Against a diverse emerging-market backdrop, we use themes to identify globally important, observable forces of long-term change that we believe can influence our investible universe. In a short series of posts we explore key themes that play a role in helping us to select our emerging-market investments, starting with ‘state intervention’.

In more developed markets, concern over state intervention centers around central bank policymaking. While that is of course highly relevant across emerging markets too, there is in fact an even larger state-led consideration when investing in these markets: the fact that c.23% of the MSCI Emerging Markets index is comprised of state-owned enterprises (SOEs).

Exhibit 1: MSCI Emerging Market sectors – estimated state control

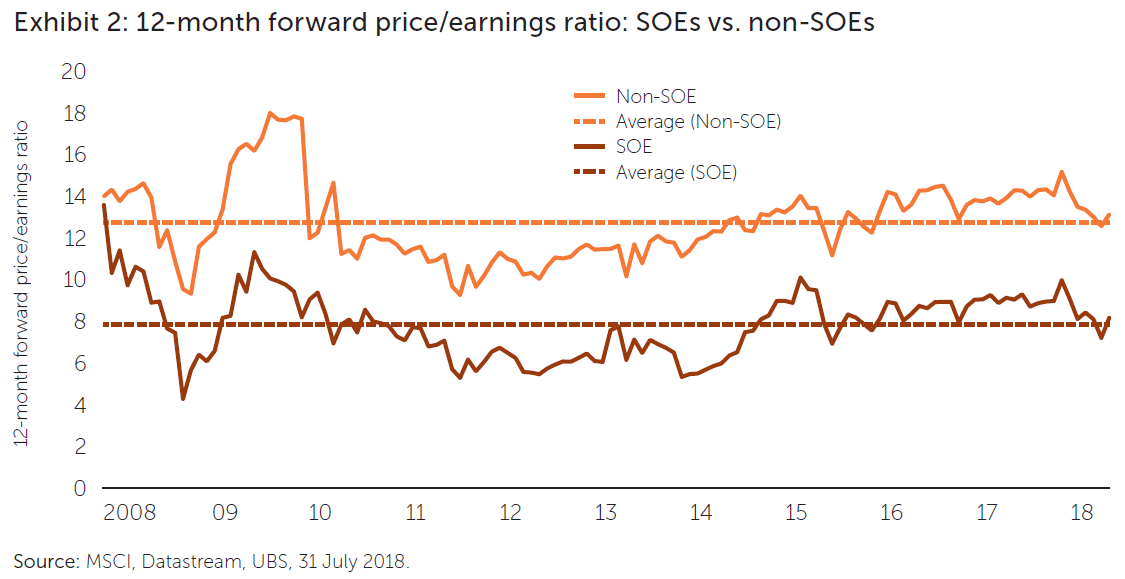

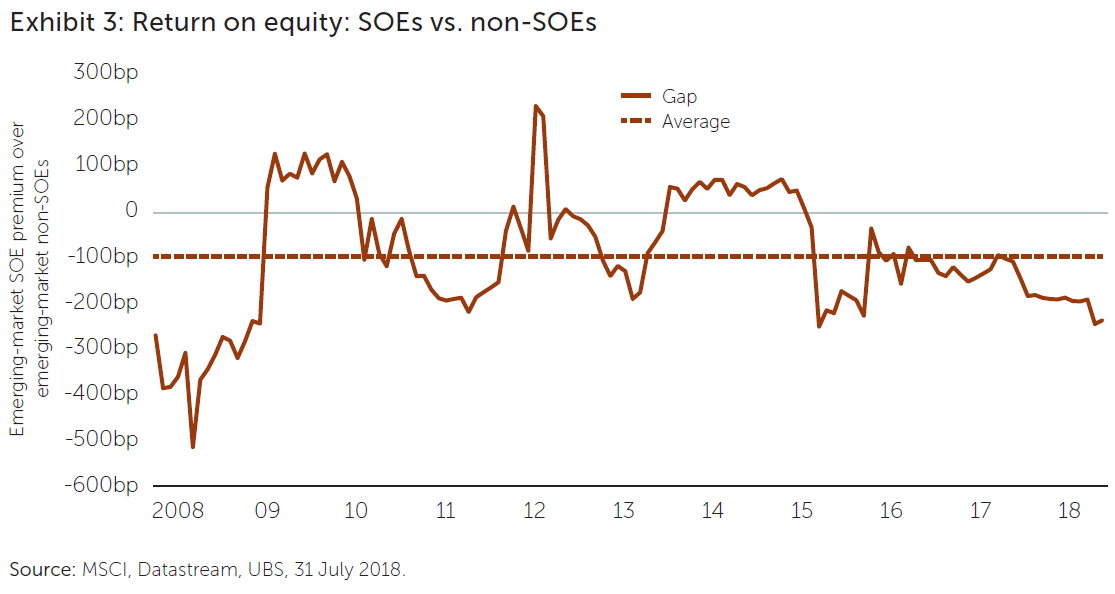

The majority of these companies are not run with profit-maximizing intentions. They tend to be strategic state assets such as banks, or utility and resources companies, with heavy capital-expenditure burdens. In our view, this tends to make them poor stock investments over the long term, though a major commodity bull market can change the optics temporarily. We think return on equity (ROE) is usually less important than other strategic desires of the state in capital-allocation decisions.

State ownership can provide stability, but this may involve significant shareholder value dilution, as minority investors tend to be a low priority in stressed situations or in capital-allocation decisions. Interestingly, we saw such dilution with many Western banks following the global financial crisis, and emerging-market companies are perhaps even less likely to focus on shareholder value in such situations.

Of the larger emerging markets, the proportion of state ownership is highest in Russia at c.55% and China at c.40%, though the Middle Eastern countries United Arab Emirates (UAE) and Qatar have the highest rates overall at 96% and 81% respectively.[1]

History teaches us that the interests of a Russian oligarch or the Chinese politburo are rarely aligned with those of minority investors, and we therefore believe our active approach which allows us to currently take zero exposure to SOEs is a big advantage. SOEs have significantly underperformed non-SOE companies over both the long term and more recent periods (11.5% vs. 22% over the 12 months to end May 2018),[2] despite trading at a wide valuation discount. This, we believe, is owing to them, in aggregate, being perennial value destroyers on a through-the-cycle basis. Exhibit 3 shows that there is a long term ROE gap (11.05% vs. 13% and widening) between the two types of companies owing to the lower quality of SOEs, which tend to have more indebted balance sheets, lower growth rates and higher capital-expenditure burdens, leading to lower cash flows and returns.

Conversely, the technology, consumer and health-care sectors are relatively free from state control and are where we find the most interesting investment opportunities.

[1] Source: CLSA, May 31, 2018

[2] Source: MSCI, Datastream, UBS, July 31, 2018.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.