknown ingredient to an orangutan-killing villain in the eyes of many. Consumers and environmental groups are now putting pressure on companies to ensure their palm oil is farmed sustainably, with the more extreme even suggesting a ban on the oil entirely.

However, whenever anything becomes a popular movement, it’s important to look beyond the social media outrage and get the facts. As part of our ongoing research and engagement, we want to share an investor’s perspective on palm oil and sustainability.

What Is Palm Oil?

Palm oil is an edible vegetable oil that is produced by either squeezing the stone inside the fruit grown on the oil palm tree, or by squeezing the fleshy fruit itself. It is currently the most produced and used vegetable oil, with the average person consuming almost 18 lb per year – a considerable amount when you consider the tiny quantities it is usually used in.

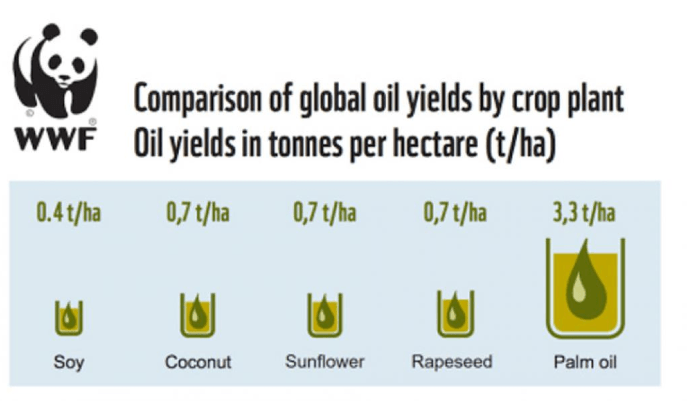

It has a number of characteristics which have led to current high levels of use, not only in food, but also in cosmetics, personal-care products, animal feed and even as a fuel. Widespread adoption of palm oil began some decades ago, when palm oil was seen as a healthier alternative to saturated fat in butter and trans fats in margarine. It is also the cheapest vegetable oil to produce in the world, providing a third of the world’s vegetable oil from only 10% of the land used for oil crops, making it in theory the most environmentally friendly oil we can produce. It is even more desirable as an ingredient given that palm oil has no smell, is a natural preservative, is semi-solid at room temperature (which is useful for spreads) but is still stable at high temperatures.

Source: WWF, March 2019

What Are the Environmental, Social and Governance Issues?

The primary concerns around palm-oil farming lie in deforestation and the carbon-dioxide (CO2)emissions which occur as a result of peat drainage. In order to make the land suitable for farming palm oil, the peatland must be drained, which releases an enormous amount of trapped CO2 into the atmosphere (around 5% of global human-derived CO2 emissions – more than air travel!) and is likely to contribute significantly to climate change.[1]

Deforestation also leads to a loss of biodiversity, and it’s not just the orangutans of the now infamous TV ad that are at risk, but tigers, elephants and numerous other species too. Between 1990 and 2015, 24 million hectares of Indonesian rainforest were destroyed, with palm oil being one of the main drivers of deforestation. With only 15% of native animal species being able to survive the transition from rainforest to plantation, these farming efforts have a profoundly negative effect on wildlife and biodiversity.

There are also concerns around the labor practices used in palm-oil farming, with child labor, forced labor, below-minimum-wage pay and exposure to hazardous pesticides all being major issues.

Can You Farm Palm Oil Sustainability?

Given palm oil’s high-yielding nature, which makes it the most environmentally efficient of the vegetable oils, we do not see removing it from products entirely as the answer.

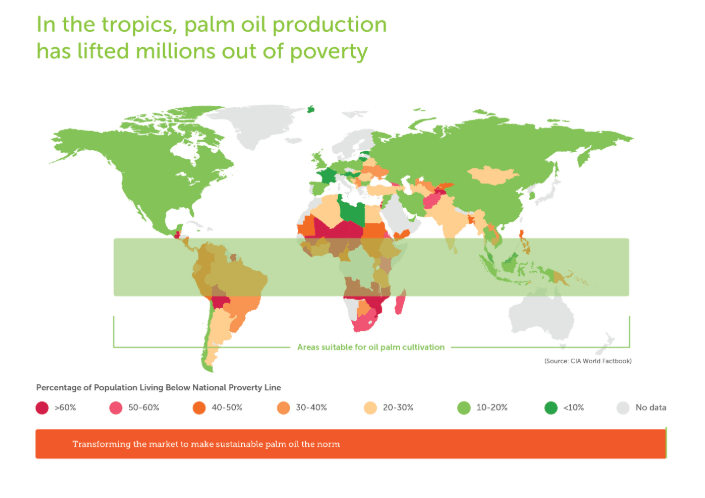

Like many issues of sustainability, the palm-oil debate is a nuanced one. 55% of the world’s palm oil is produced in Indonesia, 30% in Malaysia, 4% in Thailand, and 2% in Colombia, all of which are developing economies. In the tropics, palm-oil production has lifted millions out of poverty and is a cornerstone of the Indonesian economy. There has already been pushback from the Indonesian and Malaysian governments, suggesting that efforts to reduce palm-oil usage will stunt their growing economies. The industrialization that allowed Western economies to develop is now being demonized, and many developing economies want the right to undergo this process themselves and raise the living standards of their citizens, as the US, UK and other nations have done before them. It is too easy for rich nations to criticize as the emerging world makes use of its rich natural resources in order to develop, while forgetting that we underwent the very same process ourselves.

Source: Roundtable on Sustainable Palm Oil, March 2019

However, it is possible to farm palm oil in a sustainable way that is less destructive to the planet. The Roundtable on Sustainable Palm Oil (RSPO) is a non-profit organization that aims to unite all stakeholders to develop and implement sustainable palm-oil practices. While earlier iterations of the RSPO were criticized for being too lenient, especially on peat drainage and deforestation, which are the main environmental issues associated with palm oil, a revised set of criteria were released in November 2018 which broadly addressed these concerns, introducing what is known in the industry as a NDPE (no deforestation, no peat, no exploitation) standard.

While we share the view of many non-governmental organizations (NGOs) such as WWF that RSPO could still be more stringent, in light of these new requirements, we now believe that an RSPO-certified company is helping to contribute to the sustainable farming of palm oil, and are pleased that many of the companies we invest in have signed the RSPO. Nevertheless, we don’t think it’s enough for a company to just use RSPO certification in order to claim it uses sustainable palm oil. As such, we have developed a checklist which we use when analyzing a company’s palm-oil policies:

- Clearly defined goals: A publicly disclosed target date by which to achieve 100% sustainable palm-oil sourcing (or at the very least 100% RSPO-certified palm oil).

Ambition over and above RSPO: Implementation of innovative programs and/or further certifications beyond RSPO activities. Potential further certifications/commitments include a formal 100% no-deforestation commitment, POIG (Palm Oil Innovation Group) membership or formal adoption of official HCS (High Carbon Stock) Approach methodology.

3. An engagement protocol for dealing with non-compliant producers, including time-bound milestones for improvement. We think evidence of working with non-compliant producers to improve is preferable to simply dropping them. However, should a producer fail to improve, we would expect a company to cease trading with them.

4. Supply-chain transparency: At a minimum, we want to see efforts to achieve 100% traceability to the mill where the palm oil is processed, with aspirations to bring about transparency to the plantation. In our view, companies should be making their own independent efforts to ensure on-the-ground verification, not relying on certification alone.

5. Active industry collaboration with peers and NGOs to help tackle the broader issues.

6. On-the-ground work with smallholders: Smallholders produce 40% of the world’s palm oil, yet often they do not have the resources or education needed to comply with certification standards, and farming methods used are generally highly inefficient. We believe it is vital large multinationals engage in projects to help smallholders become compliant in order to avoid the emergence of a two-tier market where less scrupulous companies buy cheaper non-certified palm oil.

7. Prepared to reduce palm oil use where appropriate: We do not want companies to replace palm oil with other oils (as palm oil is the most environmentally efficient); however, we look for companies to be exploring innovative solutions to reduce ever-growing palm oil demand.

To conclude, palm oil is not the clear-cut villain many have made it out to be. Like the NGOs working on the ground in areas in which palm oil is produced, we believe it is possible to produce palm oil in a sustainable way that is less damaging to the environment, while also providing safe and well-paid jobs for local communities. In our view, both consumers and investors should be wary of boycotting palm oil or demanding it be replaced with oils which may in fact be more harmful for the environment. Instead, we suggest that they can look for products made with palm oil that is sustainable-certified, and make sure that they are happy that the definition of ‘sustainable’ is sufficiently rigorous.

[1] https://www2.le.ac.uk/departments/geography/research/projects/tropical-peatland/downloadable-resources/peatland-drainage

Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

Comments