Summary of Stewardship Activities: Q4 2023

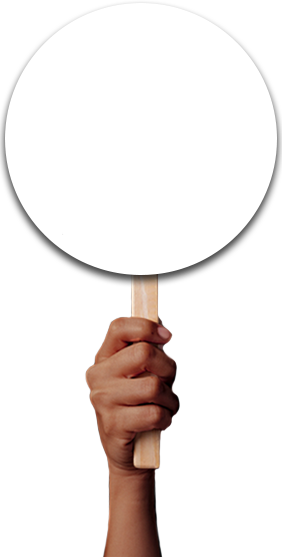

During the quarter, we exercised our clients’ voting rights at a total of 219 shareholder meetings.

Across all regions, votes were instructed against management recommendations on 266 separate resolutions, which equated to 47% of the 219 meetings.

3

took no action**

114

in favor of management***

0

abstained

102

against management*

Voting profile: Q4 2023

GLOBAL VOTING SUMMARY

RESOLUTIONS VOTED AGAINST MANAGEMENT

* Voted against management recommendations on one or more resolutions, including abstentions and withhold votes where there was no option to vote against.

** Took no action owing to shareblocking or sanctions considerations

*** Voted in favor of management on all resolutions

Important Information

Your capital may be at risk. The value of investments and the income from them can fall as well as rise and investors may not get back the original amount invested.

For Institutional Clients Only. Issued by Newton Investment Management North America LLC (“NIMNA”). NIMNA is a registered investment adviser with the US Securities and Exchange Commission (“SEC”) and subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”). The Firm was established in 2021,comprised of equity and multi-asset teams from an affiliate, Mellon Investments Corporation. The Firm is part of the group of affiliated companies that individually or collectively provide investment advisory services under the brand “Newton” or “Newton Investment Management” (“Newton”). Newton currently includes NIMNA and Newton Investment Management Ltd. (“NIM”).

This document is provided for general information only and should not be construed as investment advice or a recommendation. You should consult with your advisor to determine whether any particular investment strategy is appropriate. Statements are current as of the date of the material only. Any forward-looking statements speak only as of the date they are made, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements.

This document may not be used for the purpose of an offer or solicitation in any jurisdiction or in any circumstances in which such offer or solicitation is unlawful or not authorised. Certain information contained herein is based on outside sources believed to be reliable, but their accuracy is not guaranteed. The opinions expressed in this document are those of Newton and should not be construed as investment advice.

Any reference to a specific security, country or sector should not be construed as a recommendation to buy or sell investments in those securities, countries or sectors. Please note that portfolio holdings and positioning are subject to change without notice.

Newton manages a variety of investment strategies. How ESG considerations are assessed or integrated into Newton’s strategies depends on the asset classes and/or the particular strategy involved. ESG may not be considered for each individual investment and, where ESG is considered, other attributes of an investment may outweigh ESG considerations when making investment decisions. ESG considerations do not form part of the research process for Newton’s small cap and multi-asset solutions strategies.