Authenticity: From Hippies to Just Hip

Just a few decades ago, if you expressed some modicum of environmental awareness or concern for the planet, you’d be called a hippy or a tree-hugger. Today, things are changing.

As environmental and social concerns creep into the wider public consciousness and the stereotypes fade from memory, consumers are increasingly being drawn towards brands which are acting responsibly.

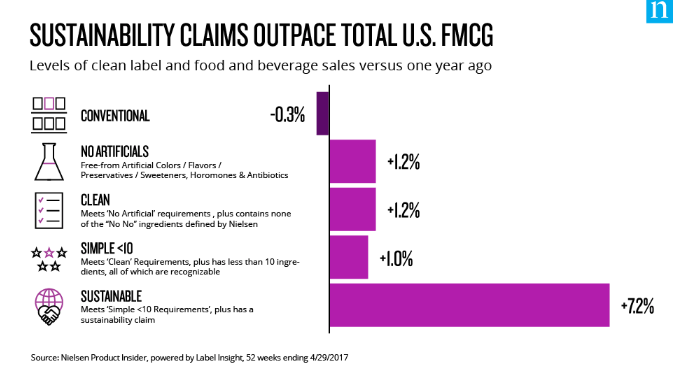

In response, companies are integrating more and more purposeful messages into their marketing, as well as offering products with a reduced impact on human health or the environment. According to Nielsen, sustainable products are set to account for a quarter of retail sales by 2025, and in 2017 we saw sales of food and beverages with sustainability claims outpace the growth of their conventional counterparts significantly, as the chart below demonstrates.

Source: Nielsen Product Insider, powered by Label Insight, 52 weeks ending 4/29/2017

This is all linked to the rise of authenticity, which is fast emerging as one of the most desired brand attributes among consumers. Authenticity is all about being unique and genuine, and one of the key ways in which companies are seeking to demonstrate authenticity is through establishing some kind of environmental or social purpose beyond just making a profit. For example, in 2011, just 20% of companies in the S&P 500 publicly disclosed environmental, social and governance (ESG) information, and today that figure is at 85%.[1]

In fact, we think this is going to continue to be such an important trend in the consumer goods sector that we’ve made authenticity one of the sub-themes of our overarching consumer power investment theme.

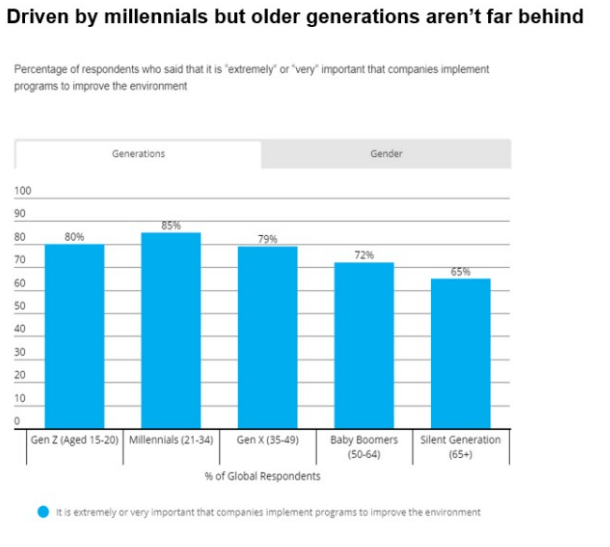

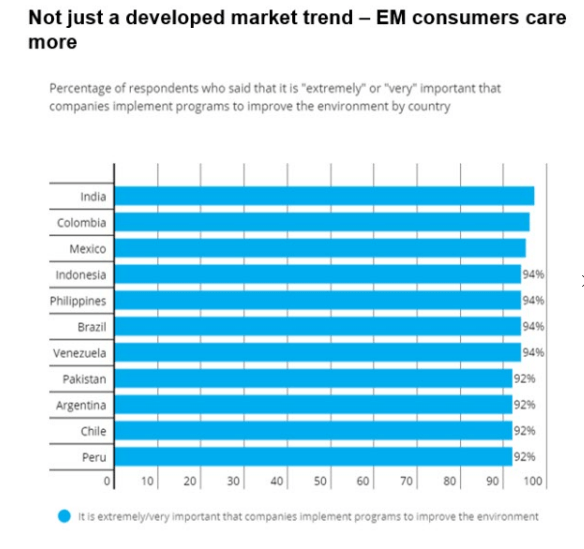

There are two key sustainability myths still to bust though. This powerful trend is not unique to wealthy developed markets or solely millennials. In fact, the research shows that while millennials care the most, they’re only slightly ahead of their older peers. Furthermore, emerging markets have been found to be the regions where consumers care the most about environmental issues, most probably because they are living with some of the worse effects of pollution and climate change, and this is only set to worsen.

Source: https://www.nielsen.com/us/en/insights/reports/2018/the-education-of-the-sustainable-mindset.html

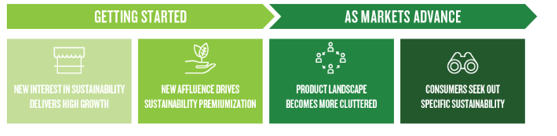

However, consumers within these regions have different requirements. In markets like India, it’s about traditional ingredients which have long been associated with health. As such, local companies with their on-the-ground knowledge tend to dominate the market. In China, where the increasingly affluent consumer wants to use this wealth to buy themselves the best they can afford, sustainability is ‘premium-ized’ and associated with better functionality and higher quality ingredients. In markets like the US and the UK, consumers tend to be more educated about sustainability, and therefore companies face the challenges of standing out in a crowded market, while understanding what specific type of sustainability the consumer is seeking.

The challenges do not stop there. Authenticity branding isn’t necessarily always a winner. Sometimes, if not carefully thought through or correctly executed, messages can seem jarring, patronizing, or just plain offensive to certain groups. Added to this, social media has given brands closer connections with their consumers, and while this can help them to disseminate ‘authentic’ content that resonates with shoppers, it also works both ways, and consumers are quick to be critical when they don’t like a message.

When a British personal care brand released a range of shower gel bottles in the shape of different female body types, the response was overwhelmingly negative. This initiative was well intentioned (if poorly thought through and insufficiently consumer tested!), but social media backlash forced the ad (and the bottles) to be withdrawn.

It’s hard to assess what impact this has on a brand (other than giving social media managers a headache), as unsurprisingly companies aren’t keen to shout about campaigns which have gone wrong. However, it’s obviously damaging to brand perception as well as a big waste of a marketing budget.

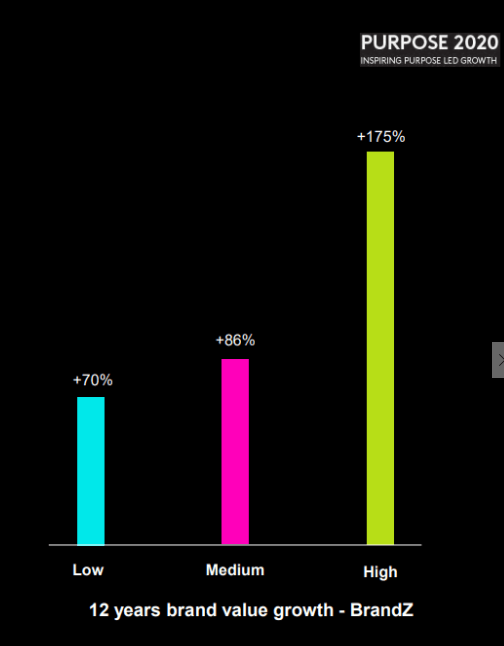

When executed well, though, such initiatives can have a very positive impact on brand value. A survey by consultancy BrandZ found that brands perceived as having a high level of positive impact have grown their value 2.5 times more than brands with a low perceived impact.

12-year Value Growth for Brands with Low, Medium and High Perceived Impact

Source: BrandZ, 2019

This theory works in practice too. A campaign launched by a multinational drinks company, which donated one year of clean water to a woman living in an area of poor water access for each pack of a particular beer bought, increased brand awareness by 5.2% and increased purchase intent by 2.7%, showing the clear uplift in sales this activity can bring.

These sustainability messages are only getting more impactful, with companies starting to enter political discourse in order to stand out in the competition for consumer engagement.

To sum up, sustainability, purpose and authenticity are all taking hold in the consumer sector, and companies are increasingly pushing the boundaries and stepping into political debates in order to stand out in a crowded space. At the same time, it’s important to make sure that these messages are well judged and coherent with the overall company because, when it comes to authenticity, consumers know a fake when they see it.

[1] Governance & Accountability Institute 2018

Newton manages a variety of investment strategies. Whether and how ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved, as well as the research and investment approach of each Newton firm. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions.

This is a financial promotion. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only. Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell this security, country or sector. Please note that strategy holdings and positioning are subject to change without notice.

Important information

This is a financial promotion. Issued by Newton Investment Management Limited, The Bank of New York Mellon Centre, 160 Queen Victoria Street, London, EC4V 4LA. Newton Investment Management Limited is authorized and regulated by the Financial Conduct Authority, 12 Endeavour Square, London, E20 1JN and is a subsidiary of The Bank of New York Mellon Corporation. 'Newton' and/or 'Newton Investment Management' brand refers to Newton Investment Management Limited. Newton is registered in England No. 01371973. VAT registration number GB: 577 7181 95. Newton is registered with the SEC as an investment adviser under the Investment Advisers Act of 1940. Newton's investment business is described in Form ADV, Part 1 and 2, which can be obtained from the SEC.gov website or obtained upon request. Material in this publication is for general information only. The opinions expressed in this document are those of Newton and should not be construed as investment advice or recommendations for any purchase or sale of any specific security or commodity. Certain information contained herein is based on outside sources believed to be reliable, but its accuracy is not guaranteed. You should consult your advisor to determine whether any particular investment strategy is appropriate. This material is for institutional investors only.

Personnel of certain of our BNY Mellon affiliates may act as: (i) registered representatives of BNY Mellon Securities Corporation (in its capacity as a registered broker-dealer) to offer securities, (ii) officers of the Bank of New York Mellon (a New York chartered bank) to offer bank-maintained collective investment funds, and (iii) Associated Persons of BNY Mellon Securities Corporation (in its capacity as a registered investment adviser) to offer separately managed accounts managed by BNY Mellon Investment Management firms, including Newton and (iv) representatives of Newton Americas, a Division of BNY Mellon Securities Corporation, U.S. Distributor of Newton Investment Management Limited.

Unless you are notified to the contrary, the products and services mentioned are not insured by the FDIC (or by any governmental entity) and are not guaranteed by or obligations of The Bank of New York or any of its affiliates. The Bank of New York assumes no responsibility for the accuracy or completeness of the above data and disclaims all expressed or implied warranties in connection therewith. © 2020 The Bank of New York Company, Inc. All rights reserved.

Comments